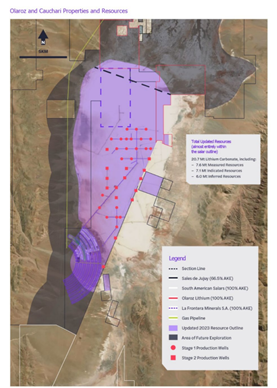

Established and dynamic lithium carbonate and boron suppliers, Allkem [ASX:AKE], revealed a resource increase of 27% to 20.7 million tonnes of lithium carbonate equivalent (LCE) for its project in the Olaroz-Cauchari basin.

This ups the total resources in the basin to 27 million tonnes of LCE in all resource categories.

Yet in spite of the news, AKE shares were mostly flat, dipping a half a percent to keep the share price around the value of $10.10 each a share.

AKE is now a far cry from its November highs of $16–16.20 a share, with the market largely falling out of favour with lithium as prices continue to disappoint:

Source: tradingview.com

Allkem ups LCE resources and prepares for expansion

The group’s flagship brine-based lithium facility at Salar de Olaroz in Northern Argentina supplies high-quality lithium chemicals worldwide.

Expansion of this facility is hoped to position Olaroz as one of the world’s largest lithium evaporation pond systems.

Today’s announcement stated that a 27% resource increase adds an additional 20.7 million tonnes (Mt) of lithium LCE, made up of 7.6 Mt of Measured resource, 7.1Mt of Indicated resource and 6Mt of Inferred resource.

It also means that the resources for the Olaroz-Cauchari basin now total 27 Mt LCE in all resource categories.

Allkem says this confirms the basin’s likelihood as host for one of the largest lithium resources in the world.

The lithium grade of the Olaroz Measured resource is 657 mg/l lithium, with the underlying Indicated Resource and Inferred Resource 612 mg/l and 604 mg/l lithium, respectively.

The group’s recent conquest, the Maria Victoria property in Olaroz North, has also provided an additional 2.8 Mt towards the increased resource, with expansion drilling ongoing towards the south.

Allkem believes the Olaroz basin to hold significant exploration potential, even with extensive areas to the north of the surface yet to be tested by drilling. The same can be said for the extension towards the Cauchari Resource and the west of the mine.

Now the lithium developer says that in combining the Cauchari and Olaroz Resources, there will be an expansion for Stage 1 and Stage 2 lithium carbonate production capacity of 42,500 tonnes per year combined.

This will also form the basis for the Olaroz Stage 3 and Cauchari expansion studies.

Allkem Managing Director and CEO, Martin Perez de Solay commented:

‘This significant increase in the resource, and the upgraded resource classification, confirms the world class status of Olaroz.

‘The combined 27 Mt resource across Olaroz and Cauchari supports future material expansion of production and will form the basis for the Olaroz Stage 3/Cauchari expansion studies currently underway. Further exploration will be required to fully test the significant potential of the Olaroz/Cauchari basin.

‘Olaroz is complemented by the company’s high-quality Sal de Vida and James Bay Projects in Argentina and Canada. These projects will produce lithium chemicals for use in the EV supply chain in areas of low or no water stress, while contributing to the local economy and communities.’

Source: AKE

A boom for drillers

Lithium is only one part of a universe that is chock-full of potential.

It’s part of a wider industry making massive bull market-like gains in the face of recession, interest rates and wider market sentiment.

To put it bluntly, drillers are booming.

More booms are marked to happen for every single metal on the period table.

Aussie mining is at its best right now, but if so many of them topped 2022, can they really do it again in 2023?

Our experts say: ‘yes’. But how do you tell which ones?

You may need a little help from our commodities expert James Cooper.

He’s found six ASX mining stocks that are heading to top the charts.

Regards,

Mahlia Stewart,

For The Daily Reckoning