Australia’s critical minerals sector has received a major boost as the Albanese government announced an $840 million financing package for Arafura Rare Earths [ASX:ARU] to develop its rare earths mine and refinery project in NT.

The Nolans project, located 125km north of Alice Springs, aims to produce crucial rare earth elements like neodymium and praseodymium used in electric vehicles, wind turbines, and defence applications.

Once developed, Arafura claims the Nolans Project will supply around 4% of the world’s demand for these high-tech minerals.

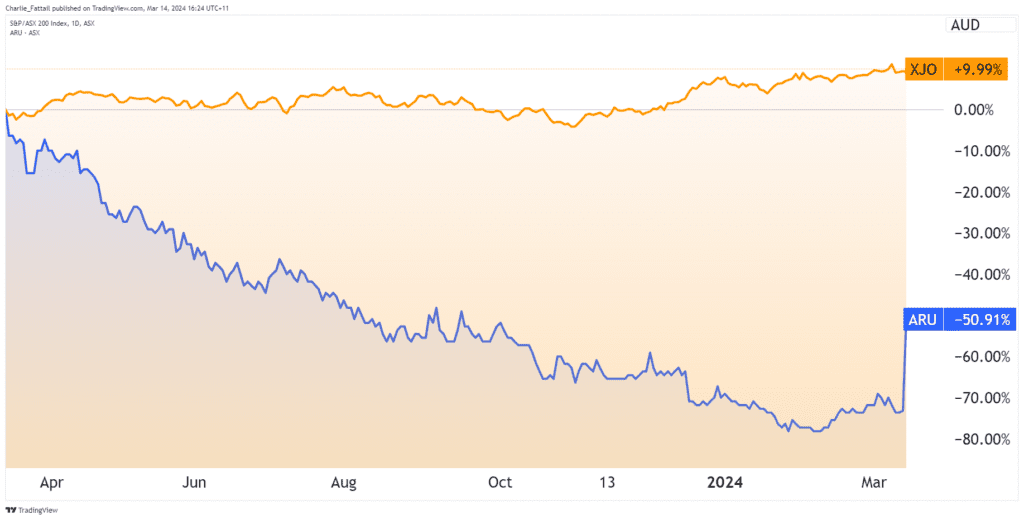

After the announcement today, the company’s share price jumped over 76% to trade at 26.5 cents per share. The move reversed the company’s considerable downtrend since peaking at 62.5 cents back in February 2023.

Is today’s move the beginning of a bull run, or are investors getting ahead of their skis?

Source: TradingView

Strategic Resources

The decision from the government will mean a good day for billionaire Gina Rhinehart, who has a 10% stake in Arafura.

The decision comes just a day after the federal government announced another $230 million loan commitment from taxpayers and $320 million from others for another Rinehart-backed player, lithium developer Liontown Resources [ASX:LTR].

The Arafura funding comprises $495 million in loans from the Critical Minerals Facility, $200 million from the revamped Northern Australia Infrastructure Facility, up to $115 million in export financing, and around $30 million in grants.

This financing effectively increases the federal government’s exposure to rare earths mining and processing by over 50% to well above $2 billion.

Federal Resources Minister Madeleine King said the investment in the project was to ensure Australia could capitalise on its vast deposits of rare minerals.

‘The main consideration is that we compete on the world stage with our natural resources … principally this is about competition,’ she told ABC Radio National on Thursday morning.

‘For too long, we have sent some of our raw minerals out to be processed in a competitor nation, but now we believe we should do more of that here.’

With an estimated cost of $1.68 billion to fully develop the mine, Arafura hopes to leverage strategic partnerships like the one with South Korea’s export credit agency KEXIM, which has indicated a willingness to lend a further $226 million.

Trade Minister Don Farrell said the government will encourage more international investment in Australia’s critical minerals opportunities while building partnerships with major economies to diversify global supply chains.

The funding comes at a crucial time for the company as it’s seen its share price slide as the price of critical minerals has struggled with weaker demand and ramping up supply from China.

This month, prices for neodymium and praseodymium fell to a three-year low at US$50 per kg. The benchmark price for NdPr in China was US$139.3 per kg in early 2022.

Despite the critical minerals sector facing headwinds from falling global prices, the government funding aims to bolster domestic supply chains and reduce dependence on China, which currently produces over 80% of the world’s rare earth oxides.

Outlook for Arafura

This is not the first time Arafura has seen extreme moves in its share price. For investors who’ve been in the stock for some time, the volatility will likely be a welcome change from the falling doldrums.

However, new investors should be wary of jumping in too early. With such a solid single-day jump, some of that price movement will likely come back down to earth in the coming weeks.

In the medium term, the hefty price tag on the development of the Nolan Project and progress in its early roll-out stages will be crucial to pick its next stock movements.

The announcement is also a boon for the Northern Territory, with the project expected to create over 300 jobs, including 200 in construction. Arafura targets securing full funding by March and aims for first production around December 2026.

Arafura remains a speculative play, as the technical challenges involved in mining and refining these minerals should not be understated.

Longer-term rare-earth prices could recover as the demand for goods such as advanced magnets, wind turbine parts and specialised alloys is projected to grow in the coming years.

However, the clear party to watch is China, whose stranglehold on rare-earths oxides makes the future of this company an exciting story to watch.

Another Commodity Breakout

Something BIG is happening in the gold market right now.

If you haven’t followed along, it’s probably because not many major news organisations are discussing it.

We are hosting a special event premiering today where you can figure out what is changing in the market.

And importantly, how you could benefit from it.

From 2015 to 2022, this insider’s private family office fund beat the Australian gold stock index for seven years running.

And when gold last broke out between 2019 and 2022, his fund beat the index by more than seven times over.

So when he is making new gold predictions, then it’s worth listening to his latest ideas.

‘There are three key signals that give me great cause for optimism right now,’ this insider says.

‘The alignment of these signals could be the perfect storm for the gold sector this year…’

‘And the biggest beneficiaries of this new bull market won’t be those holding physical bullion or coins. Instead, it will be the Australian companies who dig gold out of the ground. And more importantly, the investors who own these companies’ shares.’

Our event is called ‘GOLD FEVER 2024’.

Click here to secure a spot and join our event that opens today.

Regards,

Charlie Ormond

For Fat Tail Daily

Comments