What place holds the highest probability for a new world-class discovery?

As an Australian-based geologist and investor, I tend to look in my own backyard first, which is a phenomenon known as the home bias effect.

However, thanks to decades of a supportive mining environment, well-trained staff, and advanced exploration methods, the prospect of discovering another giant deposit in Australia is fading.

Don’t get me wrong, there could still be potential in remote outback locations, like the Tanami.

But compared to places like West Africa, where high-grade gold can still be found close to surface, Australia’s giant discovery potential is diminishing.

Then there’s Canada…

Like Australia, Canada has been heavily explored thanks to its supportive governance and skilled labour force.

Over time, that’s diminished its discovery potential.

However, like Australia, there are still some remote frontiers, especially in the northern regions, that hold discovery potential.

But if you want to stack the odds firmly in your favour and pick a place with the highest potential for a major discovery, look no further than Argentina!

Argentina: land of the giants

Argentina sits as one of the best places for mineral explorers and their shareholders. And there are a few reasons why that’s the case.

To understand the potential here, you must look at its neighbour, Chile and what it has achieved in its mining industry over the last several decades.

For starters, Chile is the world’s largest copper-producing nation.

That’s enabled it to remain one of the wealthiest nations in South America.

Its economy relies heavily on its vast copper exports, thanks to discoveries made thirty to fifty years ago.

It holds mega-copper projects that have left a legacy of long-term production.

But across the border, Argentina’s copper output has gone from modest to virtually nil:

[Click to open in a new window]

So, is there less copper in Argentina or is something else happening here?

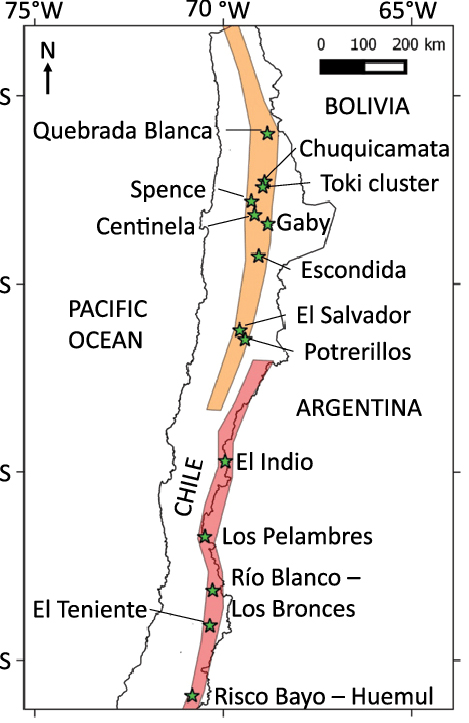

The critical thing to realise is that the same geological system hosting giant porphyry copper-gold deposits in Chile crosses into Argentina.

To show you what I mean, South America’s ‘porphyry copper belt’ straddles the border between Argentina and Chile:

Source: Risco Bayo

[Click to open in a new window]

Yet only one country has realised this potential over the last several decades… Note that all the mines (green stars) are located in Chile, not Argentina!

The opportunity

A lack of copper mining in Argentina has nothing to do with geology and all to do with politics.

Mega-mining projects take up to 20 years to develop and remain in production for decades.

As I mentioned, these mines leave a legacy for the host country and the mining companies that own them.

It’s why political stability is essential for developing giant copper mines.

And that’s the key element that’s been missing in Argentina.

Thanks to decades of hostile business conditions and economic chaos, the miners haven’t ventured into Argentina.

And that’s why the country holds a vast, untapped wilderness of geological potential.

Geology doesn’t follow national borders.

The key point is this:

The same geological setting that hosts giant copper porphyry deposits in Chile ALSO exists in Argentina.

And that’s why, for geologists, Argentina represents Chile, perhaps fifty or sixty years ago, when discoveries were far larger, higher grade and much closer to the surface.

So, why should investors start taking notice?

In case you’re not familiar, Argentina has been experiencing a tidal wave of reform since its new President, Javier Milei, swept into power in 2023.

Milei implemented a series of austerity measures, including slashing energy and transportation subsidies, laying off tens of thousands of government workers, freezing public infrastructure projects and imposing wage and pension freezes below inflation.

While it has been controversial, inflation has plummeted since Milei took office.

Bonds have also rallied while Argentina’s country-risk index, a measure of the risk of default, is at its lowest point in five years.

Milei also secured a political victory in late October, extending his ability to push reforms and encourage investment.

And clearly he’s moving the dial in the country’s mining investment…

Late last year, the world’s biggest miner, BHP, announced a multi-billion-dollar takeover deal for Filo Mining. A stock I recommended to my paid readership group back in 2023.

Meanwhile, Glencore is considering two significant copper developments in the country that would require approximately $13.5 billion in investment.

While Barrick, Lundin Mining, and Rio Tinto are other big names starting to build a presence in the country.

So, what does all this signal?

Argentina is open for business!

And if that’s the case, what are the reverberations for its untapped mining industry?

Think about it like this:

Geologists are moving into a highly prospective area that has barely been explored and are using modern exploration techniques.

In my mind, this is the formula that leads to major discoveries.

And that’s exactly what’s happening in Argentina right now.

For my paid readership group, Argentina is a key focus for some of our early-stage exploration picks.

In fact, one company in our portfolio just kick-started a new drill program near the major Filo Mining Discovery, which BHP acquired earlier this year.

If you’d like to learn more about this opportunity, you can do so here.

Enjoy!

Regards,

James Cooper,

Mining: Phase One and Diggers and Drillers

Comments