The bears are dominating the markets once again.

How quickly things can change!

But then, things appear to be different this time.

Gold — the ultimate contrarian asset, the real money, and the longest standing store of value — is falling with it.

It’s now trading close to US$1,700 (AU$2,500) an ounce again, having tried to make a run for US$1,800 in mid-August.

It seems like gold investors just can’t win these days, right?

But let me tell you why things looking so bad for gold may be just the thing that would excite a patient and astute contrarian.

Federal Reserve talks, market listens, bear roars

For much of August, markets were rallying, and the narrative was that there was going to be a Fed pivot coming soon as the US Federal Reserve acknowledged their rate rises were cause for a loss of confidence.

That narrative began crumbling when the Fed released its minutes of the July meeting late last month, suggesting that there will be more rate rises to combat inflation. The mainstream news began warning the public that the rally we just had might be a bear market bounce.

With last Friday’s speech to conclude the Jackson Hole Summit, Fed Reserve Chair Jerome Powell unleashed the bear. He revealed there’ll be more rate rises as inflation remains high, and the tightening of the currency supply will continue.

In fact, the currency tightening will accelerate as of yesterday. The Fed is going to double the rate at which it would try to unwind its massively bloated balance sheet, selling debt back into the market and taking away excess cash.

So, prepare for more selling off in the markets, it’s not over. And I believe that it won’t be until people stop listening to the Fed.

US dollar mirage shimmers but don’t fall for it

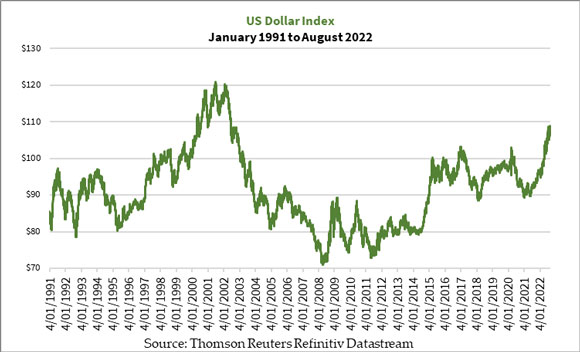

The US dollar has been flexing its muscles lately as the global economy falters and investors seek refuge in the world’s reserve currency. The US Dollar Index [DXY], acting as a proxy for the intrinsic value of the US dollar by measuring it against a basket of major world currencies, is trading at levels last seen at the turn of the millennium (refer to the figure below):

|

|

|

Source: Thomson Reuters Refinitiv Datastream |

But this is a mirage. The US economy isn’t really recovering, and neither is that of the world. There’s further trouble ahead with inflation, supply chain issues, a shortage in the supply of oil and gas, and escalating geopolitical tensions.

The reasons for taking refuge in the US dollar are to do with central banks trying to revive the dying fiat currency system. Sure, the US Treasury notes are now paying a positive yield when adjusted for inflation.

But all this is because people are comparing the US dollar’s value against the other failing currencies.

If you see through this, you won’t fall for the trap when everything comes apart.

Caution among the gold community is the latest contrarian signal

Most of you know that gold is meant to thrive in the current climate of fear and uncertainty.

However, you’ve all seen how gold delivered disappointment to its supporters over the past two years.

So much that even the most faithful are leaning towards being cautious with their projections.

Recently, I could sense the signs of investor fatigue among the gold community. I also saw on the stock discussion forums that there were several familiar names I followed who were wary about the developments or lack thereof by way of a rally in gold stocks.

But with discussion forums, you don’t get to know too much about the level of clout they have in the market.

So I wanted to get more information from someone who does.

I had the pleasure of catching up with George Kontogiorgis of Sydney-based broker firm Dalton Equities to talk about the mood among sophisticated investors regarding gold and gold stocks.

Initially, I intended this interview to be available only to subscribers of my premium Gold Stock Pro service to further warrant the caution I’ve had of late regarding the gold stock portfolio.

But after thinking about what we had discussed, I realised it might be worth spreading the word a little wider about why the case for gold is not only intact but is also strengthening in spite of the recent price actions and market sentiment.

Why?

There were several points that George covered that confirmed what I suspected.

Firstly, there is quiet optimism among the sophisticated investors as they have recently contributed more funds to companies seeking to raise capital or listing on the ASX via an initial public offering. Secondly, producers have been able to deliver solid profit margins as the price of gold in Australian dollar terms is still strong. There are several producers that are trading at a discount despite their strong performance. Also, he sees that the persistent economic issues will eventually bring gold back into favour as it’s a problem that will not go away soon.

Many investors are impatient. They buy and want to see results immediately from a price rally to confirm they made the right decision.

But those who are patient usually end up reaping the biggest rewards.

I know this from experience. Take a look at what happened with my gold stock portfolio in 2015–16 and 2019–20 here.

Your chance to seize the golden opportunity

I now ask you to take another hard look at gold and its future potential.

Cast aside the current price movements.

Do you think that the powers that be who have been trying to tackle the problem (which I believe they created) will succeed in solving it?

If you are like me and you believe that they won’t, how bad can it be for gold?

Many gold mining companies are drilling away and making discoveries to add to their books.

Some are bringing in engineers and drafting plans to construct a mine.

And some have completed construction and are pouring their first gold bars.

It’s all happening as the central bankers and governments vainly fiddle around while the economy continues to crumble.

As you wait, take your positions in good quality gold mining companies while they’re largely unloved. I have a few to help you get started, join me here.

Otherwise, click on the thumbnail below to watch my chat with George:

God bless,

|

Brian Chu,

Editor, The Daily Reckoning Australia