Earlier this week, WA Premier Mark McGowan announced he’s quitting politics.

Many of you remember that he was behind one of the most restrictive border policies in the country. These policies ruined families and businesses, notably the mining industry that relies a lot on ‘fly-in, fly-out’ workers.

Now you wonder why he’d quit so abruptly. After all, the media lauded him as a hugely popular premier in his state, which they highlighted in their polls.

McGowan told the public in his address that he was ‘exhausted’, suffered from ‘many sleepless nights’, and ‘excess worry about things’.

What’s interesting is that McGowan’s reasons for stepping down from the state’s top post echoed that of former NZ Prime Minister Jacinta Ardern, who resigned in mid-January this year, citing she no longer ‘had enough in the tank’.

Now on the surface, this seems like a nothing burger.

They’re tired and want to focus on their own lives and family.

Nothing to see here.

But if you ask me, that’s just a cover story to divert your attention.

Let me take you on a deeper dive so you know what’s at play.

Today’s hard-line leaders are not so tough

If you go back a few decades and study examples of the longest-serving leaders (many of whom were tyrants and despots), they weren’t made from the same mould as the ones today.

Now don’t get me wrong. I’d rather have today’s tyrants than those of the past.

But we’ve seen a few who’ve ruled with an iron fist over the last three years. Now they’re stepping down claiming exhaustion or a desire to spend more time with family.

Come again?

Exhausted after a few years of presiding over a state of emergency, which they happily extended continually?

Was it not energising enough for them to enjoy high approval ratings and a fawning media praising every policy they implement that strips the people of their freedom?

How about winning re-elections with a stronger margin?

I wonder whether back in the day the thought of quitting due to exhaustion crossed the minds of Cuba’s Fidel Castro, China’s Mao Tse-tung and his nemesis Chiang Kai-shek, Cambodia’s Hun Sen, Former Yugoslavia’s Josip Broz Tito, Zaire’s Mobutu Sese Seko, and Zimbabwe’s Robert Mugabe.

Or even Türkiye’s current President Recep Erdoğan, who narrowly won re-election over the weekend and is onto his third term— his 20th year at the top job. Those who follow the news in Türkiye know that running that country with its myriad of problems is no simple feat! But we don’t hear a hint of fatigue from President Erdoğan!

No dismounting off the tiger

I don’t buy this ‘exhaustion’ reason at all.

The psychology behind wielding power doesn’t line up.

There’s an old Chinese saying, ‘It’s hard to dismount from a tiger after riding it’.

Fact is, when you’ve consolidated power, you’ve upped the ante. You’ve made your enemies and crossed the Rubicon. You can’t afford to relinquish power for fear of retribution.

During the pandemic, many of these leaders wielded extraordinary emergency powers and rode roughshod over their country’s constitutional and legal framework. Not only that, but they also implemented policies that hurt many businesses and the general public.

In turn, they made powerful enemies.

This will worsen as people wake up and realise the façade of the health measures and science used to back these policies.

The tide has certainly turned against those in charge who ran with these directives and implemented measures on society without exception or leniency.

Has McGowan’s hard-line policies and grandstanding come a-haunting him at night?

Some of you may’ve lived through the hard-line policies that McGowan imposed on WA in the past three years.

The heavy-handedness of McGowan’s border closure to both domestic and international travellers, and the vaccine mandates that included heavy fines on non-compliant individuals and businesses, caused even the Sydney Morning Herald to publish an article in late October 2021 criticising him for infringing individual rights and liberties.

During the vaccine rollout, McGowan was vocal and often criticised Australians as well as leaders of other states for not pushing as hard as he did. In response, he was accused of playing politics.

McGowan has also publicly stated his reason for such harsh measures was to ensure the success of his plans to mass vaccinate the population.

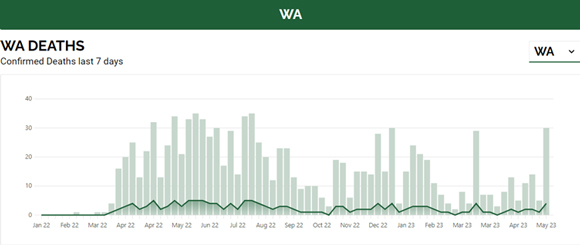

The numbers are starting to turn against him. The recent data shows that while the official proportion of the state’s population getting the vaccines is the highest in the country, the cases and deaths are rising once more:

|

|

|

|

| Source: COVID Live |

I wonder whether these are the ‘many things’ causing McGowan sleepless nights. After all, he entrenched himself heavily on this to the point where he painted himself into a dark corner.

The unintended consequences of ruined businesses and devastation to the way people live are now mounting. I believe the resentment and outright hatred will soon follow.

The wheels of justice turns slow…

If you look at the list of the leaders who epitomise medical tyranny, it seems many have already stepped down.

NIAID Director Dr Anthony Fauci out.

CDC Director Rochelle Walensky out.

British Prime Minister, Boris Johnson out.

NZ Prime Minster Jacinta Ardern out.

NT Chief Minister Michael Gunner out.

Now add McGowan to the list.

So now we wonder, who’s next?

VIC Premier Dan Andrews or QLD Premier Anastacia Palaszczuk?

Or Canadian Prime Minister Justin Trudeau?

The globalists’ pyramid scheme is collapsing

If you haven’t noticed, the globalists are shedding power and losing influence each day.

Their top-down centralised system of ruling the people through control of the monetary system, national governments, multinational corporations, and various institutions seems to be facing public rejection at every step.

In the past, it was possible to use the mainstream media to ensure that the people are getting their facts from these ‘trusted’ outlets. However, as Twitter fell to Elon Musk, that changed everything. The alternative media also launched its assault by exposing the mainstream media’s biased and slanted coverage, backing their claims with sound analysis and proof.

While they try to cling to power by appealing to their incumbency and tenure, it’s clear that the people are fed up.

Many elites and their agents see the writing on the wall. Some are stepping down from their positions. Others are caught in humiliating scandals of corruption and sexual abuse.

None of this tells me that they can prevail.

While we continue to contend with government corruption, policies that benefit the extremely rich, social transformation aimed at changing our lifestyles, and the possibility of being confined within a small region for the sake of humanity, let me remind you to be of good cheer.

Not because none of this will happen. But because the clock is ticking for them.

They know it. This is their last grasp before they all fall.

God bless,

|

Brian Chu,

Editor, The Daily Reckoning Australia