Overnight markets worked themselves into a mess again.

The growing fears of a ‘second wave’ seem to be taking hold. With the US showing particularly bad signs of ongoing infection.

For Australia though, despite a few setbacks in Victoria, things still seem to be under control.

Once again, the lucky country is living up to its name. Or so it would seem…

Right now, the biggest concern for Australia — in my opinion — isn’t the virus.

I think we’ve reached a point where we are prepared enough to deal with any further outbreaks.

That doesn’t mean we can be totally lax about it, obviously. It just means we have the ability to fight it better than most.

This is not a time to panic. It’s a time for ACTION. Click here to download your free report now.

However, the long-term threat was always going to be an economic one.

Forcing a nation into lockdown has brought most industries to the brink. Forcing businesses of all shapes and sizes into awkward situations. And while the government has generously propped up many of them during this uncertainty, the stimulus can’t last forever.

Even Scott Morrison has conceded that fact. Categorically stating that some businesses will fail when the JobKeeper and JobSeeker programs end.

At the same time, banks are also set to put an end to their generosity. Removing the loan deferral measures that came into effect in March. A life support mechanism that has put $60 billion worth of debt in limbo.

Come September, all of these measures are slated to come to an end. Both the government support and the banks’ generosity.

And when it does, expect things to get very ugly, very quickly…

Dire circumstances

To give you an idea of how bad they already are, you need only look at a recent ABS survey.

Released this week, the ABS asked 2,000 local businesses how the pandemic has impacted them. Uncovering a range of issues that seem to be permeating our industries.

For instance, two-thirds of those surveyed reported a fall in revenue. With a third of this group seeing a 50% or more total decline.

This is to be somewhat expected though. We’ve put our lives on hold to deal with this virus, so of course businesses would take a hit. That’s why the government and banks stepped in to begin with.

As I’ve been saying though, when that support ends, so too will many livelihoods.

You can already see it from the insight this survey provides.

After all, the best way to survive a downturn is cash. But right now, cash isn’t something that many of these businesses have on hand.

Take a look at the responses for yourself:

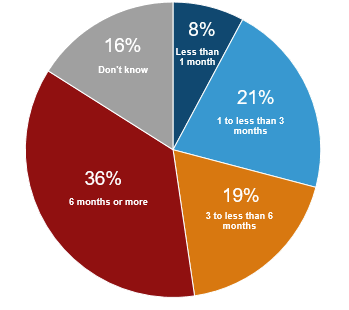

Length of time operations could be supported by currently available cash on hand

|

|

|

Source: Australian Bureau of Statistics |

This pie graph has segmented the responses of the 2,000 business. Giving us a brief glimpse at just how cash-strapped many of them are.

As you can see, it’s pretty grim.

Just over half (55%) believe they could survive for more than three months. And that’s with the government and bank support still in place. God only knows how bad it would be without this assistance…

Once September rolls around though, we’re likely to find out.

One way or another, something is going to give. A convergence that will test our economy and market — whether we like it or not.

So, as an investor, you need to start preparing for this September showdown and the end to stimulus support.

Nature of the beast

As cold-hearted as it is, I think this September crunch that is coming is necessary.

I fully expect businesses to fail. Perhaps even entire industries if things get really out of hand.

But that is the nature of the beast we call capitalism.

This will be of little comfort to those who will lose their livelihoods or their jobs though.

Unfortunately, that’s just the way life goes. Failure is part of the process. It cultivates an opportunity for something new to rise to the occasion.

This time will be no different. And for investors, it is a trend that you need to watch closely.

Just look at tech stocks of late. They have undoubtedly been some of the biggest winners of this pandemic. Providing goods and services that have been vital to this rapid transition to a more digitally oriented way of life.

The recent performance of companies like Afterpay Ltd [ASX:APT], Appen Ltd [ASX:APX], and Xero Ltd [ASX:XRO] is remarkable. All three are doing better than ever despite COVID-19.

Now, obviously that doesn’t guarantee that this good fortune will continue. But it does show you that good businesses and good ideas will always exist. No matter how bad things get.

However, identifying these winners isn’t always easy. In fact, many people would argue that tech stocks are in (or headed for) bubble territory.

The valuation of some of these companies compared to their income can be obscene. Whether or not it is justified though, lies in the eye of the beholder.

What isn’t up for interpretation though, is their access to cash or capital. Which, as we’re seeing right now, is perhaps the most important factor for any business.

Whether it’s a matter of growth or survival, cash is king right now. Because come September it will be much harder to come by.

For investors, that is something that I would consider very carefully moving forward. The time has come to look for businesses or industries that have a good stockpile of cash. Because those that don’t could be in a for a world of hurt in a few months.

Luckily the ABS have given us a handy place to start. Take a look for yourself:

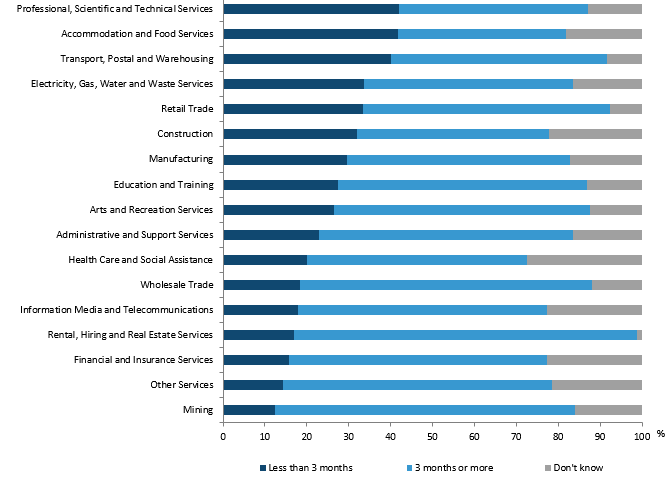

Business sentiments on length of time operations could be supported by currently available cash on hand, by industry

|

|

|

Source: Australian Bureau of Statistics |

It is by no means a definitive list, but it’s a good place to start. Showcasing a clear disparity between cashed-up and cash-strapped sectors.

I’d be avoiding those industries at the top and focussing on the ones near the bottom. Because when September rolls around things are going to get very interesting.

Regards,

Ryan Clarkson-Ledward,

Editor, Money Morning

Ryan is also the Analyst of Australian Small-Cap Investigator, a stock tipping newsletter that hunts down promising small-cap stocks. For information on how to subscribe and see what Ryan’s telling subscribers right now, click here.