In today’s Money Morning…bank buying madness…retail, banks in, tech, healthcare out?… value pivot means nothing unless you are a short-sighted fund… and more…

After a much-needed Australia Day rest, all eyes are on the upcoming earnings season.

The consensus out there points to a steady flow of positive reporting.

I’d be cautious about how much you can read into this though.

Yes, Australia seems to be in a good spot financially. Treasury and RBA forecasts for the unemployment rate look to be way off — the December rate came in at 6.6%.

But it’s possible that earnings exuberance might get certain investors suckered into buying the wrong stocks.

And I’m talking about bank stocks in particular.

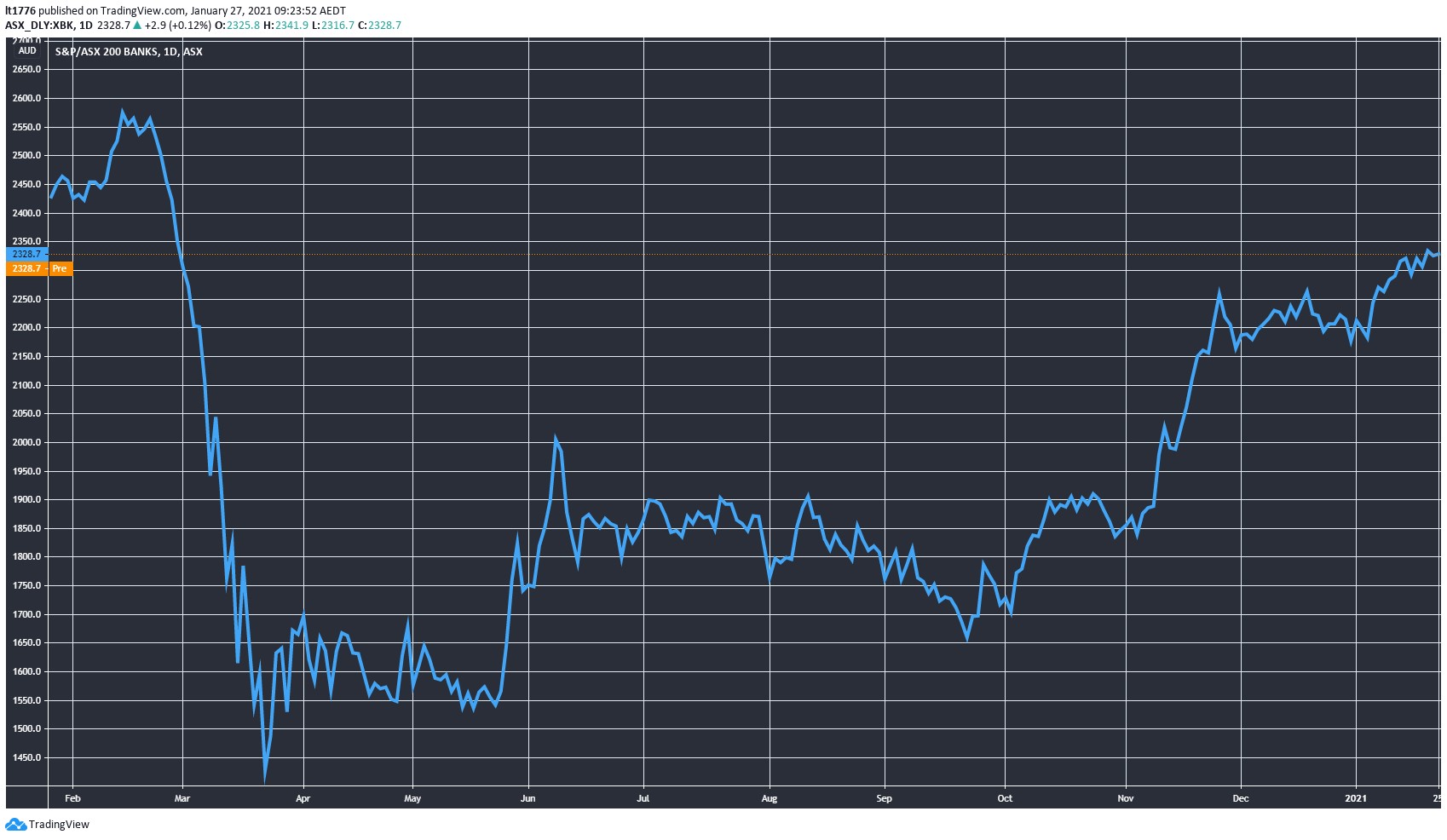

Buying Madness of ASX Bank Stocks

The S&P ASX 200 Banks Index [XBK] started taking off from the start of October:

|

|

| Source: Tradingview.com |

Australia’s big bank stocks tend to move on big-picture economic sentiment.

Which is why they are moving right now.

Don’t be a sucker though, these companies are dinosaurs that may have profit margins squeezed by near-zero rates and then be hit by a fintech wave as Australia and the world realise that these institutions offer little and take much.

[conversion type=”in_post”]

For context, Westpac Banking Corporation is trading at a P/E north of 34.

And yet, you still get graphics like these:

|

|

| Source: Marketindex.com.au |

P/E doesn’t really matter in my small-cap world, but that broker consensus data is still madness.

Where does the Australian consumer stand though?

There are few factors pointing to a rosy picture which I’ve highlighted before.

Take, for instance, these two charts from the latest RBA chart pack:

|

|

| Source: RBA |

|

|

| Source: RBA |

An uptick in disposable income, recovering consumption, and a consumer sentiment resurgence.

The most important thing though, is the savings ratio is starting to come down after a big lockdown spike.

The takeaway point — even though the RBA has no more ‘dry powder’ with a near-zero rate, Australian consumers do.

Which means a number of analysts are calling for the following.

Retail, banks in, tech, healthcare out?

Here are some quotes that caught my eye in the Australian Financial Review today:

‘We think the strength of the domestic economy will mean there’s less credit risk for the banks and potential for some of the provisions to unwind that they made over 2020.

‘Retail [is] “a definite candidate for outperformance.”

‘Dividends are poised to follow earnings upward. And, “if we do see more upside surprises on dividend and capital management, it will be a good signal about how companies see their view of their businesses going forward.”

‘A strong domestic economy is obviously going to favour a lot of domestic cyclicals.

‘Along with the discretionary retailers, the online real estate portals Domain (majority owned by Nine, publisher of The Australian Financial Review) and REA Group, and housing construction-related companies could produce surprisingly good results, the fund manager said.’

And on tech and retail:

‘The sweeping economic recovery potentially puts technology stocks and healthcare leaders at risk.

‘“Part of the reason those sectors in particular did so well was the scarcity of earnings growth,” Mr Jenneke said. “In 2021 there’s not going to be a scarcity of earnings growth. We are going to have more of an abundance of earnings growth.”

So, I guess this means buy the banks, buy retail…and tech and healthcare stocks (even medtech stocks) are out.

Here’s where this commentary goes wrong.

Value pivot means nothing unless you are a short-sighted fund

All of this commentary is usual fare from analysts that think in a 12-month window.

In a previous article, I discussed how many of the value funds out there are underperforming.

A value pivot in the market may help these laggards make up for wasted time.

But the long-term (two–three years) picture remains the same.

Small-caps with breakthrough technology and companies that can provide healthcare with innovative products to boost efficiency should be firmly on your radar.

This year has drastically accelerated trends in tech, everything is speeding up at once.

To say nothing of ‘supercycle-era commodity prices’ which is now a mainstream talking point.

Point is, as an investor you beat the funds by thinking in a longer time frame.

If you identify the big trends, sort by sub-sectors that will benefit, then identify the best-placed companies to benefit — you get your first leg up.

Then you stick to your convictions where appropriate and in turn beat the headless chooks that make up large swathes of elite finance.

These are the people that move from ‘sky is falling’ to irrational hyped-up exuberance in the same week.

So, don’t let earnings season and dividends fool you into jumping into the wrong stocks.

Most of the commentary on this comes from people that are incentivised by quarterly and half-yearly bonuses.

Regards,

|

Lachlann Tierney,

For Money Morning

Lachlann is also the Editorial Analyst at Exponential Stock Investor, a stock tipping newsletter that hunts for promising small-cap stocks. For information on how to subscribe and see what Lachy’s telling subscribers right now, please click here.

PS: Discover three innovative Aussie fintech stocks with exciting growth potential. Download your free report now.

Comments