It’s a good question.

The EV revolution was put on pause by low oil prices, and this is certainly a structural difficulty for ASX-listed lithium stocks going forward.

But the current rally for these companies started shortly after EU countries put subsidies back on the agenda.

This from Reuters in early June:

‘Germany doubled electric car subsidies, lowered value added tax (VAT) to 16% from 19%, and rejected an auto industry request to incentivise vehicles with internal combustion engines in favour of a plan to increase charging infrastructure.

‘German fuel stations will be required to provide electric vehicle charging, transforming opportunities to refuel zero-emission cars that consumers have shunned in part because of concerns over their range.’

And EV sales are holding up better than their combustion engine counterparts, despite their small market penetration.

With this in mind, I’m going to sum up what’s happening at the moment on the charts for the major Australian lithium companies and discuss whether this is the start of a long run-up or another false dawn.

The punchline — it could be both.

Depending of course, on the slippery concept of time.

ASX lithium stocks snapping a downtrend signalling early stages of lithium bull?

ASX-listed lithium stocks went into a well-documented decline from the start of 2018.

You’ve likely seen the charts.

For instance, check out the weekly chart of Galaxy Resources Ltd [ASX:GXY] since 2016:

|

|

|

Source: tradingview.com |

You can see a long-term downtrend which it is having a second go at snapping, as well as some potential resistance at $1.10.

If you made a trade on any of the larger lithium companies near the most recent bottom, you may be looking to exit quickly.

But if you just take the last three months into account on the daily chart, you can see things look more bullish:

|

|

|

Source: tradingview.com |

You can see GXY tacked on around 45% from the late-June low.

It’s a similar story for the charts of Pilbara Minerals Ltd [ASX:PLS] and Orocobre Ltd [ASX:ORE].

And again, the slippery concept of time is important here.

If they can push past resistance now, then it’s possible that this is the very early stage of a return of the lithium bull.

However, if you put any money in at or near the 2018 peak, the pain would be palpable.

The chart for the last five years still looks dire.

What do you do in this situation?

Keep loading up on the slide, safe in the knowledge that a long-term trend (EVs) will drive demand for lithium?

Or do you sell at a steep loss?

That’s certainly not ideal.

These are questions that could ultimately depend on where you sit in demographics of the investment world.

Lithium stocks may be suited to younger generations

With interest rates very low or in some cases negative around the world, a lot depends on your age.

In this environment, I’d argue that younger people should be more prepared to take both riskier and longer-term investments.

You’ve got time on your side.

You can stick to your convictions, unless something drastically changes.

You can recoup losses through income.

So ASX-listed lithium stocks may suit you.

At the same time, I’d also argue that older people should be more prepared to take less risky and shorter-term investments.

Which is why there is such strong interest in dividend stocks.

The young spend and the old save now.

To a degree, before interest rates started their descent it used to be the other way around.

So, waiting around for a lithium resurgence might not be ideal for an older investor.

Ask yourself this question before you invest in lithium

The desired demand-supply divergence seems to always be pushed back.

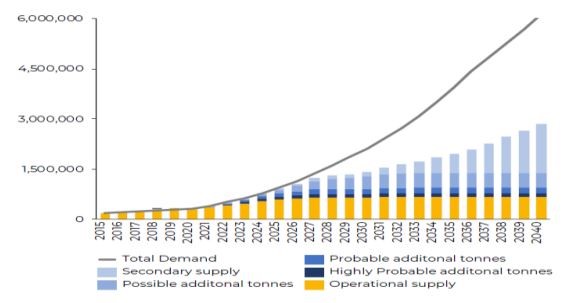

As you can see from the most recent Galaxy Resources quarterly, it looks as if 2027 could be the year that a serious lithium price rally takes place:

|

|

|

Source: Galaxy Resources Ltd |

Part of the problem is that companies like GXY are stockpiling inventory, waiting for prices to improve.

This is probably a wise move for individual companies, but if everyone does it, it means there is a longer wait on the cards.

That’s because if a company needs extra cash they can always dip into their large inventory.

It’s a bit like a game of Poker.

If everyone plays conservatively it takes longer to finish the game and winnings accrue more slowly.

So, if you are looking to try your hand at an investment in ASX-listed lithium stocks, you might want to first ask yourself this key question.

How much time do I have?

Regards,

|

Lachlann Tierney,

For Money Weekend

PS: In today’s video update I discuss the implications of a potential Chinese debt crisis and a breakdown in China–Australia relations for major Aussie miners. Watch the video below…

Lachlann is also the Junior Analyst at Exponential Stock Investor, a stock tipping newsletter that hunts for promising small-cap stocks. For information on how to subscribe and see what Lachy’s telling subscribers right now, please click here.