Junior minerals miner Anson Resources [ASX:ASN] has had a busy few days.

On Monday, ASN shares spiked after an update regarding Anson’s Paradox Lithium Project.

On Tuesday, Anson released an investor presentation.

And on Wednesday, the company retracted its production capacity growth target days after first announcing it.

The retraction didn’t bother investors too much, with ASN shares down slightly in late afternoon trade.

Over the past 12 months, Anson shares are up 115%, although flat year-to-date:

Source: Tradingview.com

Anson retracts production capacity target

This morning the miner addressed the public with reference to its statements made on Monday and Tuesday concerning its Paradox Project.

The claims related to plans to upgrade the DFS production capacity to 10,000tpa of lithium.

The announcement was followed by a discussion with the ASX, which prompted the retraction.

As Anson explained:

‘Following discussion with the ASX, the Company notes that the targeted production capacity figures quoted in the Announcement and Presentation are not consistent with the requirements of Listing Rule 5.16, to the extent that they are seen to be a statement of a “production target”.’

Why was the targeted production figure not consistent with the listing rule requirements?

‘Listing rule 5.16 requires that a production target may only be announced to the market when accompanied by disclosure of the material assumptions supporting the production target.

‘The Company intends to provide further information regarding the planned increase in Stage 1 Lithium Carbonate production capacity at the Paradox Lithium Project on announcement of the DFS.’

To this end, Anson has retracted the 10,000tpa production target figure.

Anson’s investor presentation

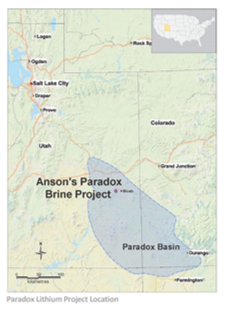

Yesterday, Anson Resources talked investors through the specifics of its 100%-owned Paradox Lithium Project based in Utah.

The lithium miner said its Paradox Project has a high concentration of lithium and bromine, with its JORC Resource containing 186kt (thousand tonnes) Lithium Carbonate Equivalent (LCE) and 1,012kt of bromine.

In that presentation, it referenced the now-retracted 10,000tpa figure.

Anson reported that:

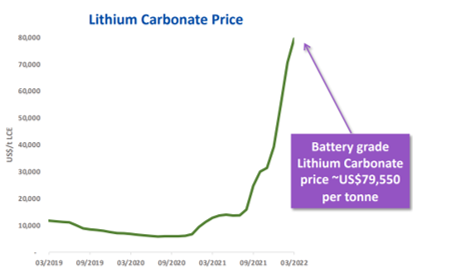

‘Substantial developments in the lithium market, combined with the unique attributes of the Paradox Lithium Project, have driven plans to increase Stage 1 Lithium Carbonate production capacity to 10,000tpa.

‘This represents a 275% increase in production capacity from the 2,674tpa published in the Project’s Updated Preliminary Economic Assessment.’

Source: Anson

According to Anson, there are only 750,000 tonnes of Lithium Reserves in the United States, less than 3.5% of the world’s lithium reserves.

Lithium battery production is expected to grow, too. By 2025, in the US alone, they are set to multiply 10-times to 382GWh a year.

By 2030, production is to multiply 17-times to 620GWh a year.

Source: Anson

Now, on the topic of lithium, which ASX lithium stocks are out there that have been severely overlooked by the market?

In our recent report, we think we have identified three overlooked lithium stocks.

To find out more, read this research report.

Regards,

Kiryll Prakapenka,

For Money Morning