The Afterpay Ltd [ASX:APT] share price is slightly up today after posting strong Q3 FY21 results and flagging a potential US listing.

APT shares were up as much as 2.6% in early trade, currently trading 0.6% higher at $126.74 per share.

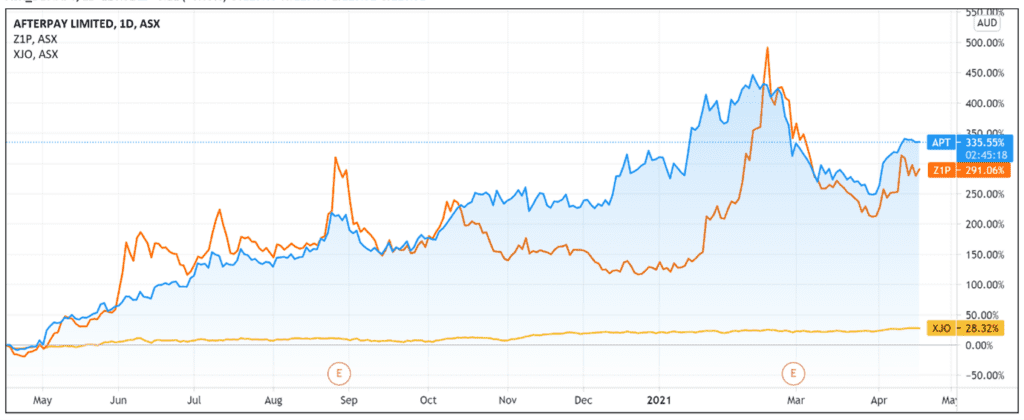

It’s been a tipsy-turvy year to Afterpay’s share price, with a March sell-off seeing the stock well off its 52-week high of $160.05 achieved on 11 February.

However, APT gained 17% in the last month and is still up 335% over the last 12 months.

Afterpay continues growth

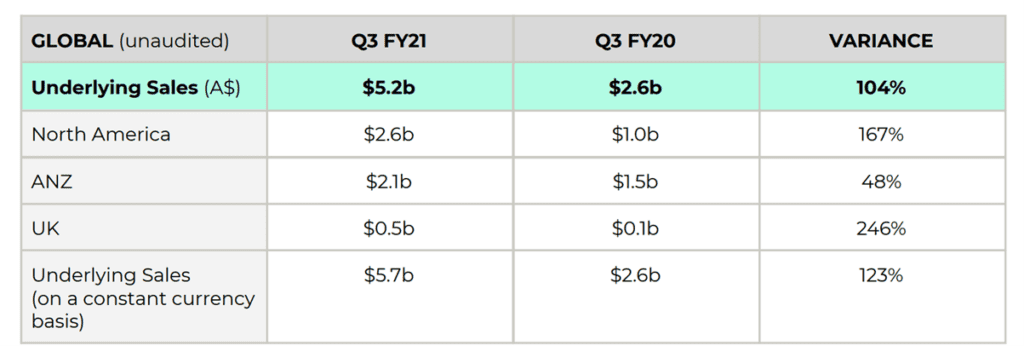

The fintech today reported that its quarterly performance on a constant currency basis was 123% higher than Q3 FY20.

On a local currency basis, Q3 FY21 underlying sales in the US and the UK were up 211% and 277% respectively on Q3 FY20.

In a sign of a maturing market, underlying sales in Australia and New Zealand lagged growth rates in the US and UK but were still up 48%.

Afterpay also reported that March 2021 delivered the ‘second highest monthly underlying sales ever recorded.’

This was no doubt boosted by the US becoming APT’s first region to record more than $1 billion in underlying sales in a single month.

Total active customers grew 75% to 14.6 million, with North America reaching 9.3 million active users.

Total active merchants grew 77% to 85,800.

In an interesting statistic, Afterpay reported that the top 10% of its customers now transact 33 times per year on average or about three times a month.

APT found that the top 10% of Australian and New Zealand customers transact 62 times per year.

CBA calls for more BNPL regulation

With Afterpay continuing to grow its customer base, the discussion over BNPL regulation is unlikely to abate.

Writing in the Sydney Morning Herald, Elizabeth Knight even posited that an ulterior motivation behind CBA entering the frenzied BNPL sector is to ‘enlarge it sufficiently that it can no longer avoid regulation.’

Last Thursday, CBA Chief Executive Matt Comyn fronted a House of Representatives standing committee in Canberra answering queries on responsible lending, employment, house prices and the like.

When questions turned to the buy now, pay later industry, Comyn didn’t waste the opportunity for a broadside against the sector and its leader.

The CBA CEO argued the sector is now too big to avoid regulation and that its users are riskier than non-users.

Comyn told the committee the likes of Afterpay should be subjected to a comprehensive credit-reporting regime.

This would require BNPL providers to report into credit bureaus, thus revealing the total amount of debt held with different providers and allowing banks to better assess customer risk.

Citing CBA’s own analysis, Comyn suggested hardship rates are double that of non-BNPL users and that BNPL users have higher arrear rates on credit facilities:

‘We see roughly buy now, pay later users having twice as much credit on their credit facilities, and typically on their credit cards [and] they have more credit products.

‘That is what we can see. But a number of buy now, pay later providers don’t contribute to “comprehensive credit reporting”.

‘I would suggest the line around innovation in this area is skewed to a complete absence and lack of regulation in a number of areas.’

Latitude Financial Chief Executive Ahmed Fahour, whose company offers BNPL and successfully debuted on the ASX today, also thought the sector will eventually be forced to perform credit checks.

Fahour told the Australian Financial Review that there will be ‘more regulatory requirements unless the industry is able to truly implement the changes that are required.’

While BNPL helps consumers with budgeting and merchants with marketing, Fahour thinks ‘it is credit at the end of the day and an appropriate level of credit assessment or verification is required.’

Is Afterpay headed for a US listing?

With behemoths like CBA pushing for more regulation and upstart rivals like Latitude agreeing that some level of credit assessment is necessary, it may seem like Australia is becoming a less enticing market for Afterpay.

But what about the US?

Afterpay today flagged that it is working with external advisors to ‘explore options for a US listing given the US market is now the largest contributor to our business and is expected to continue to grow strongly.’

Afterpay’s Q3 FY21 underlying sales of $2.6 billion from North America equalled the company’s total underlying sales in Q3 FY20.

And as of 31 March 2021, there are 9.3 million US active customers compared to 3.5 million Australian and New Zealand customers.

Importantly, APT’s North American customer base grew by 112% since 31 March 2020 whereas the Australian and New Zealand customer base only grew by 9%.

When was the last time Afterpay reported growth metrics in the single digits?

Speaking with Reuters, Datt Capital Founder Emanuel Datt, whose firm invested in Afterpay at $7.00 in 2018, commented:

‘U.S. investors are generally willing to pay a higher multiple for a growth business like Afterpay.

‘That is related to the deeper pools of capital that are available … relative to Australia.’

Afterpay management is likely wondering what US investors would make of APT processing more than $1 billion in underlying sales there in one month.

The fintech intends to remain an Australian headquartered firm but acknowledged that a US listing would accommodate a shareholder base that is ‘increasingly becoming more globally focused.’

As the Australian Financial Review noted:

‘Why shouldn’t a company that has the bulk of its operations in the US, the bulk of its investors in the US, and the bulk of investor interest coming from the US find a second home on Wall Street?’

The US listing could be pursued via a dual listing or via a primary listing model called a CHESS Depositary Interest, which was used by Amcor in 2019.

Afterpay did not set a timeline for a board decision on the US listing question and noted any listing would be subject to market conditions and approval by a US exchange.

Afterpay’s volatile year showcases that making investment decisions in the shadow of COVID-19 is no easy feat.

It’s important to gather the right information, sift the credible investment ideas from the incredible, and invest wisely.

And while that can be challenging, our Editorial Director Greg Canavan is excited about the opportunities the current environment presents.

We’re not talking about crypto plays or small-cap plays or more fintech plays.

We’re talking about ideas that could help manage your whole portfolio.

If you’re interested, then click here.

Regards,

Lachlann Tierney,

For Money Morning