2023 just keeps throwing out the surprises. The latest is the surge in bitcoin. What is it telling us? Lots of things!

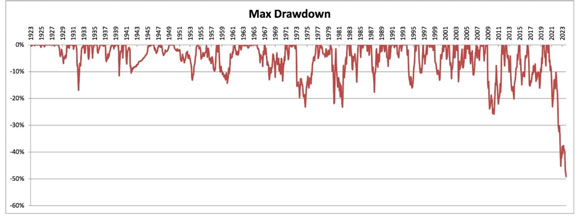

Look at this chart…

|

|

|

Source: Via Empire Financial Research |

This shows the current slaughter of long-term bonds in the United States.

This chart goes back 100 years. You can see the carnage is epic relative to history.

Part of what’s driving bonds lower is the fear around how sustainable US government debt is.

US bonds are supposed to be ‘safe’.

Clearly, they’re not.

I wrote (for Fat Tail’s paying subscribers) back in August how this dynamic would be ‘good’ for hard assets like gold and bitcoin.

Officially, I said:

‘Bitcoin stopped being the plaything of retail punters a long time ago.

‘The Tulip Mania period that washed through the crypto world in 2017 is long dead.

‘And yet bitcoin remains…$45,000 per BTC in Aussie dollars.

‘It does so because the market isn’t stupid.

‘People can see perfectly well that the current currency system has one foot above an open manhole and another about to step on a banana peel.’

Part of the rationale for this was I expected the Fed to return to buying US bonds directly to juice the markets.

That hasn’t happened yet, at least overtly.

In fact, China is moving first!

‘There are no coincidences’ say the market strategists.

Bitcoin is jumping at the same time Chinese President Xi is making a very public visit to the Chinese central bank.

Xi is raising China’s fiscal deficit.

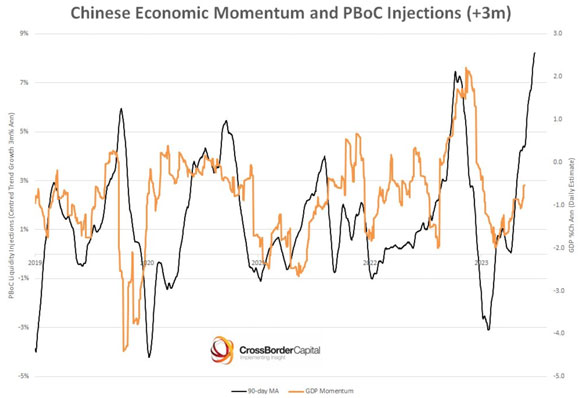

Liquidity expert Michael Howell says that the People’s Bank of China is also juicing the Chinese markets.

You can see that here…

|

|

|

Source: CrossBorder Capital |

Bitcoin appears to be sniffing this out.

Watch iron ore!

Any move here would be confirmation that the Chinese economy is coming back from its lacklustre year so far.

Commodities could rally across the board. Here’s a reminder of how important China is to the commodities market…

Of global demand, China accounts for…

- 16% of oil

- 17% for LNG

- 51% for copper

- 55% for steel

- 58% for coal, and

- 60% for aluminium

I told you last week that my favourite iron ore small-cap play was likely to jump on its latest quarterly result.

We got the result, and it was a belter. Net cash went up nearly $100 million from the last three months.

The stock rallied. It wasn’t huge. But it went up while the market gets clobbered.

However, long-term, this just gives you a chance to buy more stock at a suppressed valuation.

By the time the company reports its half year results, I’d be staggered if they don’t declare a big dividend or stock buyback.

There’s just so much cash building on their balance sheet.

And see above…China is stimulating. The next three months should see even more money pour into their accounts.

I’m not saying its without risk. I can’t promise you that.

But I still like it from here a lot. You can get the full story on it by following this link.

Here’s another interesting, personal angle on what’s happening now.

This month, I travelled to Melbourne to attend an event that Aussie stock market luminary Geoff Wilson hosted. Here’s a snapshot I took:

|

|

|

Source: Callum Newman |

I didn’t discover all that much, except for an interesting insight from his portfolio management team.

They had met with Rio Tinto Chief Executive Jakob Stausholm.

In turn, Stausholm told them he had met recently with China’s government elite, including Xi Jinping (apparently).

The feedback told to the room is that the Chinese government is not happy with the current state of their economy — and highly likely to act more aggressively to do something about.

It seems to be playing out right in front of us.

The current market is one of the toughest I’ve seen in a long time.

But we could be about to see a big rally in the commodity sector. The would be much needed good news for the ASX indeed.

Best wishes,

|

Callum Newman,

Editor, Money Morning