I’ve spent the best part of the past decade badgering people about Bitcoin.

I just can’t help myself!

As far as I’m concerned, it’s a better form of money for a fairer financial system. It levels the playing field.

And it also has the added advantage of being severely undervalued, in my opinion. If I’m right, the earlier you get off zero Bitcoin, the better off you’ll be in the future.

So, why wouldn’t I shout it from the roof tops?

In the early years, it was my soccer team mates who bore the brunt of my crypto evangelism.

I told them at training on a near weekly basis to buy Bitcoin from 2014 through to 2017.

It traded for as low as US$250 during this time period.

But as far as I know, only one person took me up on the idea and bought in (he bought 10 Bitcoins for the grand total of $6,000. Today that’s worth half a million dollars).

Then in mid-2017 I started my first public crypto advisory service.

With my friend Sam Volkering we launched the Secret Crypto Network — a mysterious name for what was still a mysterious asset back then.

We got a lot of people into Bitcoin at around $3,000 and Ethereum for around $250.

Since then, there’s been several raging bull markets and just as many earth-shattering downturns.

Price volatility has been the one constant. And that’s probably not going to change anytime soon.

But for much of this decade I’ve been a lone wolf in espousing the virtues of Bitcoin in the wider investment community.

I mean, none of my old colleagues in financial advice have ever recommended it. No super fund I know of owns any in Australia. The mainstream media still treats it as a criminal enterprise.

And even some of my own colleagues here at Fat Tail Investment Research have actively campaigned against it over the years!

However, in the past six months, there’s been a huge shift.

It’s happening slowly, but it seems I’m no longer a lone wolf in this.

Indeed, a growing number of mainstream financial institutions and analysts have done a complete 180 on Bitcoin.

And they’re getting louder by the day…

It’s off the charts

Check out these quotes from this month:

‘Money is about to undergo fundamental changes in the way it is created and used, potentially unleashing a dramatic re-ordering of the financial system.’

Oliver Wyman report, October 2023

I don’t own any Bitcoin…but I should’

Legendary investor Stan Druckenmiller,

24 October 2023

‘I like a barbell portfolio of cash and Bitcoin’

Mohammed El-Erian, former CIO of PIMCO,

31 October 2023

Interesting, eh?

But my favourite bit of analysis came last week from Head of Macro at Fidelity, Jurrien Timmer.

He wrote:

‘Bitcoin is volatile but its scarcity and adoption curve create the potential for it to be a high-powered hedge against monetary shenanigans. I think of it as “exponential gold.”’

‘Exponential gold?!’

That’s sure to make some ears prick up…

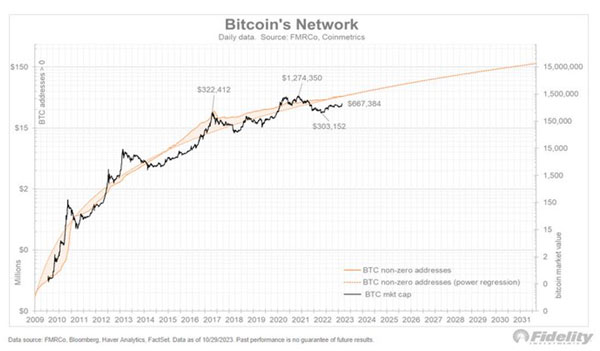

Timmer shared this chart to back up his claim.

| |

| Source: Fidelity |

What you’re looking at here is the correlation of Bitcoin’s value against its user base.

The black line is Bitcoin’s market cap and the red line is the number of ‘non-zero’ addresses holding Bitcoin.

This is on a log scale, so the figures rise exponentially.

You can see the clear correlation.

The more addresses holding Bitcoin, the higher in value Bitcoin goes.

Interestingly enough, right now the price is lagging this adoption metric. But that’s happened in previous cycles too.

If the cycles repeat, we could be in a for a ripping 2024 as valuation bridges the adoption gap once more.

But Timmer also shared a few other interesting data points in support of Bitcoin.

Let’s start with this one:

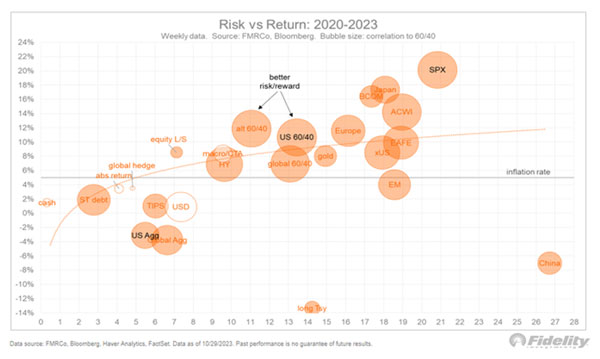

| |

| Source: Fidelity |

This shows different asset classes measured by their risk and return profiles.

Where’s Bitcoin, you ask?

It’s off the charts!

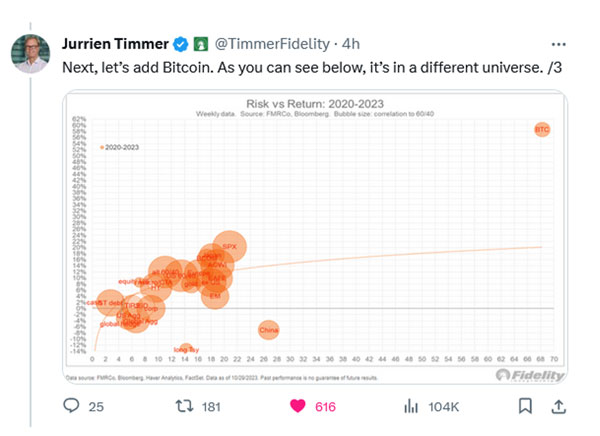

As Timmer tweeted:

| |

| Source: Fidelity |

As you can see, both the risk and the return on Bitcoin is huge.

But as Timmer points out the returns make the risk worth it.

He notes:

‘Yes, Bitcoin is down 54% from its two-year high, but it is also up 84% from its low. Government bonds can’t hold a candle to that risk-reward math, and neither can many other asset classes, at least at this moment.’

Anyway, he dives in deeper and actually comes out with a 50/50 Bitcoin/gold holding that rebalances quarterly as a very attractive strategy.

But none of this is news to readers of my Crypto Capital subscription. It’s the kind of thing I’ve been saying for years.

It’s one thing me saying it though, and another the head of macro at Fidelity saying it.

You see, there’s a professional snowball effect.

People like Timmer and Larry Fink over at Blackrock have spent the past six months legitimising Bitcoin as an asset class.

And it’s filtering down into the system.

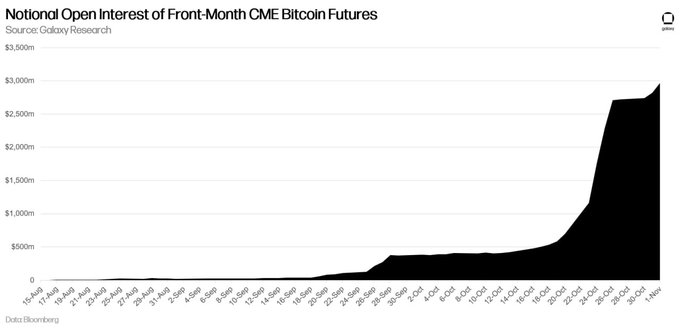

For instance, check out this chart:

| |

| Source: Galaxy Research |

This shows the amount of open interest in Bitcoin on the CME exchange (a massive regulated commodity exchange in the US) has tripled over the past month.

That’s huge!

And it’s a growing sign of increased institutional interest in Bitcoin.

It seems to me it’s no longer a career risk for finance pros to start recommending some Bitcoin in their portfolios.

Indeed, it might start the case that it’s a career risk to NOT have some Bitcoin exposure soon!

Because here’s the thing about Bitcoin.

When the price starts to move, it can move very fast…

Supply shock incoming!

With a spate of Bitcoin spot ETFs potentially being approved at any time, demand could rise thick and fast.

While at the same time, the supply of new Bitcoin is set to fall dramatically in April 2024.

Today around 900 new Bitcoin is ‘mined’ every day.

In April 2024, this figure falls to 450.

At today’s prices, that’s just US$15.75 million of demand per day needed to soak up 100% of post-April new supply.

A fall from US$31.5 million today.

Remember too that 80.34% of existing supply (19.5 million) is held by what’s classified as long-term holders.

These are people who lived through the carnage of 2022 and stayed the course.

Believe me, you’re not going to part these types from their Bitcoin at these cheap prices!

It’ll take at least a break of all-time highs — a 100% rise from here to US$69,000 — for that to even start to tempt some, in my opinion.

And as I noted last week, the window of opportunity to front run this potential supply-demand shock is running out.

Are you prepared for ‘exponential gold’?

Good investing,

|

Ryan Dinse,

Editor, Fat Tail Daily