Power company AGL Energy’s [ASX:AGL] stocks were falling this morning after the company released its full-year 2022 results with underlying profit down 58%.

The company expected the downgrade in EBITDA and underlying profit due to lowering customer prices, however, increasing market volatility and ‘planned and unplanned’ power outages were also to blame.

Aside from this month, the energy stock has been regaining some of that mometum from April this year with a rise of 27% year-to-date.

August has not been partial to the rising pattern, however, and the stock has now dropped more than 4% for the month.

Source: www.tradingview.com

AGL’s 2022 results

AGL released its full-year results for the 2022 financial year, presenting a lower EBITDA and profit for the year.

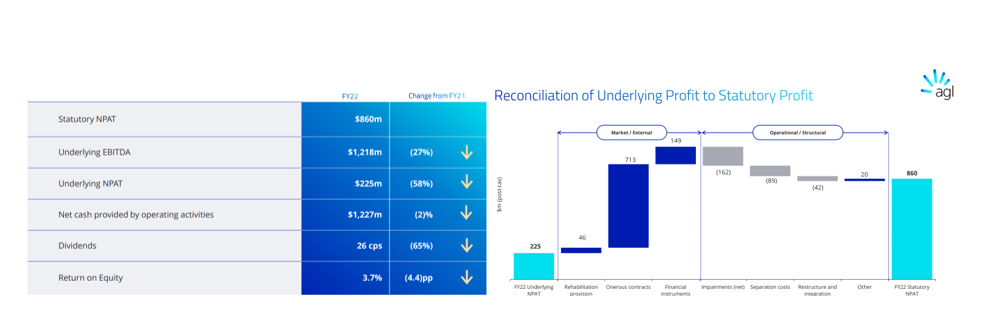

These were AGL’s highlights in 2022:

- Statutory profit after tax was $860 million (including $486 million from ‘onerous contract provision revaluations, impairments, and costs associated with separation, restructuring and integrations’)

- Underlying EBITDA was down 27% at $1,218 million

- Underlying profit after tax was down 58% at $225 million

- Total AGL customer services were flat year-on-year with 4.2 million

- Total generation volumes were also flat at 40,755 GWh

- Final dividend of 10 cents per share (unfranked), with total dividend at 26 cents per share (unfranked) for 2022

Source: AGL

AGL claimed more than $150 million in reduced operating costs benefitted the year, putting the company on track to deliver a reduction of $100 million in capital expenditure by FY23’s end.

Pipeline developments continue, with operating 250 MW Torrens Island grid-scale batteries expected at the start of 2023.

FID was achieved on the Broken Hill Battery Project, and the company is now approved for 500 MW Liddell and 200 MW Loy Yang grid-scale batteries.

The company will be reviewing strategies on outcomes in time for its September FY23 guidance update.

Meanwhile, AGL’s global hunt for new board members and CEO are ‘well underway’.

A word from the CEO

CEO of AGL Graeme Hunt commented:

‘AGL’s FY22 results delivered an Underlying Profit after tax within guidance, reflecting the resilience of AGL’s underlying business against a backdrop of challenging energy industry and market conditions that have intensified in the second half.

‘As we anticipated, Underlying EBITDA and Underlying Profit after tax were both down year-on-year, reflecting the expected step down in Trading and Origination Electricity earnings due to lower realised contracted and wholesale customer prices, increased costs of capacity to cover periods of peak electricity demand, and the absence of the Loy Yang Unit 2 insurance proceeds recognised in FY21. Other factors that negatively impacted the result included planned and unplanned plant outages, unprecedented market volatility and suspension, milder weather, increased residential solar volumes and margin compression via customer switching.’

Business in a bearish world

Mr Hunt said AGL recognises the need to offer ‘price certainty’ to customers, and its electricity exposure spot prices are ‘hedged with customer load, generation fleet and financial derivatives’.

All in all, the company trusts FY23 earnings to ‘remain resilient amidst the current challenging energy industry and market conditions’.

AGL said:

‘This is underscored by the strength of AGL’s large and diversified customer base, low-cost baseload generation position supported by strong fuel supply arrangements, robust risk management, with prudent margin management ensuring retail strength and stability in a highly volatile market.

‘AGL is largely hedged for FY23 and well positioned from FY24 to benefit from sustained higher wholesale electricity pricing as historical hedge positions progressively roll-off.’

Source: AGL

Bear market strategies

The current economic environment hasn’t just been wreaking havoc in the energy sector; it’s been affecting plenty of businesses ranging across industries.

We are all painfully aware of the continuation of the bear market.

This makes it quite tricky to figure out what to do next.

Thankfully, our Editorial Director Greg Canavan has seen the bear before, more than once.

You could benefit from his experience and approach to investing, especially in his recent report on weathering a bear market while exploiting mispricing opportunities.

All the best,

Kyrill Prakapenka