The world’s largest consumer packaging company Amcor [ASX:AMC] had a tough first half of the financial year.

Like shipping companies, Amcor can be seen as a bellwether for consumer spending.

Amcor saw softer volumes and lower profits across its international plants.

Amcor operates 210 factories in 43 countries, producing food, beverage and healthcare packaging.

The inflation-impacted reduction in consumer spending is hardly news for the packaging giant.

It’s in the middle of a cost-cutting initiative that included closing ten plants and cutting 2000 jobs.

Despite this, the company’s shares are up by 2.80% today, ;trading at $14.72.

Shares are down -14.7% in the past 12 months but have moved sideways for nine months since its disappointing Q3 FY23 results.

Peeling back the first layer of bad news, the first signs of recovery have shone through some parts of the report today.

So, how bad were its latest financial results, and what signalled investors to buy today?

Source: TradingView

First-half financial results

Cost-of-living pressures pushing down consumer demand were blamed for Amcor’s poor 1H24 results.

With inflation still biting around the globe, demand for packaging has also fallen.

Net sales fell by -8% compared to the prior half, totalling US$6,694 million.

Almost half of those sales declines were related to falls in North American soft drink and bottle consumption.

These declines took the executive team by surprise, as Amcor CEO Ron Delia admitted, saying:

‘Second quarter volumes were slightly lower than we anticipated at the beginning of the quarter, as destocking accelerated, particularly in the month of December, and demand remained soft.’

This destocking has been widespread in pharmaceuticals, where customers were still running down high inventories from the pandemic.

The lower sales volumes resulted in an -8% drop in EBITDA of US$913 million.

Despite the drops, the company focused on reigning in costs and maintained its margins across those segments at 12.6%.

These cost savings were most clearly seen in the company’s free cash flow of US$52 million.

That was US$113 million higher than its previous year’s cash outflow of US -$61 million.

While that helped lessen some of the blow, the company’s profits still fell -12% to US$453 million.

Still, the savings did help the company’s earnings per share (EPS) exceed expectations, at 31.3 US cents per share.

Mr Delia was unphased by the performance, saying the results ‘leave us on track.’ He went on to say:

‘Our underlying businesses are strong and we believe we are well-positioned in our markets.’

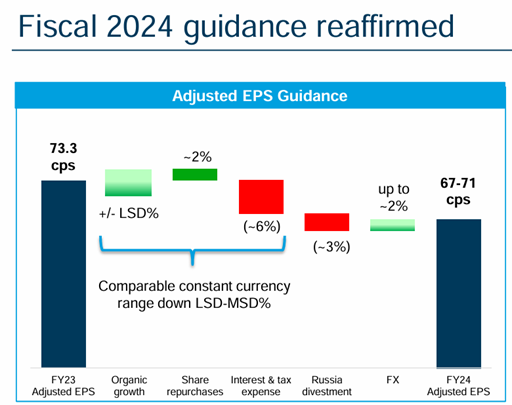

The company reaffirmed its FY24 fiscal outlook with an adjusted EPS of 67–71 cents per share and free cash flow of US$850-950 million.

Its dividend was also increased to 12.5 US cents per share, and a US$30 million share buyback was also completed in the half.

Amcor is primarily listed on the New York Stock Exchange after merging with US giant Bemis Co in 2019.

The nearly $10 billion acquisition and merger saw it leave its Aussie home listing and shareholders with Chess Depositary Interests (CDIs) on the ASX.

Outlook for Amcor

Despite leaving its Aussie beginnings, the company was international long before the acquisition. Over 95% of its revenues were international before the merger.

With such sizeable international exposure, any outlook will naturally drift towards the macro.

Uncertainty here seems to have eased with a clearer pathway to a soft landing in the US.

But any unexpected event could still set back Amcor’s hopes of a clean recovery.

Investors seem to be trading on the idea of a clear bottom today.

CEO Ron Delia echoed similar sentiments today, saying:

‘We have seen volumes improve in January relative to the first half and we expect the business to build momentum in the second half, including delivering mid-single digit adjusted earnings growth in the fiscal fourth quarter.’

These volume improvements may spark optimism in traders, but they are still modest for now.

In the recent earnings call, Mr Delia admitted ‘we’re not expecting any rebound in the consumer.’

So to reach its FY24 EPS guidance, Amcor will have to continue to focus on costs.

Source: Amcor

Amcor’s cost-cutting strategy accelerated in the December half, with 1000 jobs cut since June.

Mr Delia said the total cost reductions reached US$200 million for the half, a large chunk of which was the firing of around 5% of its staff.

He also signalled that material costs were beginning to settle after costing the company approximately $4 billion over two years.

Confusingly, both material cost rises and, later, falls had stung the company.

Price mechanisms built into customer contracts saw the company pass on potential savings as material costs came down.

That totalled US$85 million in the most recent half but is expected to ease in 2H24.

The second half should also see interest rate cuts, which will help debt servicing costs.

Another large anchor that will soon be behind them will be the completion of their Russian divestment, which began in 2022.

These various cost-cutting strategies appear to have done enough to satisfy many investors today.

Moving forward, Amcor moves into a more favourable macro environment. But for investors, it’s still a shaky road to recovery.

Other stocks worth your time

Larger cap companies have remained the darlings of many traders in the past year.

With a lumpy market, investors have sought safer hands with clear dividend incomes.

That income gives you more security and means you don’t have to speculate on ‘the next big thing’.

Dividend stocks are the ‘Stealth Wealth’ makers in the market — simple, safer, and stress-free.

But finding the right ones takes more than just finding the best dividend payers.

Editorial Director Greg Canavan has written a simple guide to helping people find the right ones.

Click here to find out how to access the report.

Regards,

Charlie Ormond

For Fat Tail Daily