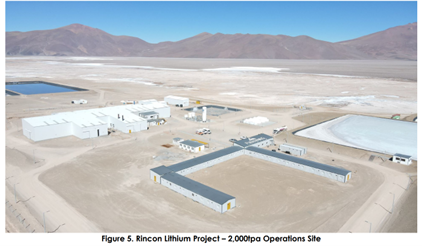

Australian lithium mining group Argosy Minerals [ASX:AGY] has presented an update on ramp-up works at its Rincon Lithium Project, located in Salta Province, Argentina.

The group states that its 2,000tpa operation nears continuous production, with batch production trials having produced 13.5 tonnes battery quality lithium carbonate product, at an average product quality of 99.79%.

The miner’s stock is still quite low since its huge decline last month, trading for around 41 cents a share by lunch time on Monday.

Year-to-date, the lithium stock has decreased 28% in share price, and it’s currently down more than 10% below its sector average:

Source: TradingView

Argosy hits 13.5 tonnes at Rincon

Early on Monday, the lithium miner said that has managed to churn through batch production trials, during commissioning and ramp-up work, of 13.5 tonnes of battery quality lithium carbonate product, to date.

This was produced with average product quality of 99.79% at its 2,000tpa operations at the Rincon Lithium Project, located in Argentina.

Argosy has now completed all the chemical process and technology validations required to informed decisions, as well as passing its verification works, which has contributed the group confirming its ability to produce battery quality lithium carbonate product at commercial scale.

Argosy’s Managing Director Jerko Zuvela stated:

‘The Company’s Puna operations team are successfully progressing the 2,000tpa operation commissioning and ramp-up works towards continuous production operations, where we have produced 13.5 tonnes of battery quality lithium carbonate product to date.

‘It is a significant achievement to validate our chemical process technology to produce battery quality lithium carbonate at a commercial scale operation. This has not been achieved very often in the lithium sector and is critically difficult to successfully accomplish, as we have seen from other operators attempting such at their operations.

‘We look forward to realising many more significant milestones in 2023 as we transform into a cashflow generator, capitalising on lucrative lithium carbonate prices via upcoming product sales revenues, leading to a significant near-term growth phase for the Company.’

Source: AGY

AGY eyes solid near-term lithium pricing

Argosy is known as a major lithium producer in Australia, and it has been championing the lithium journey since it started producing primary lithium product in Argentina in October last year.

Now its commissioning works are close to completion AGY can prepare for setting up continuous production operation trials.

The group also hopes to ramp-up batch works simultaneously with the continuous production trials, a goal which has been targeted from Q2.

Hitting this milestone will be a big achievement for the group, especially once AGY moves into the role of commercial producer.

The group will finally have access to cash flow generation from its lithium product and benefit from the sales of a product in such high demand for the EV takeover.

Argosy pointed out that it has an upcoming advantage through current and near-term lithium prices, with the Benchmark Mineral Intelligence lithium carbonate CIF Asia (contract) price recently quoted at US$54,000 per tonne.

Australia to profit from incoming drilling boom

The wider energy industry is making massive bull market-like gains in the face of recession, interest rates, and wider market sentiment.

It’s almost like an alternate universe: the universe of booming drillers.

It’s been described as a ‘new golden age’ for junior explorers, and for investors who get in early.

Aussie mining is at its best right now, but if so many of them topped 2022, can they really do it again in 2023?

Yes, it’s very possible. Many are small caps primed to grow into mid-to-large caps, but how do you tell which ones?

You may need a little help from our commodities expert James Cooper.

He’s found six ASX mining stocks that are heading to top the charts.

Regards,

For Fat Tail Commodities

Comments