As you’ll probably know, Victoria went into stage four lockdown yesterday.

In normal times this would be a catastrophe for markets.

But as we’ve seen in recent months, these aren’t normal times. So, we’ll see what happens on that front this week.

Personally — as an investor and trader — I’m ready for anything.

It’s definitely not good for the economy though, and there will be ripple effects to deal with in the months ahead.

Whatever happens, hopefully this new lockdown does put a final nail in the coronavirus coffin, and we can start to move on.

And most importantly, put an end to the deaths and suffering.

But today, I want to take a step back from the here and now and instead take a look at the big picture.

Because in a strange way the stock market reaction to the turbulent times of 2020 makes sense, when seen through the prism of one huge, overarching trend that dominates much of the Western world.

Let me explain…

Four Innovative Aussie Stocks That Could Shoot Up after Lockdown

Why failure is a good thing

One of life’s greatest gifts is failure.

Without the chance to fail, success becomes irrelevant.

Participation medals?

Pfft! No thanks…

Don’t get me wrong I don’t want to fail. But the prospect of failure is what makes success so sweet.

The chance of failure motivates you to do better. To use your brain, to do the hard yards, to try your best. It brings out the best in you.

And it’s not all about winning.

Learning to deal with failure the right way is also a very important part of life.

And in the economy, one person’s or one business’s failure is actually good for the rest of us.

Yes, I know that sounds cruel.

But the very idea behind free markets is that only the best, the most useful, and the most well executed ideas win out.

Which as Adam Smith noted is good for everyone:

‘By pursuing his own interest (the individual) frequently promotes that of society more effectually than when he really intends to promote it.’

But here’s the thing…

When it comes to present day markets, it seems like failure is no longer an option.

Stocks and property prices must only go one way.

Up.

But although we regularly fling mud at central bankers, politicians, and the usual cast of economic meddlers, the fact is, their actions are rooted in a source closer to home.

They are doing what they think we want.

At least, what they think one of the biggest cohort of groups that has ever lived wants.

The influential baby boomer generation.

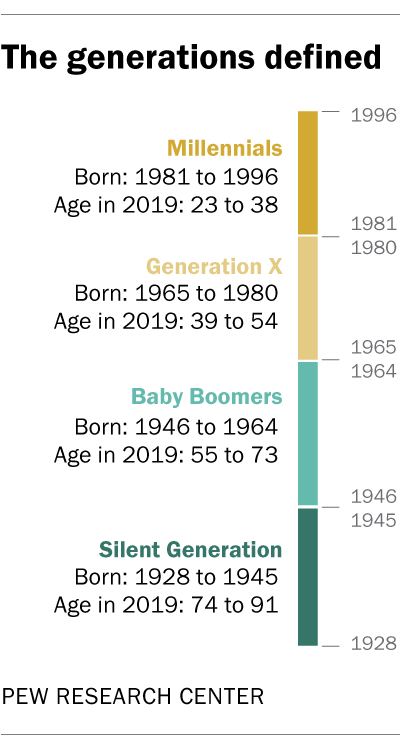

|

|

|

Source: Pew Research Centre |

That’s the essence of democracies after all. The will of the people wins (or at least the largest voting block) out.

So today, I want to address the question:

Are the baby boomers too big to fail? And if so, what does that mean for markets and economies going forward?

Let’s dive in…

The perspective of Mr X

I’m not going to get involved in any ‘generation wars’ stuff today.

Stereotypes of ‘greedy’ boomers and ‘lazy’ zoomers are boring — and in my experience, mostly wrong.

But as an independent (and irrelevant) generation X-er, straddling the middle of the two biggest demographic groups in society, I can’t help but see some definite trends developing.

And I’ve a front row seat.

My parents are boomers, and three of my younger siblings are millennials. I hear their complaints, views, and hopes on a regular basis.

This isn’t just theory to me!

Which takes me to the first big change taking place right now…

You’ll find this interesting if you don’t know it already.

The fact is, the millennial generation are close to overtaking the baby boomer generation as the largest generation — and hence are about to become the largest voting block.

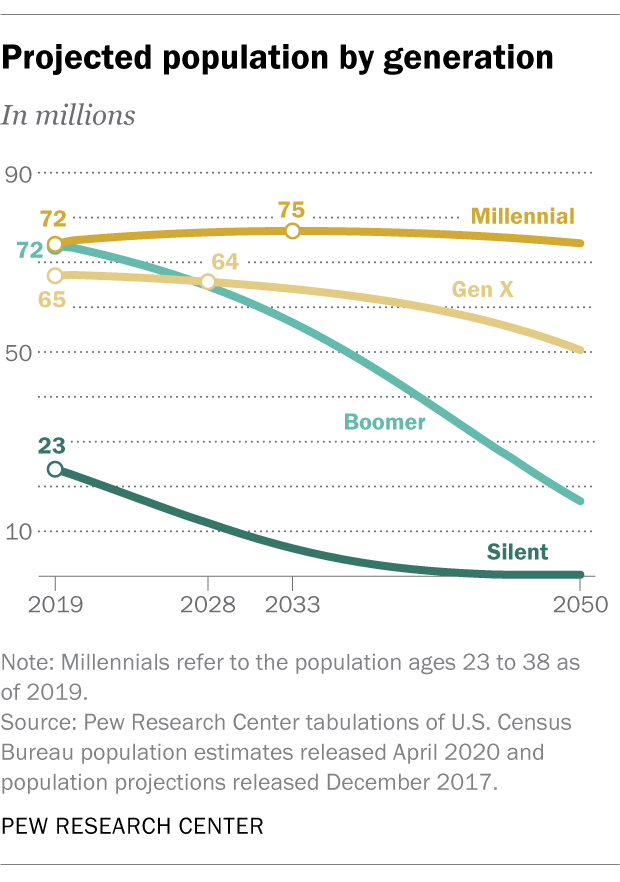

|

|

|

Source: Pew Research Centre |

This chart is for the US, but the trend is similar in many Western countries including Australia. There’s a power shift underway and it’s about to pick up steam.

Economically speaking, there are consequences to this fact.

A so-called ‘demographic cliff’ is looming.

There are five million baby boomers in Australia. 50% of them will be retired by this year, with almost all retired by 2029.

This is going to put an increasing strain on government budgets. Health costs alone are forecast to cost $36 billion a year by 2028.

Then there’s other associated retirement costs like the aged pension to account for too.

Now, in a perfect world, these soon to be retirees will have sufficient money to help make their dotage a comfortable experience.

They’d be able to self-fund to a degree, helping both the economy and the budget bottom line.

But that means living off their savings.

And these savings are overwhelmingly invested in shares and property right now.

So, what happens if markets and/or property prices tank?

This is the great risk, not just to the boomers’ retirement plan, but also to the entire economy.

In effect, the boomers are too big to fail!

So, what happens next?

Seen through this macro lens, the actions of central banks in propping up markets through endless money printing is at least understandable — if not ultimately effective.

The real rot set in after the GFC in 2008.

This was a chance for acceptable failure.

But instead of allowing the forces of creative destruction to work their magic and set up the economy for a more resilient future success, a series of bailouts and exercises in money printing led to the type of crony capitalist system we live in now.

A system where the government is the guarantor of everyone else.

Not allowing failure back then has ramped up the risks now.

If the inefficiencies of the economy had been addressed in 2008, a lot of baby boomers would have had time to recover.

Now?

Not so much.

So, a-printing they will do.

There will be fallout though.

It will destroy the system of money we currently operate under. And we can see that happening through the surge in gold prices and the falling US dollar.

But asset inflation isn’t a by-product of other economic goals.

It is the goal.

If asset prices don’t stay high, it’ll create a destitute boomer generation living off the teat of a heavily indebted society that can’t afford them.

But there could be a curve ball to all this…

As I alluded to at the start, there’s a potential fly in the ointment of a ‘boomer first’ economic plan. And that’s the soon to be very influential millennial generation.

Saddled with student loans, living off low wages, and locked out of assets like property, their reactions to these times will be interesting.

They’ve got the power, but I’m not sure they know it yet.

Though like anything in life, there will be nuance too.

Some of these millennials stand to inherit their baby boomer parents’ wealth and are happy to support the status quo of asset price inflation.

But many aren’t in that boat. And it’s why we’re seeing younger politicians start to publicly wonder out loud about new forms of economics.

It’s also a big impetus for the world of cryptocurrencies, where according to some reports a whopping 20% of millennials own some bitcoin compared to just 2% of boomers.

Anyway, from my relatively powerless Gen X position I’ll continue watching this fascinating generational trend unfold.

I advise you to too.

Because the outcome of this tug of war will have major implications on asset values, economies, and specific sectors of the market.

Good investing,

|

Ryan Dinse,

Editor, Money Morning

Ryan is also editor of Exponential Stock Investor, a stock tipping newsletter that looks for the biggest investment opportunities on the market. For information on how to subscribe and see what Ryan’s telling his subscribers right now, click here.

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here.