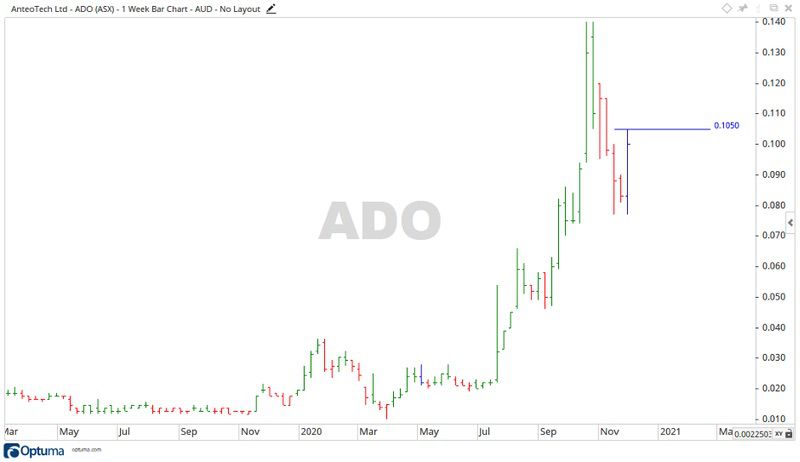

At the time of writing the AnteoTech Ltd [ASX:ADO] share price trades at 10.5 cents, up 5%.

AnteoTech announced the company received a cash refund of $1,195,634, under the Federal Government’s research and development tax incentive scheme.

Source: Optuma

AnteoTech develops COVID-19 test

The COVID-19 pandemic saw companies worldwide turn their attention to finding a solution for the problem.

AnteoTech have developed a rapid test to do exactly that.

The company announced recently that all development processes and internal testing procedures for the high-sensitivity COVID-19 Antigen Rapid Test (ART) are complete.

The company declared a ‘design freeze’ for the product.

The final design of the test is less than one-minute analysis time in the reader.

The planning of clinical trials with Victorian Infectious Diseases Reference Laboratory — a unit of Doherty Institute — is underway and on track for December 2020 commencement.

The injection of cash combined with the proceeds from the conversion of underwritten options gives the company a strong cash position of over $6 million.

The funds will be used for new R&D programs.

The race to contain COVID-19

Cases of the virus in Australia are slowing, with some states reporting to be COVID-19 free.

The northern half of the world is still in trouble, however. Cases in the US and Europe keep rising, making the demand for rapid and accurate tests huge.

Source: Optuma

From the low in March the ADO share price moved up 1,300% to the all-time high of 14 cents.

Retracing 50% before moving up to where it trades at the time of writing.

The fall took place on decline volume, this combined with the 50% retracement is a strong sign of confidence.

If the move up can be sustained, then the levels of 11 and 14 cents may be broken.

If a fall back happens, then 9 cents may come into play.

AnteoTech holds a market of $137.76 million. With the new test looking promising, the company looks set to get bigger. Could be a good share to put on a watchlist.

Regards,

Carl Wittkopp,

For Money Morning

PS: The Next Afterpay? Discover three promising Aussie fintechs that are currently trading below $1. Click here to learn more.

Comments