According to many, the biggest 50-day stock market rally in history was caused by a bunch of spotty millennials buying ‘stonks’ with their $1,200 stimulus handouts.

Legend has it these enfant terribles bought into the market crash with careless abandon.

The bigger the falls and the more dubious the stock, the more they ploughed in.

Beaten-down airlines, cruise ship companies, and even bankruptcy cases like Hertz were particular favourites.

Then, unbelievably, as the Wall Street pros scoffed from the sidelines, the market ripped higher, back to previous highs.

The ‘Robinhood trader’ was the new master of the universe…

As one social media trading star explained on MarketWatch:

‘On Monday, Portnoy slammed Berkshire Hathaway’s Warren Buffett for unloading airline stocks as the coronavirus epidemic took its initial toll.

‘He also went off on how he made almost $300,000 on the day but missed out on an even bigger number by getting out too soon.

‘“I’m just printing money,” Portnoy said. “Why take profits when every airline goes up 20% every day. Losers take profits. Winners push the chips to the middle. … I should be up a billion dollars.”’

He modestly added:

‘“I’m not saying I had a better career. … He’s one of the best ever to do it,” he said. “I’m the new breed. I’m the new generation. There’s nobody who can argue that Warren Buffett is better at the stock market than I am right now. I’m better than he is. That’s a fact.”’

You can watch the clip here for a good laugh.

So, is this the new reality?

And did these upstarts really drive a history-making rally?

Initially, I was a bit sceptical of this narrative.

It seemed a bit media-driven; a rehashing of the old ‘boomer versus zoomer’ story.

I’ve no doubt the Robinhood traders have been very busy in the market…

But to have the capital to cause such an all-time surge in markets?

I highly doubt it…

Unless they all cashed out at the top of the crypto boom in 2017 and became secret millionaires (Narrator’s voice: they didn’t), I seriously doubt they had anywhere near the firepower to cause this run.

So, what’s really going on with this market rally?

Well, I decided to have a closer look. And let me tell you, what I found was a shock.

You see, I found that the Robinhood traders were the cause of this rally.

But not how you think they were…

This is not a time to panic. It’s a time for ACTION. Click here to download your free report now.

If something’s free

For those not familiar with the Robinhood share trading app, here’s the gist.

Launched in 2013 to great fanfare, the application promised to bring share investing to the masses.

As a smartphone app, it was sleek, easy to use, and most importantly — free to trade.

It marked the start of a new breed of fintech applications that have really started to dominate in the past couple of years.

And Robinhood was a roaring success. It introduced a whole new generation of younger investors to the stock market.

But if we’ve learned anything in recent years from the scandals at Facebook and Google, it’s that nothing is really free.

If you’re not paying, then in some way you must be the product.

And that’s exactly what’s happening at Robinhood…

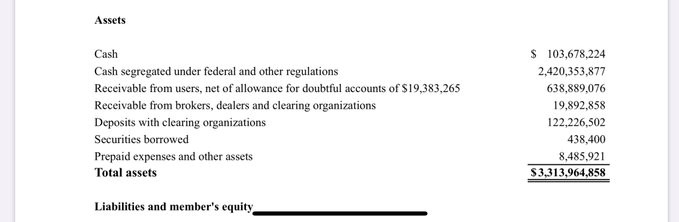

According to their accounts, Robinhood has a paltry $3.3 billion of customer funds.

|

|

|

Source: Twitter @GerberKawasaki |

That’s less than even the smallest of Vanguard funds. A mere rounding error in the huge funds management industry.

And yet we’re supposed to believe this is what caused the history-making rally?

But then there’s this…

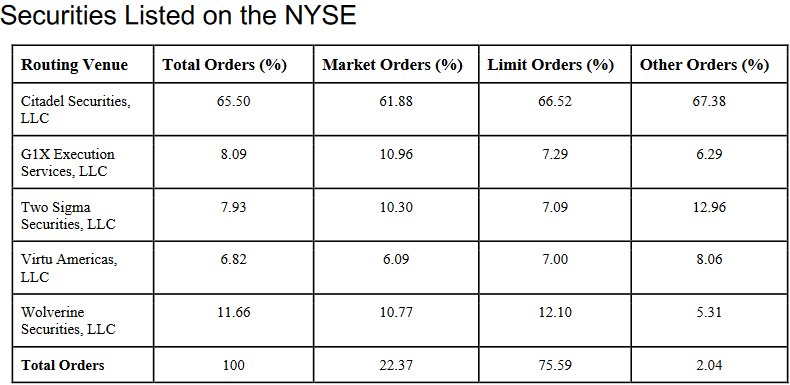

Check out this other document from Robinhood’s accounts:

|

|

|

Source: Robinhood |

The paragraph accompanying this table explains:

‘Revenue that Robinhood Securities and Robinhood Financial receive from the third-party market venues detailed below are shared pursuant to a fully-disclosed clearing agreement between the two firms. The per share/per contract amounts received below represent the total amount of payments received by Robinhood Securities and Robinhood Financial.’

What does that mean?

Well, this is Robinhood selling their customers’ order flow to certain institutions.

Many of these institutions have high-frequency trading algorithms. Which means if they know the order flow of Robinhood investors’ trades, they can front-run — get in ahead — of the Robinhood buy and sell volume.

This makes things interesting.

You see, the HFT funds are a lot bigger and usually highly leveraged.

So, in effect they amplify the Robinhood volume many times over.

And that is how a few thousand mug punters on Robinhood can in fact move markets.

What does this mean?

To be honest, I’m not sure…

All I know is it’s yet another crazy fact you have to deal with in the markets. Add it to the list, I suppose…

What will central banks do?

What will President Trump do?

What will the Chinese do?

And now, what are the Robinhood traders doing!?

The markets…don’t you just love them!

Good investing,

Ryan Dinse,

Editor, Money Morning

Ryan is also editor of Exponential Stock Investor, a stock tipping newsletter that looks for the biggest investment opportunities on the market. For information on how to subscribe and see what Ryan’s telling his subscribers right now, click here.