The struggling financial giant gave warning to its investors recently of some unimpressive unaudited earnings.

AMP Ltd [ASX:AMP] announced it expected its profits to range in the $140–$150 million mark — over a 50% decline from 2019, where profits were $309 million for the same period.

On the announcement the AMP share price dropped 12.2% to $1.47 at time of writing.

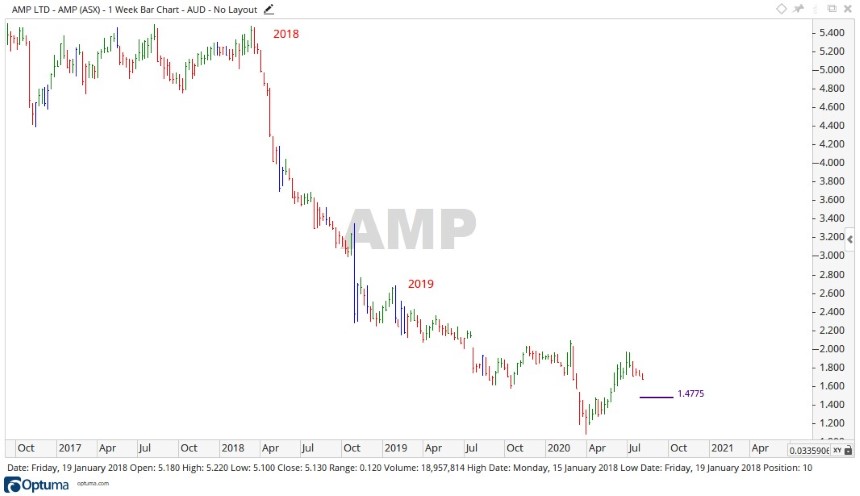

Source: Optuma

What’s happening at AMP?

The last few years have been rough sailing for AMP.

The 2019 royal commission into financial practices unearthed some breaches finding AMP charged thousands of dead superannuation customers for life insurance, despite knowing there was no longer a life to insure.

At the time of this revelation, the inquiry’s barristers recommended Australia’s largest wealth manager face criminal charges for lying to the Australian Securities and Investments Commission.

With AMP’s shares already starting to decline through 2018, the news from the inquiry made matters worse and AMP fell sharply.

Source: Optuma

The impossible recovery

2020 still had AMP dealing with the fallout from 2019 and sold off their life insurance arm to Resolution Life.

Then the backlash from a sexual harassment claim by a female subordinate in 2017 that AMP Chief Executive Boe Pahari settled.

Throw in the COVID-19 pandemic that saw AMP have higher costs associated with skyrocketing client needs, along with dwindling performance and management fees.

As a result the cumulative effect of this has become year-on-year of declining profits.

First half year figures:

- 2018 $500 million.

- 2019 $309 million.

- 2020 $140–150 million.

Where to from here for AMP?

Things for the wealth giant still aren’t looking great with two class actions against the company along with the ever-present pandemic.

Source: Optuma

With price currently trading near the support level of $1.47, it’s hard to say the price looks in a strong position. Should the decline continue, then the levels of $1.35 and $1.27 may provide future support.

But if the $1.47 level can halt the fall, the level of $1.61 may become the focus for future resistance.

Regards,

Carl Wittkopp,

PS: Four well-positioned small-cap stocks: These innovative Aussie companies are well-placed to capitalise on post-lockdown megatrends. Click here to learn more.

Comments