Another day, another forecast from one of the major banks throwing a dart to give their latest forecast for the housing market.

This time, it comes from Australia’s biggest lender — the CBA:

‘The Commonwealth Bank is predicting overheated house prices will plunge in Sydney — and across Australia.

‘Median house prices in the Harbour City have spiked 23 per cent in the past year, but could drop nearly $200,000 by the end of 2023, analysis by the Commonwealth Bank shows.

‘The bank’s dwelling price projections predict the median house price across Australia will drop by eight per cent in 2023.

‘This includes a three per cent drop this year and a nine per cent fall next year in both Melbourne and Sydney.’

CBA doesn’t have a great track record.

Their forecasts have been consistently wrong over the last few years — changing like the weather — along with the other major banks.

Back in 2020, CBA warned that house prices would plummet by almost a third because of the coronavirus pandemic.

Their worst-case scenario was a 32% drop by March 2023.

By February 2021, with a rocketing boom underway in the Australian property market, CBA flipped.

Their forecast changed to an increase of 16% over 2021 and 2022.

It underestimated the boom significantly.

Median prices were 25% higher by the end of 2021 and continue to climb, predominantly in the smaller capitals by population.

Still, their latest forecast falls in line with the other majors.

ANZ and Westpac are also predicting major falls in the property market in 2023.

All of them have an appalling track record for accuracy.

If they studied the land cycle — as we do over at Cycles, Trends & Forecasts — they would have advised their investors to scoop up property in early 2020, in preparation for the greatest real estate boom in Australia’s recorded history.

This is precisely what we did, and those that followed our advice are now sitting pretty.

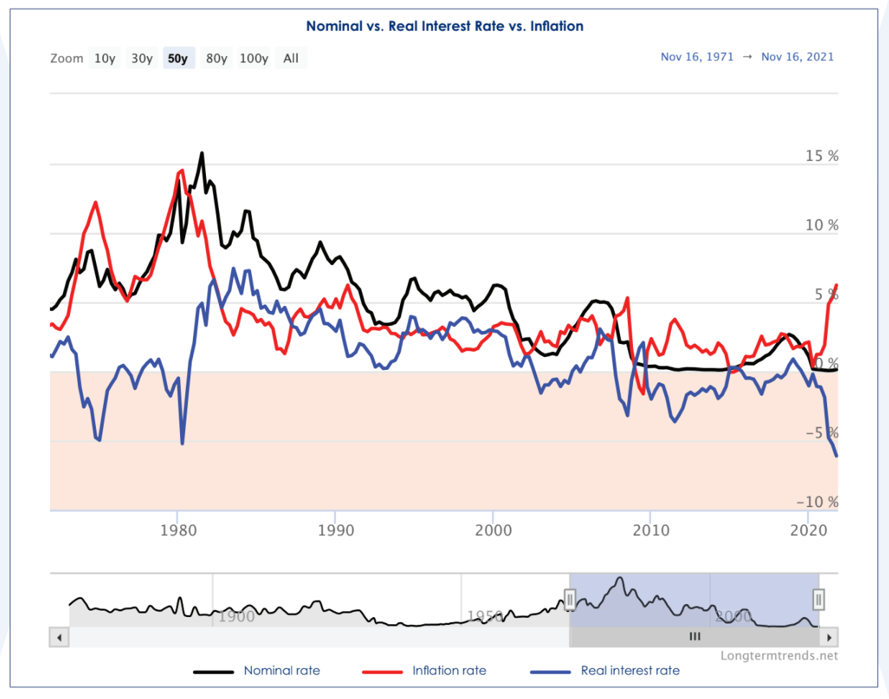

Further, the forecasts are being made solely on the prospect of rising rates.

There are a few things to consider when it comes to rising rates in an inflationary environment, however.

Firstly, real interest rates (minus inflation) are negative — sitting at -2.9% here (and -5% in the US).

|

|

|

Source: Louis Christopher, ‘Boom and Bust Report’ (buy it here) |

If the RBA raised rates by 50bps (basis points), it may shock the market, but it still leaves real rates negative.

Assuming inflation keeps pumping, as I expect it will, a small ramp-up in rates is not enough to produce a marked downturn.

In other words, if housing prices are rising faster than a hike in lending rates, it could slow — but not stem — an upward trend.

This is a point that Louis Christopher makes in his ‘Boom and Bust Report’.

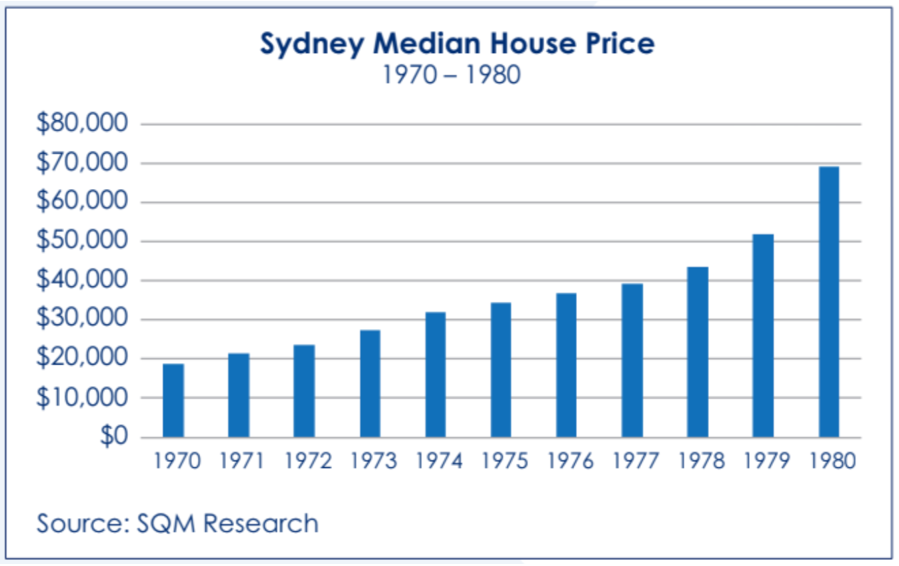

We can look back at what happened in the 1970s, when Australia’s inflation reached about 17.5%.

Average lending rates were around 8–10%. Yet the median house price in Sydney tripled over the period:

|

|

|

Source: SQM Research, ‘Boom and Bust Report’ |

Granted, wage growth in the 1970s was rampant — far in excess of what we have today.

But that’s not to say we’re not seeing strong wage growth in some sectors.

The mining industry is a major one!

New engineering graduates in WA are being offered salaries of $160,000 to work in the mines.

Wages have increased by 27% in just 18 months! There aren’t enough workers for the jobs on offer.

It’s one reason that over at Cycles, Trends & Forecasts we have had Perth as a top pick for investors.

There’s also upward pressure on wages in other states. There’s an acute shortage of workers across many industries, including hospitality, construction, technology, medical, etc.

In addition, companies have been forced to digitalise at a rapid pace.

There’s no shortage of job opportunities, but there’s most certainly a shortage of talent.

It’s yet to be seen if they will ramp up immigration to the levels needed to offset the trend.

It won’t happen in a heartbeat.

We’re still in a situation where more people are leaving Australia than arriving.

Considering this, a small rise in interest rates (and therefore lending rates) would follow improvements in the economy (wage growth, etc.), and rises in median property prices would follow.

The important point here is that land prices rise with inflation.

More so due to the current drivers of inflation:

- Shortages in commodities and manipulated disruptions to the supply chain. This is impacting construction. Projects are being delayed and new property values are being ramped up to cover construction costs.

- Massive stimulus spending outside of any prudent economic analysis catapulting us toward CBDCs (central bank digital currencies).

This is just one reason why we’ve had the fastest period of growth since 1989.

We can expect Melbourne and Sydney to pull up early.

I warned late last year in The DR that this would occur. Migration is flowing away from both states. However, this is not the case in other areas of Australia.

If you give the above reports of major price falls in 2023 any energy, you’ll be making a big mistake.

The peak of this current market cycle won’t occur until 2026. Find out why by clicking here.

Sincerely,

|

Catherine Cashmore,

Editor, The Daily Reckoning Australia