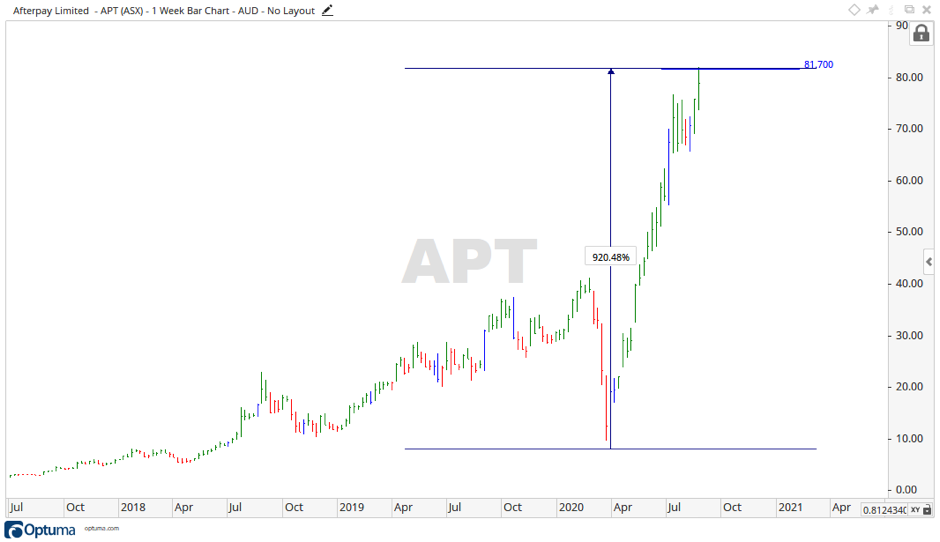

One of the standout performers of the COVID-19 pandemic is up again. Adding 3.48% at time of writing to trade at $81.70, the Afterpay Ltd [ASX:APT] share price continues its charge while people are stuck at home.

Source: Optuma

Afterpay and the BNPL sector

Throughout the COVID-19 pandemic, Afterpay forged ahead to become one of the leading growth stocks of 2020.

The virus is forcing people to stay at home and work from home for extended periods. This created huge increases in online shopping, the knock on effect being that companies like Afterpay and Zip Co Ltd [ASX:Z1P] are going through periods of extreme growth in terms of stock price and users of their services.

Afterpay is expected to announce their full year results this coming Thursday (27/08), and said its earnings would be 96% higher than it forecast back in July.

Z1P has also made the most of the pandemic up to now, reporting that the company achieved a record monthly transaction volume in excess of US$70 million in July, representing a 30% increase on the June quarter average and a 600%-plus increase year-on-year.

Both companies have plans and deals in place to keep expanding internationally and with no end in sight for the COVID-19 pandemic; you would think both Z1P and APT are well placed.

Where to from here for BNPL providers

Both companies are accelerating plans of expansion into Europe and the US.

The virus is savaging the US, and multiple European nations are seeing an increase in daily cases again.

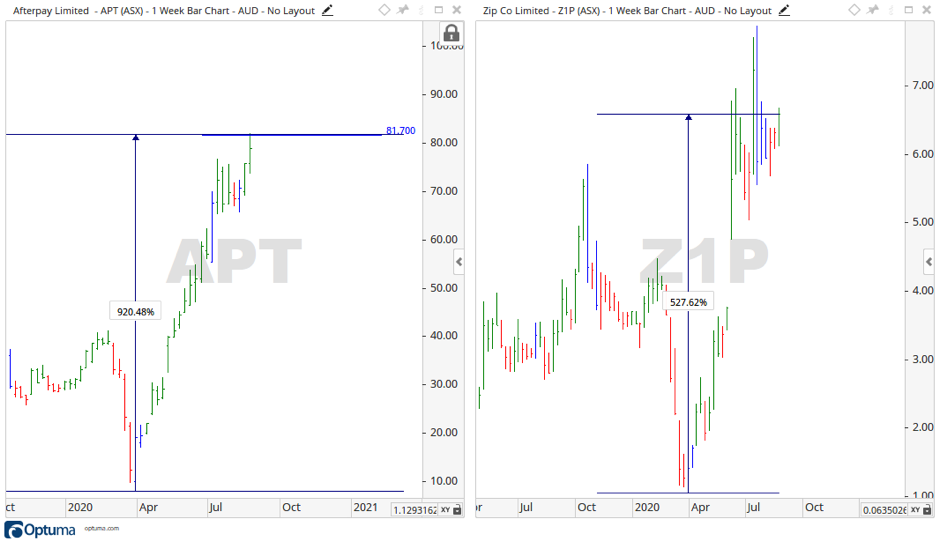

Let’s take a look at the charts for the Z1P and APT share price.

Source: Optuma

There’s a fair bit of momentum on both weekly charts.

But where’s the ceiling?

Once the APT earnings are released, there should be a much clearer picture of where the price could be heading and a better indication on how much confidence the market has in their future growth.

You can catch a discussion of BNPL stocks and risk management in the context of their share price growth here.

Regards,

Carl Wittkopp,

For Money Morning

PS: APT and Z1P started as small-caps. So, check out our four well positioned small-cap stocks: these innovative Aussie companies are well placed to capitalise on post-lockdown megatrends.

Comments