In today’s Money Weekend…a boom for the history books…a bigger commodities boom, or a looming bust?…all you really need to decide is which major metal takes your fancy…and more…

It’s no secret that commodities have been going gangbusters this year.

The reason for this, of course, is the broader economic recovery. As nations all around the world begin to emerge from the pandemic-induced slump of 2020.

Fortunately for Australian miners, it has also been a great blessing.

Sending all kinds of sectors to new heights. With some of the standouts being copper, lithium, and of course, iron ore…

In fact, it is likely that iron ore will account for half of our total resource and energy exports for FY21. A staggering statistic, but one that highlights just how ravenous demand is for this critical mineral.

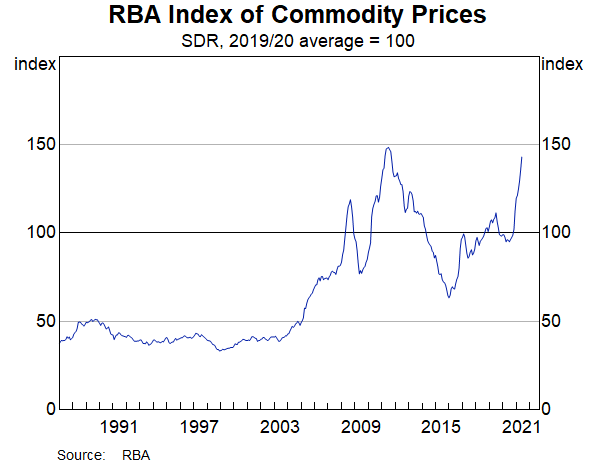

But to really put this whole boom into context, you just need to look at the RBA’s latest graph…

A boom for the history books

Yes, on Thursday the RBA released its latest commodity price index figures. Including its handy graph that puts everything into perspective:

|

|

|

Source: Reserve Bank of Australia |

Suffice to say, it is a picture worth a thousand words.

Highlighting not only how close we are to breaking our previous commodity price record, but also just how quickly it has happened. The line is practically parabolic at this point.

How to Capitalise on the Potential Commodity Boom in 2021. Learn More.

This was thanks to a 5.6% increase (monthly average) in the index for the month of June. Up from the already strong 4.7% increase in May. Bringing the total increase for the past year to 49.1%.

We’re now just a 3.7% increase away from breaking the previous record — set in 2011.

And the eerie thing is, the similarities between the previous record and our current situation are scarily close.

Because just like 2011, this boom is being driven by Chinese demand for iron ore. Coming off the back of a global economic slowdown; previously from the global financial crisis, and this time the COVID-19 pandemic.

The only real difference is the price!

With iron ore now hovering around the US$218 per tonne mark, down slightly from the US$228 per tonne highs seen in May.

But that’s still well above the US$188 per tonne seen back in 2011. Which is precisely why Aussie miners, and the economy as a whole, are laughing all the way to the bank.

The only question now is, will it last?

A bigger boom, or a looming bust?

Arguments about whether we’re in the early stages of a commodities supercycle are plentiful, with a strong case both for and against a long-term boom.

As the Financial Times commented last Thursday:

‘Our view is that we are seeing a normal business cycle recovery in commodity prices, not a supercycle.

‘Our definition of a supercycle follows that of Russian economist Nikolai Kondratieff — and his depiction of long-term trends that prevail over decades. In the context of commodity prices, a supercycle means an upswing in prices that lasts 10 to 35 years.

‘Supercycles are pretty special events. Over the past 150 years, there have been just four supercycles but there have been many more business cycles.

‘We believe commodity prices will come off their current peaks and remain elevated for some years. But we do not predict prices will be elevated for a decade, which is what is needed to be supercycle worthy.’

So perhaps it may be a far more short-lived boom than some expect.

Or perhaps we’re just months, maybe even weeks away, from the bottom falling out of this commodity narrative. After all, no one really knows what will happen next for certain.

But, right now, things are booming. And they’re booming big time.

In fact, our very own in-house gold expert — Brian Chu — believes that gold could be another place to look. Because while it is somewhat of a unique commodity, it has far fewer industrial use cases.

Nevertheless, Brian believes Australia could soon become the ‘epicentre’ of a new gold bull market. Which would not surprise me given what we’re seeing from the mining sector.

As for the broader commodities boom, well, there are plenty of options.

All you really need to decide is which major metal takes your fancy. Because if the supercycle really is here to stay, then the boom may just be getting started…

Regards,

|

Ryan Clarkson-Ledward,

Editor, Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here