The Argonaut Resources [ASX:ARE] has acquired prospective uranium exploration licenses in South Australia and the Northern Territory.

Argonaut holds these licenses via a 100%-held unlisted public company Orpheus Minerals.

Argonaut plans for Orpheus to list on the ASX later this year.

Argonaut Resources [ASX:ARE] share price is currently up 14%.

Let’s look at today’s announcement in detail.

Bitcoin vs Gold — Expert reveals how these assets stack up against each other as investments in 2021. Click here to learn more.

Argonaut, uranium assets, and IPO plans

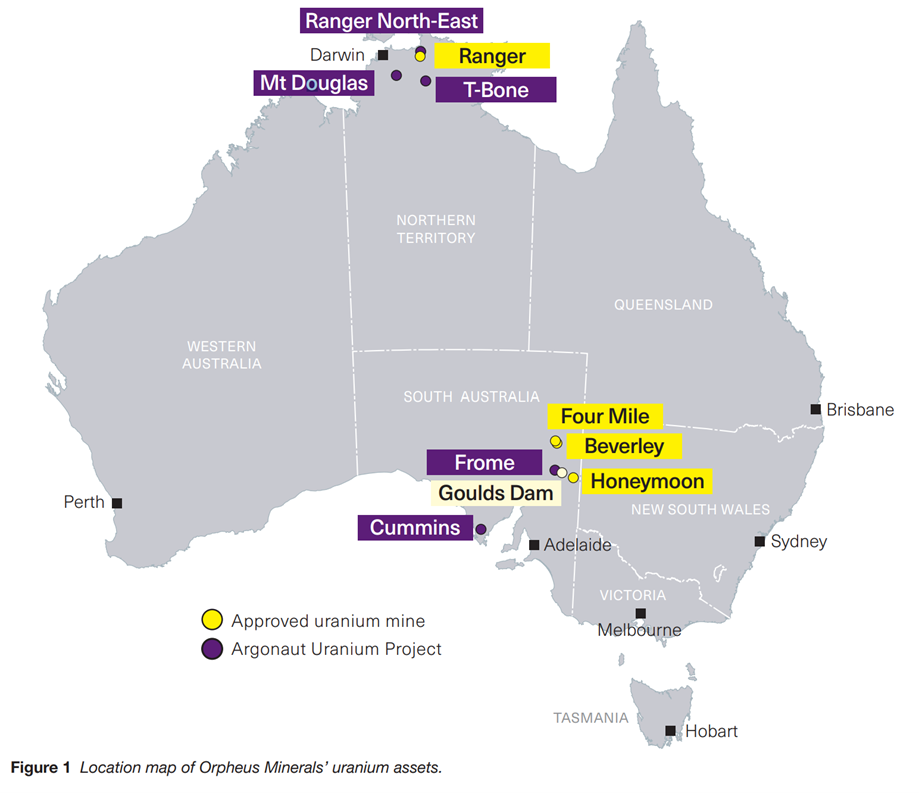

Via Orpheus, Argonaut has assembled a package of prospective uranium projects in South Australia and the Northern Territory.

All projects are either 100%-held or secured via an option to acquire 100%.

Argonaut said it chose the projects following a thorough review of uranium deposit-styles and available projects over the past two years.

ARE focused on SA and NT because the majority of permitted Australian miners operate there.

Argonaut also said IPO preparations for Orpheus were ‘well advanced’.

The Argonaut board is considering an entitlement offer of Orpheus shares to Argonaut shareholders as part of the IPO process with a potential in-specie distribution of Orpheus shares to Argonaut shareholders.

The shares will be subject to statutory escrow provisions.

Orpheus has 100% ownership of all the related mineral titles backed by holding a 100% interest in the three granted exploration licenses and three exploration license applications.

Orpheus also executed option agreements to acquire 100% of one granted exploration license and one exploration license application.

The first project is the Frome, with a 2,894 km2 tenement package in South Australia.

It is located near existing uranium mines at Honeymoon (Boss Energy Ltd [ASX:BOE]) and Beverley/Four Mile (Heathgate Resources).

The Frome project has an advanced exploration status with drill-ready targets.

Next up is the Cummins project with a 953 km2 tenement package and multiple uranium targets, also in SA.

These targets are shallow, drill-ready palaeochannel targets.

This brings us to the Northern Territory — which has hard rock uranium targets.

The first project there is at Mount Douglas, with a 601 km2 of tenement package of drill-ready targets.

Ranger North-East is the next project with a 64 km2 tenement package.

Last up is the T-Bone project with a 230 km2 tenement package backed by a prospective uranium anomaly on a major structure that hosts other deposits.

What’s in store for the Argonaut share price?

Argonaut’s 100%-held Orpheus is a junior explorer and there are a lot of obstacles to overcome if the company is to compete in the emerging uranium market.

The recently acquired licenses may hold optimistic futures for Orpheus but there’s plenty of risk involved.

That said, governments and private interests alike are converging on cleaner, renewable energy.

Lithium is commanding a lot of attention and investor interest.

Uranium is coming out of the shadows, too. But uranium’s future is harder to predict following the Fukushima disaster.

That said, chief investment officer of Segra Capital Adam Rodman, whose firm oversees a dedicated nuclear energy fund, said the world could be facing ‘a structurally undersupplied market over the next couple of years, even the next decade.’

So if you’re wondering exactly what this trend means for savvy private investors, I recommend reading our free report on the renewables revolution.

There, our energy expert Selva Freigedo reveals three ways you can capitalise on the US$95 trillion renewable energy boom.

Regards,

Kiryll Prakapenka,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here