Yesterday, I mentioned how gold was a big winner to come from US sanctions on Russia.

The use of the US dollar as a market weapon has been swift and relatively effective.

Which is precisely why the rest of the world has taken notice…

The more the US wields the dollar as a big stick, the more it will push other economies to abandon it. We’re already seeing this with the BRICS bloc, for instance.

My colleague Ryan Dinse already brought this up on Monday. This cohort of developing nations is set to meet next week and aims to formalise a new currency agreement that doesn’t involve USD.

It won’t be an easy transition if they decide to make it happen.

But it also isn’t the only push away from the dollar that we’re seeing.

Back in 2018, China made its first bold move to dethrone the reign of the petrodollar. The undertaking was slow at first, but the rise of a counter petroyuan has been steady.

As for whether it will ever replace the petrodollar, it is hard to say. Because while I’m sure China would love that, I doubt the rest of the world is looking to replace one financial weapon for another.

Instead, expect to see more countries moving away from both!

India makes its move

Earlier this week, India was the latest economy to go rogue in terms of typical oil deals.

Negotiating with the United Arab Emirates, India has managed to secure oil contracts settled in rupees. The first million barrels under these terms are, reportedly, a done deal.

It was a milestone moment for the rising Indian economy and another big blow for the petrodollar.

It almost certainly won’t be an anomaly deal, either.

The Saudi Finance Minister, Mohammed Al-Jadaan, made it clear earlier this year that they are open to more agreements of this kind:

‘There are no issues with discussing how we settle our trade arrangements, whether it is in the US dollar, whether it is the euro, whether it is the Saudi riyal,

‘I don’t think we are waving away or ruling out any discussion that will help improve the trade around the world.’

And while it is certainly good for encouraging new forms of global trade, it’s bad news for the USD. But that is what happens when you start treating a currency like a weapon.

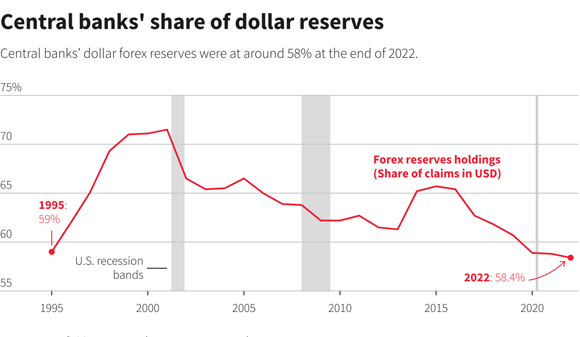

It has certainly impacted central bankers’ desire to hold onto USDs. You can see the trend away from the dollar clearly in the following chart:

|

|

| Source: Reuters/IMF |

And as I mentioned yesterday, those dwindling dollar reserves are being replaced by gold.

Which is why, as an investor, it may be wise for you to do the same…

The shifting tide

See, while oil contracts and trade blocs are certainly worth paying attention to, they don’t really impact you on a personal level. Sure, you might feel trickle-down effects in some ways, but it is hard to differentiate that impact from the million other market variables.

All of us can sympathise with the idea of control over our wealth.

No one wants the threat of government meddling to ruin you financially.

That’s why keeping some of your nest egg in hard assets is important. Many Aussies already know this, which is why property is such a loved investment in this country.

Given the state of inflation and interest rates, though, property is a trickier game than usual right now.

Gold may be the perfect alternative, however.

It is far easier to invest in, has a better track record in terms of volatility, and has plenty of long-term upside ahead of it. But you don’t need to hear that from me.

Instead, you should be listening to Brian Chu and his expertise. In fact, you can check out his latest thesis in The Australian Gold Report.

Because as he will tell you, this precious metal has been biding its time in terms of its role in markets. A play that, for the true believers like Brian, will prove its worth as dedollarisation continues.

In his own words:

‘I’d rather for gold to rise steadily and that the fiat currency system dies slowly as it drowns beneath the sheer volume of increasingly worthless paper and digital bits. That’s how the veterans in the gold investment community struck it rich.

‘You still want to buy gold bars, coins and good quality mining companies while they’re affordable, right?’

Regards,

|

Ryan Clarkson-Ledward,

Editor, Money Morning