Ansell [ASX:ANN] shares plummeted this morning due to the release of a trading update that sparked investor concern. The company’s shares have declined by a staggering 14.48% today, trading at $23.75 per share — causing alarm among shareholders.

Today’s reversal wipes out all of the past year’s gains for the company plus change — with share prices now down by 4.12% for the past 12 months.

The company had been previously lauded for divestment of its Russian operations in late April after selling its manufacturing plant in Tula, Russia, to Perspectiva CJSC.

But broader macroeconomic trends have caught up with the company, which has seen profit margins fall as it reduced prices. These price drops were in line with distributors who are reducing inventories across the board.

Source: TradingView

Ansell 2024 earnings forecast to fall

The reason behind the sharp drop today was a trading update that provided guidance for both FY2023 and FY2024.

The company stated that based on the initial consolidation of its full-year results, it expected to report FY2023 earnings per share (EPS) in the US$1.17–1.18 range.

While this was in line with its most recent guidance range, it fell at the low end — after excluding adjustments associated with its Russian exit.

Looking at the events that unfolded during the year, Ansell’s management revealed that Industrial GBU sales for FY 2023 had decreased to approximately US$750 million from US$762.5 million the previous year.

However, there were signs of growth and overall margin improvement in both the mechanical and chemical segments during the second half of the year.

In contrast, Healthcare GBU sales dropped significantly to approximately US$900 million from US$1,189.6 million in FY2022.

The decline was attributed to distributors and end customers reducing high levels of inventory accumulated over the past two years, which continued in the second half of the year as market uncertainty grew.

Looking ahead to FY 2024, Ansell seemed cautiously optimistic about its industrial prospects. But it acknowledged that its performance would be influenced by broader macroeconomic headwinds.

In Healthcare, the company expected volumes to recover, but price reductions would likely offset that growth. Despite this, it anticipated that demand for its Surgical and Life Sciences products would continue to grow.

Ansell plans to embark on a major investment program across a series of productivity initiatives to address these challenges. ANN said these changes are ‘designed to drive EPS growth and improve returns on capital employed.’

The program is expected to have a cash cost of US$40–50 million but is expected to deliver annualised pre-tax cost savings of US$45 million by FY 2026.

Based on the above, Ansell is guiding to FY2024 EPS in the range of US$92–112 cents on an adjusted basis.

If you include its investment program costs, Ansell’s 2024 EPS is expected to be between US$57–77 cents.

The share price reaction to the update was swift, with Ansell shares falling 14.48% to $23.75. The sell-off wiped out all of the company’s 12-month gains and some more.

Outlook for Ansell

Shareholders were clearly disappointed by today’s trading update. With growing levels of market uncertainty, their reaction signals a clear intention by investors to find safer waters.

It is now clear that Ansell had high earnings expectations that were partly influenced by previous COVID sales.

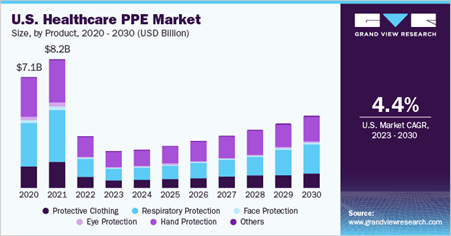

In a post-COVID world, distributors realise they are holding huge stocks of inventory that they need to clear as demand drops — and prices of single-use surgical gloves and PPE are bottoming.

Source: Grandview Research

The warning of a potential earnings decline in FY2024 comes at a time when the broader market is also facing headwinds, such as rising inflation and interest rates.

For Ansell, the road ahead appears challenging. The company would need to execute its investment program successfully to regain market confidence and drive future growth.

Thankfully, the company is currently holding very low debt after its pandemic boom in sales. Therefore, its investments to drive growth will come at a lower price than most in a high-inflation market.

How the Ansell share price will perform in the coming months remains to be seen. However, the recent sell-off suggests investors are souring about the company’s prospects and looking elsewhere.

But in turbulent markets, where do investors look?

In uncertain times, defensive positions often mean looking for companies that will weather the storm and provide dividends.

Finding dividends that are worth your time

The market has roiled stock investors for the past year — steady ground has been rare.

With things looking uncertain in the stock market, maybe it’s time to change tactics.

Smart investors are focusing on quality stocks that can provide safety and pay dividends.

But blindly buying the ‘best dividend-payers’ could be a fruitless move beyond the short term.

That’s why our investing expert and Editorial Director, Greg Canavan, has spent his time finding the smart move.

He calls it the Royal Dividend Portfolio, and it’s the sweet spot between growth and dividends.

If you think you’re overexposed in uncertain times or simply too defensive with cash and bonds, you may want to consider a different strategy.

Click here to learn more about what that looks like.

Regards,

Charles Ormond,

For Money Morning