As you might know, Bitcoin [BTC] hit the magical US$100,000 figure last week.

Even the mainstream press had to acknowledge the milestone – though it was begrudgingly.

The Financial Times, a paper that has spent the past 14 years telling its readers not to buy Bitcoin, even published a mea culpa:

| |

| Source: Financial Times |

But they weren’t being genuine about it.

In the article, they double-downed on their arguments against Bitcoin, saying things like:

‘The price of a bitcoin is an arbitrary hype gauge that’s disconnected from any utility… any intrinsic worth comes from sunk costs of infrastructure and intangibles like regulatory acquiescence.’

Bit of a word salad there.

And as is typical of the mainstream investment industry, the fancy words betray a lack of understanding of what Bitcoin is, what it enables and why it matters.

As one Bitcoiner retorted:

‘Bitcoin’s price reflects more than “hype”. You don’t HYPE to 2 trillion dollars.

‘Like gold, Bitcoin’s value derives not from what it does but from what it represents: an immutable ledger / a hedge against fiat debasement. Its “sunk costs” (mining infrastructure) are part of the mechanism that secures this ledger and ensures its decentralization. This isn’t a bug; it’s the feature that sets Bitcoin apart from copycats. Muppets.’

Funnily enough, an unlikely ally, Fed Chairman Jerome Powell, made this same connection to gold last week, too.

He said at the Deal Book Summit:

‘It’s not a competitor for the dollar. It’s a competitor for gold.’

Actually, I think he’s wrong about that. It absolutely is a competitor to the US dollar and every other fiat currency.

But it’s interesting to see some in the finance establishment gradually change their tune on Bitcoin.

Then there was the less celebrated milestone that hit last week.

This one was a lot closer to home…

Overtaking the Aussie dollar

Last week’s price surge saw the total value of Bitcoin surpass the value of the Australian dollar.

Check it out:

| |

| Source: Bitcoin Magazine |

Bitcoin is now the 10th largest currency in the world and it’s moving higher every year.

You can continue to ignore this and listen to publications like the Financial Times, which have consistently got it wrong.

Or you can put aside your bias and ego and accept that maybe there’s more to this than you’ve been told.

If you do, there is a rabbit hole of information for you to explore.

I don’t know of anyone who has genuinely explored the idea of Bitcoin and come away thinking there’s nothing to it.

But that’s for you to work out.

Just don’t expect the ‘authority figures’ of the mainstream to help you do this…at least until it’s far too late to capitalise from it.

They’ve too much-entrenched interest in the status quo.

Though even on that front things are starting to shift.

In fact, a meeting tomorrow in the US could light the touch paper when it comes to mainstream adoption.

Let me explain…

The Wall Street Kings vote

A big meeting is scheduled for 10 December at 11:30am US Eastern Standard Time.

It involves three powerful Wall Street institutions, one tech giant and thousands of individual shareholders.

Between them, these three ‘Wall Street Kings’ control nearly US$24 trillion worth of wealth.

They also have massive stakes in all the companies that make up the S&P 500 index, including Apple, Nvidia, and Google…

…and Microsoft.

And that’s the key company meeting tomorrow.

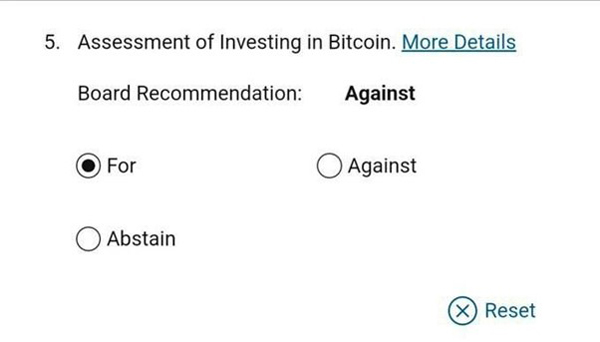

At Tuesday’s Microsoft AGM, there’s an agenda item – item number 5 – that shareholders will vote on.

Here it is:

| |

| Source: SEC |

Yep, Microsoft shareholders are going to vote on whether the company should invest part of its massive US$76 billion cash pile in Bitcoin.

A ‘yes’ vote would be big news.

If just 10% of this cash pile were put into Bitcoin, it would represent a massive endorsement for corporations to strategically stockpile Bitcoin.

And it could, in my opinion, spur widespread adoption of this strategy beyond the handful of early adopters currently pursuing it.

Michael Saylor—the Chairman of Micro Strategy, a company famous for buying Bitcoin and becoming the best-performing company over the past four years—presented this concept to the Microsoft board.

You can watch his three-minute presentation here.

To be clear, the board still seems to be against this proposal. And are recommending against it.

But this is a shareholder vote.

And three of the biggest fund managers in the world are on the top 10 shareholder list, namely BlackRock, Fidelity and State Street.

All three of these companies have become big supporters of Bitcoin (and crypto) over the past two years.

BlackRock launched the best-performing ETF of all time in early 2024—their new Bitcoin spot ETF—and has even become a Bitcoin evangelist!

It’ll be interesting if they dedicate their votes to supporting this motion. I mean, it’s in their own interests.

I should add that one big fund, Vanguard, is famous for having no crypto business exposure, and they have 9.09% of outstanding Microsoft shares.

But the three crypto-supporting funds control around 14% of total shares, so that more than cancels it out.

The vote could come down to the millions of individual investors that hold the stock, and that is a big unknown.

Anyway, we’ll see how it plays out tomorrow.

While a no vote won’t sway things too much, a yes vote could be a game changer for wider corporate adoption of Bitcoin.

Let’s see what happens.

Speak soon…

Regards,

|

Ryan Dinse,

Editor, Crypto Capital and Alpha Tech Trader

Comments