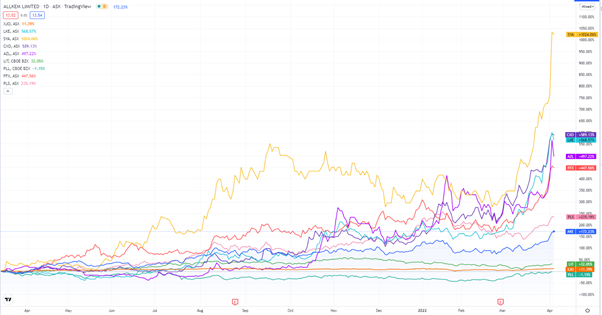

Allkem [ASX:AKE], the established lithium producer, is looking to take advantage of the strong lithium market.

Like many of its peers, Allkem has been on a roll lately, as interest in the lithium theme remains strong.

AKE shares are up 170% in the last 12 months. While impressive, it is lagging against juniors like Sayona Mining [ASX:SYA] and Lake Resources [ASX:LKE].

Both SYA and LKE are up more than 500% in the last year.

Source: Tradingview.com

Allkem releases strategy update

Allkem today announced its plans to capitalise on strong lithium prices in its strategy update.

Allkem said it’s determined to become a top three global lithium supplier, aiming to provide 10% of the world’s lithium.

AKE said it intends to focus on lithium-rich locations of each of its lithium projects, setting up new drilling sites and maximising production in existing sites.

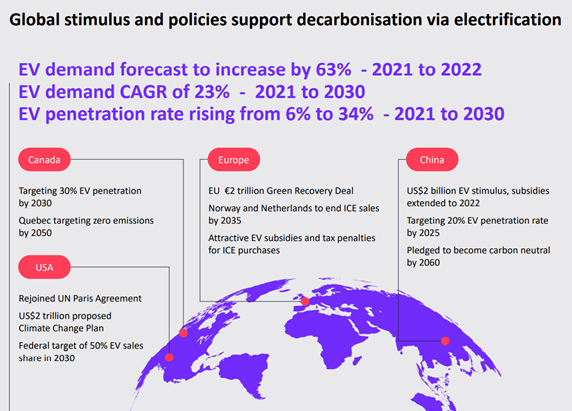

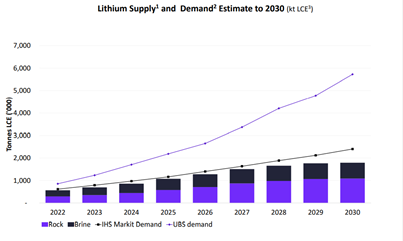

On the topic of market conditions, AKE expects the lithium market to be in a supply deficit for the remainder of the decade.

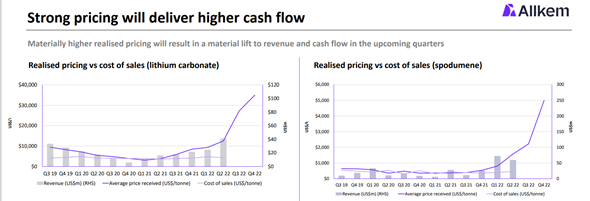

AKE aims to secure a foothold as a trusted supplier to battery companies and build share presence in the global market with ‘strong pricing’ that will ‘deliver higher cash flow’.

Source: Allkem

Allkem is also integrating cheaper renewable energy into its operations.

Allkem’s Sal de Vida project, for instance, will source at least 30% of its energy use from renewables at Stage 1 of production.

And 44% of James Bay’s energy will be provided by Hydro-Quebec renewable electricity.

Source: Allkem

Allkem lithium projects update

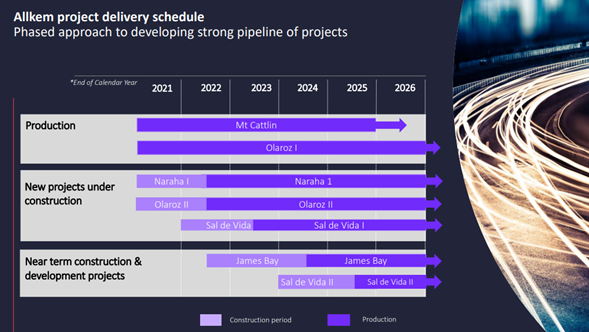

AKE also provided updates for two of its lithium projects, Olaroz II and Sal de Vida.

Olaroz’s resources have jumped from 6.4 million tonnes (Mt) lithium carbonate equivalent (LCE) to 16.2 Mt.

Olaroz resources now total 22.5 Mt LCE, making it one of the biggest global lithium resources.

Sal de Vida has had a capacity increase to 45,000 tonnes a year, which supports an estimated 6.85 Mt LCE, a 10% increase since last year.

Allkem’s CEO Martin Perez De Solay said:

‘This material increase in resource confirms the world class status of the Olaroz basin and complements the high-quality Sal de Vida project and James Bay which is one of the best hard rock projects in North America. The combined 22.5 Mt resource across Olaroz and Cauchari underpin further material expansions of production to provide the lithium that is essential for the growing decarbonisation by fleet electrification. The pre-tax NPV of nearly US$2.7 billion for the Stage 2 expansion alone clearly illustrates how additional capacity is highly value accretive to Allkem.’

Source: Allkem

Allkem share price outlook: lithium trends

Allkem’s plans to improve production and ship out lithium as a top supplier comes at an opportune time as lithium prices continue to rise.

AKE itself presented evidence suggesting lithium demand will continue to outpace supply for years to come.

Source: Allkem

But as lithium producers well know, demand doesn’t run ahead of supply forever.

Lithium prices crashed in 2018 when too much supply came online, flooding the market.

While the market dynamics are different now — with the EV revolution well on the way — the competitive dynamics are different, too.

Today’s high prices are inviting more exploration as suppliers rush to meet demand.

So what will the market conditions be like in 3–5 years? How much supply will come online then and will that stabilise prices?

What will that do to lithium juniors who are still years away from production?

And are there lithium stocks the market is overlooking right now?

According to Money Morning’s latest research report on the sector, yes.

In fact, the research report profiles three of them.

To find out more, access the report here.

Regards,

Kiryll Prakapenka,

For Money Morning