Lithium developer Arizona Lithium [ASX:AZL] released its quarterly report today to a muted market response.

The lithium stock — not immune to the wider sell-off in the lithium sector — is down 20% year to date.

Most of the ASX lithium stocks are down this year, as you can see on the chart below:

Source: Tradingview.com

AZL’s June quarter cash flow

As part of its quarterly release, Arizona Lithium shared its cash flow report with the market.

AZL ended the quarter with $42.3 million in cash and cash equivalents after total cash outflows came to $1.2 million for the quarter.

Its cash balance was boosted by $23 million raised from issued equity during the period.

During the June quarter, the developer spent a modest $0.6 million on exploration and evaluation activities.

AZL said its exploration and evaluation expenditure primarily centred on metallurgical test work and the scoping study on its Big Sandy Lithium Project.

Arizona’s June quarterly activities

This morning, Arizona Lithium also reported on the key developments during the June quarter.

During the quarter, AZL signed a lease for a ‘world-class’ Lithium Research Centre, the completion of Hazen Research results for its Big Sandy Project, a US$1 million grant for its Research Facility, and $23.2 million received in Tranche 1 share placement.

Arizona Lithium also signed an initial five-year lease for a Lithium Research Centre in Tempe, Arizona, with options for extension. The ‘world-class’ centre will be utilised as a technology incubator for extracting lithium from ore and brine from projects like Big Sandy.

The company also said that the research centre would facilitate the production of battery-grade lithium chemicals.

Construction is expected around the end of November 2022, with operations due to commence around the fourth quarter.

The property will measure 9,000 square metres, including a 1,900 metres building, extended pavement, security gates, and a brick wall.

370 square metres will be used for laboratory instruments and 1,530 square metres for ore, brine, and lithium processing.

AZL’s Chief Technical Officer Brett Rabe remains in charge of operations for the Facility.

Source: AZL

Arizona also announced that Hazen Research have completed testing for Big Sandy design and flowsheets, including beneficiation, concrete leaching, and hydrometallurgy appraisals.

Ausenco Engineering will also be expanding on these results with a scoping study in August.

The lithium miner also provided an update on funding for the Research Facility based in Arizona, affirming it has now received a grant of US$1 million from the Arizona Commerce Authority (ACA).

AZL says the company is eligible for further financed programs which will aid in the business’ capital investment and employment sector, a financial aid which could reach more than US$100 million.

AZL share price outlook

Commenting on the quarter, AZL managing director Paul Lloyd said:

‘The June Quarter was another critical period for the Company, as we continued to position AZL not only as a future supplier of lithium for the rapidly growing EV industry, but importantly as a future leader in lithium research and processing.

‘With a 5 year lease signed for a world class Lithium Research Center on a 9,700m2 property in Tempe, Arizona, AZL is well positioned to create a hub for technology incubation focussed on lithium extraction and processing.

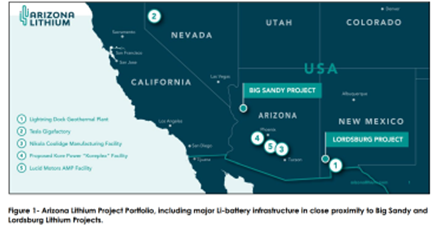

‘AZL expects the facility to attract some of the best talent from around the world, which will significantly benefit the Company’s Big Sandy project, but also the Lordsburg Lithium Brine Project.

‘We are pleased to commit to the state of Arizona for both the Research Facility and also our processing facility, and I would like to thank the Arizona Commerce Authority for contributing a US$1m grant to the Company, with Arizona also offering significant incentives and financial programs of up to over US$100m.’

Have lithium stocks peaked for good?

Now, while the demand story for lithium is still strong — with more and more automakers pledging to transition to EVs — the lithium stocks themselves have been hit hard this year.

Exuberant bidding saw many lithium stocks reach steep valuations that inevitably precipitated selling as markets soured on riskier assets — like junior lithium stocks.

But the battery tech theme is still in its infancy.

We’ll need a lot more battery tech materials to supply the anticipated EV future.

So are there still opportunities in the saturated battery tech space?

Our small-cap expert Callum Newman thinks so.

And he explains why in his recent report on three battery tech stocks that he thinks can become Tesla’s ‘chosen ones’.

To hear more about Callum’s thesis, read on here.

Regards,

Kiryll Prakapenka,

For Money Morning