Last week, ANZ slashed 3,500 jobs. NAB quickly followed suit, cutting 728 more.

The move came just two months after ANZ introduced a raft of AI tools.

ANZ’s CEO, Nuno Matos, said the cuts ‘had nothing to do with AI,’ but other companies have been less unequivocal.

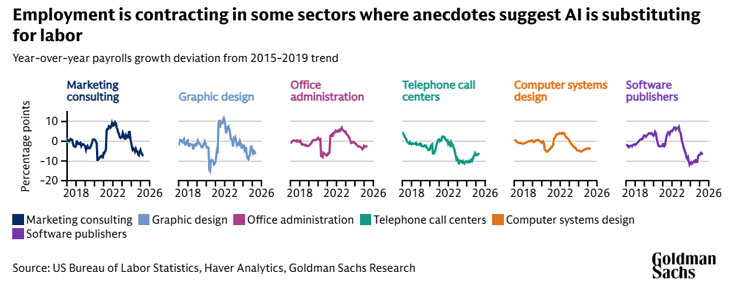

Broadly, hiring is slowing in the West, and the big question is: How bad could unemployment get with AI?

Estimates of the impacts vary. Goldman Sachs thinks 50% of all jobs could be fully automated by 2045.

Meanwhile, AI-bulls at McKinsey put the figure closer to 1/3rd by 2030. And while their confidence isn’t as high, they say at least 60% of jobs will be ‘significantly altered’ by AI at the end of the decade.

While interesting, those timelines are still years away. Here’s a snapshot of AI’s impact on the job market today:

Source: Goldman Sachs

[Click to open in a new window]

Recent earnings reports provide further anecdotal evidence of a continued slowdown in hiring.

As to the why, CEOs often sidestep the reasons — perhaps due to the poor optics, particularly as spending continues in other areas.

These questions of labour participation and spending will become critical in the coming years. Especially for Australia, as we continue to struggle with sluggish productivity.

Source: RBA

Are our productivity woes going to be fixed by AI? And will that wave come with AI supporting workers or replacing them?

No Clear Answers, Yet

AI critic Professor Scott Galloway recently described AI as ‘Corporate Ozempic’ for its ability to reduce costs (workers), while raising revenues.

While this simplistic critique has its issues, it still highlights a tension between workers and AI that Aussie bankers now know all too well.

The fear here is that these layoffs will accelerate as AI improves.

But on the other hand, if AI doesn’t improve, we may find our bull market quickly running out of steam.

It’s an odd tension.

Either AI delivers real productivity gains — or the tech investment frenzy hits a ceiling and drags markets down with it.

As I’ve argued in the past, these big tech companies view this ‘Capex’ race as existential.

Capex refers to capital expenditure; effectively, companies need to put money down now on AI or become irrelevant.

As the saying goes, you have to spend money to make money.

This time, though, it’s about survival.

They don’t want to be the next Nokia or Blockbuster — a relic of the past.

Capital markets are supporting companies, too.

As long as shareholders continue to feed the beast and invest, they’ll continue ramping up spending.

You can see how much ‘cloud’ data centre spending is defying even prior lofty goals set each quarter.

Source: Andreesen Horowitz

[Click to open in a new window]

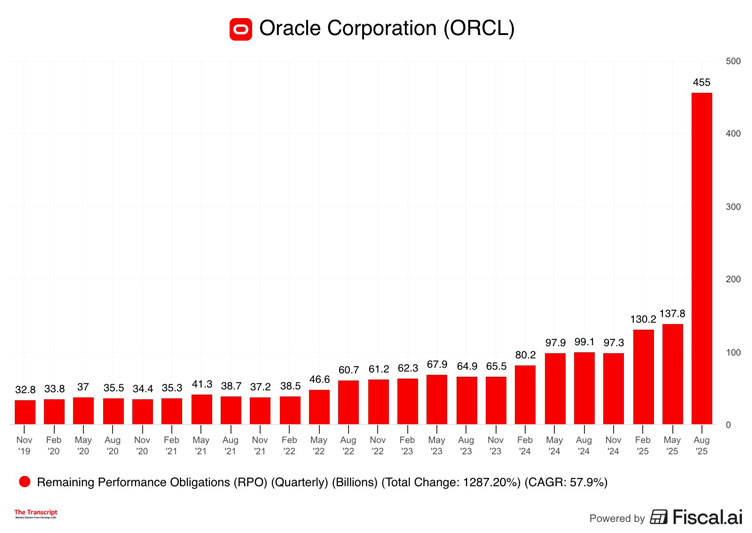

Last week, analysts, the media (and myself) were stunned as Oracle’s already richly valued stock jumped 36%.

Why? Oracle saw an incredible 358% jump in its backlog of contracts after signing four multi-billion-dollar contracts, including one with OpenAI.

Source: Fiscal.ai

[Click to open in a new window]

That surge briefly made Larry Ellison the world’s richest man, even as Oracle quietly axed 3,000 staff.

Shares rocketed from US$241 to US$335. Boasting an incredible 16.4x sales multiple (P/S).

A sign of the frothy times.

With the latest job revisions in the US showing an even weaker economy than many thought, the AI race is now the glowing heart of the US economy.

And the stock market’s primary engine.

JP Morgan estimates that data centre spending will contribute 10–20 basis points of US economic growth next year.

That’s roughly equivalent to all other commercial buildings constructed.

Meanwhile, Apple, Microsoft, and Nvidia now account for ~17.5% of the entire US stock market.

Concentration risk is rising. All of our stock market eggs are in one basket — AI.

Source: Econvisuals

[Click to open in a new window]

To me, these are signals of market exuberance that’s moved into dot-com bubble territory.

But then again, my own biases are to be cautious in these moments.

I’m certainly not calling a top, but I am positioning more defensively.

Is there a risk that this run-up becomes the greatest capital destruction of our time?

This will massively depend on where AI goes next.

Mind the (Algorithm) Gap

The reality is that we need a new generation of AI algorithms to meet the bullish timelines being thrown around by tech executives.

Now, I don’t want to confuse you — I’m very bullish about AI in the long run. What I’m questioning here is the narrative of ‘every job will be AI in mere years‘.

A recent survey of 475 AI researchers reveals that 76% believe adding more computing power and data to current AI models is ‘unlikely’ or ‘very unlikely’ to lead to Artificial General Intelligence (AGI). We need new AI structures.

One major limitation is that the latest flagship AI models still can’t ‘continuously learn’ like humans.

Many see this as a fundamental requirement for the AGI they’ve been promising.

Without new algorithm breakthroughs, holding the memory or ‘context’ of work will continue to cost huge sums…and remain the barrier to scaling AI workers anytime soon.

Looking at a July MIT study, we can see that this context or memory gap is the primary factor limiting wider adoption. As the study concludes:

‘The core barrier to scaling is not infrastructure, regulation, or talent. It is learning. Most GenAI systems do not retain feedback, adapt to context, or improve over time.’

Source: MIT State of AI Business 2025 Survey

[Click to open in a new window]

Comparatively, what makes humans incredible as workers is their ability to learn, upskill and hone their work.

But if AI memory is like a goldfish, economic value is far more limited. Significant, yes, but not existential for a white-collar workforce.

Until we see breakthroughs in AI’s ability to store and recall information in its vast web of matrices, these short timelines raise concerns.

AI’s promise is real — but so is the risk of a painful reset if hype keeps outrunning reality.

The next phase will hinge on whether AI delivers real productivity gains — or whether valuations and jobs face a sharp reset .

A new AI economy could eventually replace the old economy, but lofty expectations about the pace of change may hurt markets in the short term.

For an agnostic investing theme that will benefit in whatever future we can imagine, you should consider energy.

China’s latest energy breakthroughs are leaving the West in the dust, but our commodity expert James Cooper thinks the ASX still holds some great solutions.

Regards,

Charlie Ormond,

Small-Cap Systems and Altucher’s Investment Network Australia

Comments