35 years ago my family arrived in Sydney.

I had just started primary school. I knew little of the world compared to what I know now.

My parents told me we were leaving Hong Kong to seek better days in Australia. We didn’t like the idea of the upcoming handover of Hong Kong to Mainland China in 1997.

I’m glad my parents moved here. I identify more with life here, despite my Chinese upbringing and heritage. I recall singing the Australian anthem at school every week, gradually grasping the meaning of the words.

Growing up here, I thought I’d leave behind the threat of encroaching authority and restricted freedoms.

But it seems like the troubles we wanted escape from are catching up to us. Our society has become more restricted in recent years. Those who govern us seem estranged from the common folk.

Take, for example, the latest absurdities from our Reserve Bank of Australia (RBA) governor, Michelle Bullock. Late last week, she threw water on hopes of interest rate cuts, something that could provide relief for many ordinary Australians. Instead, she said some may have to sell their homes to deal with the challenges faced by the Australian economy.

Many Australians may place little trust in their government. But they trust the economists on the RBA board, believing they’re doing their best to steer the Australian economy and help Australians prosper in the long term.

I’m pretty sure the latest warning from Michelle Bullock is a punch in the face of the ordinary Aussie battler.

And don’t think that Michelle, the RBA Board or those sitting in parliament are in this plight together. Many are well-heeled, owning several investment properties and have little to worry about. They’re in a good position to snap up more properties should some throw in the towel.

Rather than throw us a life raft, they’re handing us the anchor.

The gradual descent of the West,

and the world

Just how did we get into this mess?

Most of us born before the 1980s are likely pining for the good ol’ days. Back then, there was hope with the Australian economy (and much of the West, for that matter) with many looking at a bright future. Australia’s economy was growing, and families were prospering.

Many households lived comfortably on a single income and had enough to build their wealth for retirement. The average household had 2.3 children in the mid-1990s.

You may even remember the Ford Laser advertisement featuring a boy who was ‘the 0.3’ in the family. If you don’t, let me recap:

Today, a household with more than two children isn’t as common as back then. The average fertility rate for Australian women is below 1.7 today. This is below the replacement rate, contributing to economic problems and an ageing population.

Furthermore, migrant women have more children than local women. The mood among local women is to put off having children or to have less.

There are reasons why women are having fewer children. The move towards gender equality meant a woman could aspire to have it all – a career, financial independence and a family.

Sadly, the reality of rising costs and falling wealth mean they prioritise career over family. For many successful career women, having a family becomes a race against time or a ‘could have but didn’t’.

And don’t get me wrong, men are just as culpable for the falling fertility rate. Their failures created the gap that women had to step in to fill.

From an economic perspective, the cost of forgoing a job to have children is rising. Just look at the average income of a Sydney worker in terms of gold in Australian dollars over the last 30 years:

| |

| Source: ABS, Refinitiv Eikon |

The average paycheque is steadily increasing, no doubt about that. However, what it buys is declining, and at an alarming rate.

An average worker earned an equivalent of 60 ounces of gold in 2007. Today, it’s half of that.

You might find it hard to believe, but the purchasing power of today’s average Sydney worker is less than that of a university graduate when they first joined the workforce back in the 2000s. Specifically, 30 ounces of gold in 2007 was worth around $30,000.

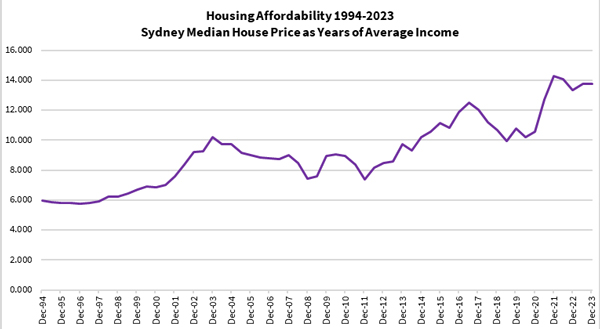

Housing affordability has become more elusive. This is how the value of a median Sydney property changed over time relative to average income:

| |

| Source: Refinitiv Eikon, ABS |

For many to live like they did when they were growing up, they’d need two incomes. Even then, it mightn’t be enough.

I believe Western society got itself into this mess by embracing consumerism, love for the sake of love rather than commitment, and the YOLO (you only live once) lifestyle.

When people embrace an egocentric philosophy rather than make the world better for future generations, things go downhill quickly.

Hitting the brick wall of excess debt

It might seem like a stretch for me to link up those seemingly disparate points to explain why society has found itself here today.

But if you think about it deeper, you’ll see it makes sense.

Our personal decisions drive society’s trajectory. And our governments will fulfil that through its policies.

The Western democratic governance structure means parties represent the diverse interests of their people. Whoever gets the most votes win. But the ruling party has a limited term to follow through with their promises. There’s little room for long-term planning.

Over the last four decades, the ordinary voter shifted their preferences from the future to now. Technology and social media have changed our mindset and the social fabric. Therefore, political parties seek to win elections by playing to these character weaknesses.

Short-term goals and instant gratification become costly over time. Someone must pay.

Meanwhile, the government puts it on a tab by borrowing.

Who does the government borrow from? The central bank and other lenders. There’s interest on the loan, and it grows with time.

And who pays? The people and businesses.

Paying that interest stifles actual growth, strains our economy and destroys wealth.

Several key events in the last 40 years led to where we are today. Each time the Australian economy took a hit, our policymakers opted for a quick fix by borrowing. In turn, businesses and households followed suit.

From those at the top to the ordinary folks, we borrowed to the hilt to keep things going.

We’ve just reached the end of the road paved with excessive debt. Beyond this is a pit.

The RBA has just indicated it’s prepared to push the mortgage holders over, in a vain attempt to soften the landing of those next to fall.

Back to basics to Advance Australia Fair

The current crisis Australia — and the world — faces is a huge one. In the past decade, we’ve tried to wish it away, believing we can borrow our way out of debt.

Like digging a hole deeper thinking that’s how we get out, it won’t end well. We just don’t know when.

At the risk of simplifying a complex problem, we can do our bit for our children and future generations by getting back to basics of building a strong family and exercising financial responsibility. This will slowly restore the Australian economy and household wealth.

It isn’t easy to stop living for the moment, spend more than we earn and reward unproductive behaviour. Not when society is divided, our values remain messed up and living costs continue to rise.

Rather than pursuing the superficial and the expedient, let’s foster commitment and discipline.

These are all counter-cultural but will pay dividends.

When I reflect on our national anthem, I think of what we inherited from our forefathers:

Our land abounds in nature’s gifts, of beauty rich and rare.

And I’d like to continue…

In history’s page, let every stage, advance Australia fair

In joyful strains then let us sing, advance Australia fair.

My fellow readers, do it for the country, your children and future generations.

God bless,

|

Brian Chu,

Editor, Gold Stock Pro and The Australian Gold Report

Comments