At time of writing the Adairs Ltd [ASX:ADH] share price trades at $3.41 up 5.90%.

Today, Adairs provided a trading update for the first 23 weeks of FY21.

Source: Optuma

The growth of Adairs Ltd

Adairs’ share price plummeted in February on the announcement of the COVID-19 pandemic.

Falling over 83% in five weeks.

As lockdowns got enforced across the nation, Adairs started to bounce back.

The company had nationwide store closures through April and May.

As the traditional bricks and mortar side of the business struggled, the online side accelerated.

It was reported in August that online sales grew by 61.4%. Redecorating became something many people did while stuck at home during lockdown.

This saw the share price move up over 844% to an all-time high in October.

Source: Optuma

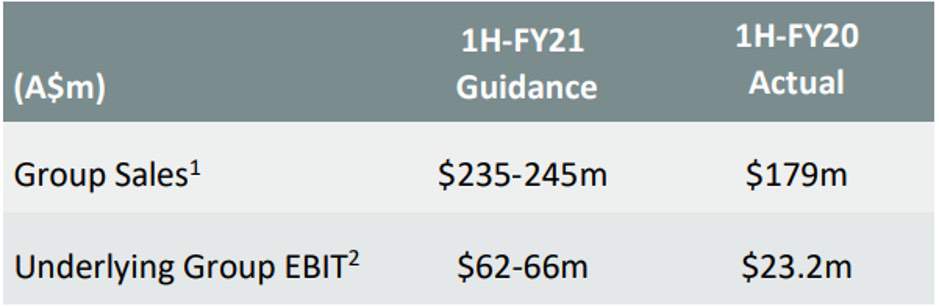

The company announced the guidance for the first 26 weeks for FY21:

Source: newswire.com

CEO and Managing Director Mark Ronan noted:

‘With a few weeks to go, it is now clear our first half FY21 result will be outstanding and builds on the excellent result in FY20.

‘Whilst we have clearly been a COVID-19 beneficiary, the result has been delivered through the team’s strong execution against our articulated business strategies.

‘These gains extend across all aspects of our business with Adairs achieving strong growth through our integrated omni-channel model.’

Will Adaris’ growth continue?

The company currently holds a market cap of $544 million.

With debt at $1 million. While also paying a $0.11 fully franked dividend.

The company appears to be doing very well.

Looking at the chart.

Source: Optuma

From the October high, the price fell more than 20% to where it trades at time of writing.

Should the fall continue then the levels of $3.03 and $2.73 may provide future resistance.

If the price turns to the upside, then the level of $3.63 may become the focus.

Adairs is going through an exceptional year of growth. It may be easy to forget the circumstances around this.

With the nation in lockdown and with many people out of work, they were propped up by the government stimulus packages JobSeeker and JobKeeper.

These measures will disappear by April 2021.

Christmas is also close by.

As good as the ADH share price looks, I think it may just be starting to run out of steam. As life resumes to normal, we may start to see a pull back.

As markets move up and down it is important to know how to limit your risks while trading volatile stocks. To learn more, download here.

Regards,

Carl Wittkopp

For Money Morning