This year proved to be very profitable for online retailers across furniture and homewares.

One of the quiet achievers so far is Adairs Ltd [ASX:ADH].

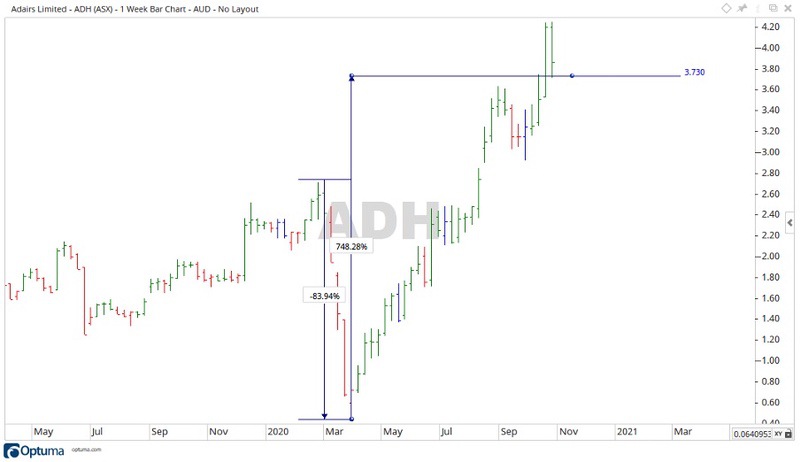

The ADH share price is sitting at $3.73 at the time of writing. The company fell back slightly in recent weeks, but overall is still up massively for the year.

Source: Optuma

What’s happening at Adairs?

Back in late February, the company had been trading at $2.74, close to the all-time high of $2.95 set back in August 2015.

Then the COVID-19 pandemic hit and the Adairs stock price dropped over 83% to 44 cents.

As the virus took hold, people all over the country were forced to stay home.

For online businesses and those in the homewares sector (like Adairs), the knock-on effect was a set of business circumstances most companies could only dream of, as people went online to pretty up their homes.

Adairs saw a big increase in sales and recently reported some great figures:

- ‘Group Sales +12.9% to $388.9m

- Group online sales up 110.5% to $124.2m

- Adairs online sales up 61.4%; Mocka sales up 30.4%

- Stores sales –7.3% with LFL store sales +3.9%

- Group underlying EBIT up 39.7% to $60.7m

- Net debt of $1.0m (down $7.2m)

- Final dividend of 11.0 cents per share (fully franked)’

Source: Optuma

The increase in sales also saw the company’s stock price jump up over 748% to where is sits at today, and gave the company a market cap of $652 million.

Where to from here for Adairs?

The stock price fell back over recent weeks, but with Christmas just around the corner there may be more spending as people shop for gifts.

As people look to get new furniture from online companies like Temple & Webster Group Ltd [ASX:TPW], they will most likely look for complimentary home decor items to complete the look of a room.

This is where Adairs comes into play, one goes with the other.

Source: Optuma

The ADH share price would have to create a new all-time high above the previous level of $4.24 for the stock to continue its bullish run.

Should it continue to fall back, then the levels of $3.60 and $2.90 may provide future support to a further decline.

Regards,

Carl Wittkopp,

For Money Morning

PS: Four Well-Positioned Small-Cap Stocks: These innovative Aussie companies are well placed to capitalise on post-lockdown megatrends. Click here to learn more.

Comments