Lithium explorer Anson Resources [ASX:ASN] released news of its latest discoveries at its Green River Lithium Project, confirming promising geological features very similar to those of its flagship Paradox Lithium Project.

Therefore, the miner expects easy brine flow to make a positive impact on Paradox Basin Lithium projects by simplifying the processes and cutting costs.

Shares for the lithium miner were moving up by 2.5% not long after the update emerged on the ASX.

In the past year, ASN shares surged by 60%, and the company continues to perform strongly in its sector:

www.tradingview.com

Green River prospects confirmed

Today Anson reviewed its findings for the geological features and structure of its Green River Lithium Project. The company is excited that Green River is similar to its flagship project, Paradox Lithium, due to ASN finding indications of higher porosity in host rocks. This creates potential for artesian flow of brine from depth to surface without the need for any pumping processes or equipment.

ASN has also found there to be several salt-water geysers and springs about 15km wide and 16km long, a geological feature known as the ‘Ten Mile Graben’.

The group believes the similarities between the Green River’s structure and ‘Roberts Rupture’ at Paradox will deliver a positive ESG impact for all the group’s Paradox Basin lithium projects, simplifying processes and making the situation both ‘unique and advantageous.’

The company said:

‘This is a highly positive outcome and is of significant importance. These results, combined with Drill Stem Tests (DST) data from historic wells within the Project region, indicate that the Mississippian strata has a high permeability across a large area. This permeability indicates that flow rates required to support a planned lithium plant may be achieved, as well as indicating that the pressure may remain constant over the life of the lithium project.’

Source: ASN

Anson’s research into the Green River Project has revealed historic oil and gas wells drilled into the rock, providing an extensive database of information for the company, reducing exploration costs, and shortening time frames for JORC calculations.

Some core sampling and flow testing have also been carried out on some of these wells. Anson intends to obtain these samples from the Utah Core Research Centre to determine indications like porosity and yield, saving the company on costs this testing would usually incur.

Anson said:

‘This will deliver a significant cost saving for the Company in upgrading the Green River Exploration Target (ASX announcement, 15 February 2023) into a JORC Mineral Resource estimate. The available data indicates that the Green River Project is very similar in all aspects to the Paradox Lithium Project.’

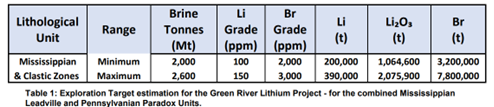

In the company’s previous Exploration Target estimation, the company reported, ‘2.0 billion tons to 2.6 billion tons of brine, grading 100 – 150ppm Li and 2,000 – 3,000ppm Br’ for Green River.’

Source: ASN

Australia’s boom in commodities and how to capitalise

Things are getting pretty competitive in the commodities market.

It’s a busy place with so many options. Sometimes it can be hard to figure out which companies to bet on and which ones are on the pathway to the most success.

Our in-house resources expert and trained geologist, James Cooper, thinks the Australian resources sector is set to enter a new commodities boom brought on by the ‘Age of Scarcity’.

James is convinced ‘the gears are in motion for another multi-year boom in commodities’… and better yet, this is a boom where Australia and its stocks stand to benefit greatly.

The next big mining boom is predicted to happen in the next few years. The question is, are you ready for it?

Don’t let the same people who got rich last time be the only ones for a second time!

You can access a recent report by James on exactly that topic AND access an exclusive video on his personalised ‘attack plan’, right here.

Regards,

Mahlia Stewart,

For The Daily Reckoning