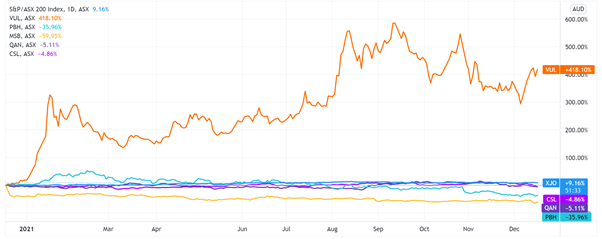

We examine ASX updates from PointsBet Holdings Ltd [ASX:PBH], Vulcan Energy Resources Ltd [ASX:VUL], and CSL Ltd [ASX:CSL].

CSL’s equity raise largest in Australia’s history

Australian shares traded lower in afternoon trade, dragged down by a sharp fall in CSL Ltd’s [ASX:CSL] share price.

CSL — the giant pharmaceutical manufacturer — is the third-largest company on the ASX by market capitalisation. Big moves in CSL’s share price tend to impact benchmarks like the ASX 200.

CSL was down over 8% after raising $6.3 billion to fund a $16.4 billion takeover of Swisse company Vifor.

The capital raise is the largest primary capital raising ever excluding Telstra’s IPOs and was the seventh largest in the world in 2021.

But an acquisition with a price tag that high will make investors wary.

Has CSL paid too much? Will the fresh capital needed to fund the takeover impact CSL’s return on equity?

Paying too much for Vifor could lead to write-downs down the track…and impact future profitability.

Discover our top three ASX-listed pot stocks in 2021. Click here to learn more.

Vulcan settles and J Capital gagged

Vulcan — ASX’s bellwether lithium stock — late yesterday relayed news from the Federal Court of Australia.

The irksome matter of short-seller J Capital’s negative research report on Vulcan’s commercial viability is finally resolved.

Vulcan, aspiring to become a clean lithium producer for Europe’s burgeoning EV market, has reached an out-of-court settlement with J Capital and J Capital’s founder, Tim Murray.

Judging by VUL’s share price action, investors were happy the saga concluded.

VUL shares were up 6% in afternoon trade, although still down about 20% since JCap published its report.

As part of the settlement, the court also ordered J Capital and Murray to abstain from disseminating, publishing, or republishing any matter concerning Vulcan, its directors, or officers.

The order is extensive, even permanently restraining JCap from ‘taking any action or doing any other thing to undertake or have the effect of undertaking in the dissemination, publication, or republication’ of any matter relating to Vulcan.

Hypothetically, even a tweet from JCap — who are active on Twitter — could breach the court order.

Steering clear from direct reference to Vulcan, JCap later tweeted:

‘J Capital chose to domicile in the U.S.A. because of the Constitution’s First Amendment right to free speech. Corporations have the financial strength to chill free speech. In the U.S.A. we are confident in defending our opinions. We do not feel the same in every jurisdiction.’

‘Two jurisdictions we do not feel confident in defending our opinions are North Korea and Australia.’

Despite today’s spike in VUL’s share price, the stock is still down nearly 30% from its all-time high, raising a few questions.

JCap published its report weeks after Vulcan began to slide from its all-time peak of $16.65.

JCap’s report was not a catalyst for the slide but an emblem of a hot stock potentially reaching melting point.

Short sellers follow the hype, not precede it.

So will the market consider matters raised in J Capital’s critical report closed? Or will they linger?

PointsBet widens US footprint

PBH shares were up 5% in afternoon trade today as the betting stock launched operations in the US state of Virginia.

Virginia, the US’s 12th largest state, is now PBH’s eighth operational US jurisdiction.

PointsBet has already launched in New Jersey, Iowa, Indiana, Illinois, Colorado, Michigan, and West Virginia.

PBH will operate in Virginia, along with its partner Colonial Downs, and leverage its exclusive sports betting partnership with NBC Sports.

PointsBet said it will ‘utilize the media giant’s premium television and digital assets to promote the PointsBet brand in the state of Virginia across its local sports communities.’

Now, if you’d like to learn about how to use small-caps to your advantage, check out our latest tips here.

It’s a great resource for seasoned investors and first-time traders alike.

Regards,

Kiryll Prakapenka,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here