If you had to choose, what would you pick: A free 1 ounce Gold coin or US$20?

It’s up to you.

It’s not something we’re asking, but an experiment Youtuber Mark Dice ran on the streets of California last year. He walked around asking random strangers which one they wanted, and they got whatever they chose.

Surprisingly, everyone in the clip chose paper money over the gold coin. In fact, there wasn’t much interest in gold.

As one conversation went:

‘I’ll take the US$20.’

Mark Dice: ‘You don’t want the gold?’

‘No.’

‘What are you going to do with a 1 ounce gold coin, right?’ (ironic tone)

‘Can’t put it in the parking meter.’

Dice has been conducting this experiment for years. In fact, he has a whole playlist of them, you can check it out here.

One of my favourite moments involves the choice of a free King-size Hershey’s bar or a 10-ounce silver bullion bar.

Faced head-on with having to pick, one person comments:

‘I don’t have any way to do anything with the silver.’

Mark Dice: ‘So do you prefer the Hershey’s bar?’

To which she answered: ‘Yeah but is it real? It doesn’t seem real.’ The chocolate bar, that is.

The point is that many people out there today still don’t see much value in either gold or silver.

At some point, debt starts to hinder growth

Global markets are down today as economic worries continue to pile on.

Overnight, Moody’s lowered credit ratings for 10 small US banks and said it’s reviewing ratings on six large banks that include Bank of New York Mellon and State Street.

Moody’s said it’s concerned about the sector:

‘Many banks’ second-quarter results showed growing profitability pressures that will reduce their ability to generate internal capital.

‘This comes as a mild US recession is on the horizon for early 2024 and asset quality looks set to decline, with particular risks in some banks’ commercial real estate (CRE) portfolios.’

Of course, it’s not the only credit downgrade we’ve seen recently.

Last week, Fitch changed the US Government’s credit rating down to AA+, down from AAA.

As the agency said:

‘In Fitch’s view, there has been a steady deterioration in standards of governance over the last 20 years, including on fiscal and debt matters, notwithstanding the June bipartisan agreement to suspend the debt limit until January 2025.’

The worry is that US debt has continued to grow along with interest rate payments.

On the other side of the world, China’s continued slowdown also bogged down markets. Data shows that both countries’ exports and imports fell more than expected in July, which could hit commodities prices such as iron ore.

And then there’s the war between Russia and Ukraine…and the small matter of inflation, which could continue to be a problem.

While inflation has been slowing, oil prices are climbing. So are food prices and fertilizer prices. All this along with higher interest rates could continue to hit consumer’s pockets…and keep inflation high.

When things in the economy get dire, investors usually flock to gold, which is seen as a safe haven.

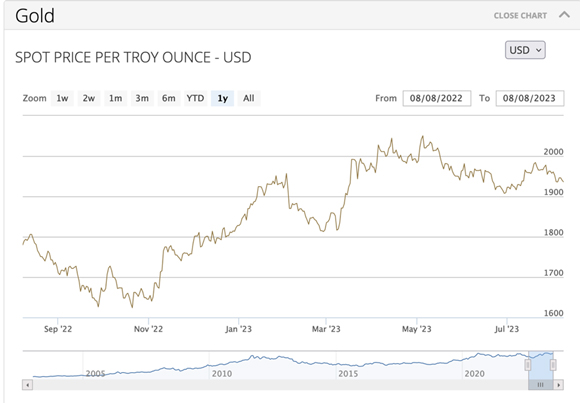

But the gold price hasn’t really budged recently, it’s hovering just above US$1900 an ounce.

|

|

|

Source: ABC Bullion |

Why gold prices aren’t moving

One of the reasons gold has been holding steady is that, with the chance that inflation rising again, the US Fed could decide to keep hiking interest rates in the future.

Higher rates are usually bad for gold since gold pays no yield.

But looking at the gold price chart above, the fact that gold has been holding up at record highs even though central banks have been raising interest rates is quite telling.

One of the reasons for the support in gold prices is that central banks have been buying a lot of gold as a way to diversify their assets from the US dollar. In 2022, central banks bought a record 1,136 tonnes of gold, the most since 1950.

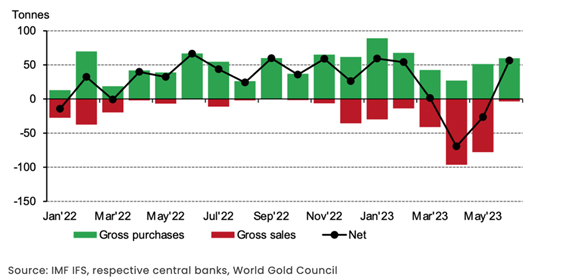

And while central banks have sold some of that gold in recent months, they were back at it in June, as you can see below:

|

|

|

Source: GoldHub |

In June, central banks bought a net 55 tons of gold. Some of the largest buyers included China, Poland and Uzbekistan.

In short, uncertainty continues, and all this is good for gold.

Gold has been a store of value for thousands of years.

You can’t print gold.

And gold is a hedge against inflation and a store of wealth.

Best,

|

Selva Freigedo,

Editor, Fat Tail Commodities

PS: If you haven’t yet seen, my colleagues Greg Canavan and Kiryll Prakapenka host a weekly podcast called What’s Not Priced In which, as you could probably guess, talks about any news or development that the market hasn’t yet priced into stocks. Yesterday, Greg released a ‘bonus’ episode, looking at the cost and implications of Australia’s energy transition from an economic and political perspective alongside Rob Parker, founder of Nuclear Climate for Australia. Check it out here if you’re interested.