Air traffic control specialists Adacel Technologies [ASX:ADA] has won a significant contract from the Federal Aviation Administration (FAA) for ongoing services connected with ADA’s existing installed network of training systems.

The contract will last five years and is valued at US$59 million over that period.

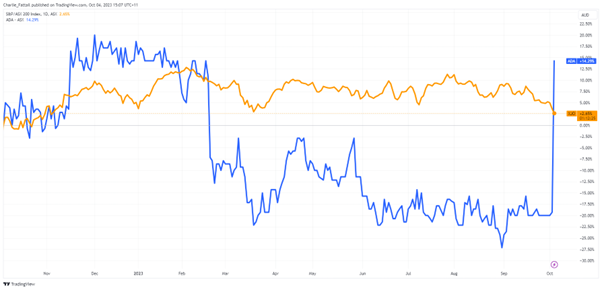

Shares have surged today, up by 41.59%, trading at 80 cents per share after being awarded the contract, which should allow shareholders and leadership to breathe a sigh of relief.

The company’s shares have tracked sideways since a -16% one-day drop in its price after disappointing 1HFY23 results posted in late February.

The company’s revenues have fluctuated wildly in recent years as it struggled with considerable contract renewal delays and the war in Ukraine, affecting the deployment of one of its remote tower systems in Estonia.

So, with the contract awarded, what does it mean for the company moving forward?

Source: TradingView

Adacel Secures Contract worth $59 million from FAA

The deal revolves around its Tower Simulation Systems (TSS), a critical component in air traffic management training.

Known as MaxSim Tower Simulator and Training, Adacel’s training system is considered the industry leader, with over 370 installations across military and civilian partners. MaxSim can use virtual reality (VR) and augmented reality (AR) headsets but is primarily used simply as a digital analogue of air traffic control environments.

Adacel is tasked with comprehensively upgrading major components within the TSS systems and mobile units as well as offering long-term services support.

The services include maintenance, help desk assistance, field servicing, and data repository management.

While the contract is a significant win for the company, the award was hardly a great surprise, considering Adacel is the FAA’s original equipment manufacturer for the training systems and had a long history of supporting the TSS systems.

Daniel Verret, CEO of Adacel, reiterated this and expressed pride in the announcement today, saying:

‘Our industry track record spans over 35 years, including over two decades of supporting the world’s largest TSS program, characterised by exceptional system availability throughout its history. It is an honour to partner with the FAA in ushering in this new era of TSS program support and to continue the longstanding commercial partnership between our organisations.’

The contract will compound with other minor contracts that the company has secured in recent months, including a US$7 million contract to an unspecified NATO member for the MaxSim training.

With 70% of the company’s revenue sourced through services — compared to 30% from systems — these new larger contracts will help bolster this segment that has fallen in recent years.

In ADA’s FY23, services revenues were lower at US$19.1 million compared to $US20.6 million in the previous financial year.

The company blamed the slowdown in tourism and aviation from COVID-19, which had a knock-on effect on its largest revenue generator, the Advanced Technologies and Oceanic Procedures (ATOP) contract.

The long and vague title hides ADA’s bread and butter. ATOP is essentially an anti-collision system for planes crossing long stretches of the ocean. The contract accounts for approximately 40% of the company’s revenue.

Now flying numbers are back to pre-pandemic levels, what will the company’s future bring?

Outlook for Adacel

The past few years have been a challenge for the company beyond the obvious COVID-19-related slowdowns. The company has seen delays across many of its significant contracts and lowered service revenues.

Thankfully, there was growth within the systems segment of the business, which saw revenues of US$8.2 million in FY23 from the previous year’s US$6.9 million.

Growth in its systems segment usually means future revenue streams for the business, as service contracts often stem from selling the systems due to their niche and bespoke nature.

Historically, the company also benefits from the sticky nature of these service contracts. Churn is extremely low, and the organisations it deals with are incredibly reliable parties, such as the US Air Force, FAA, and Royal Australian Air Force.

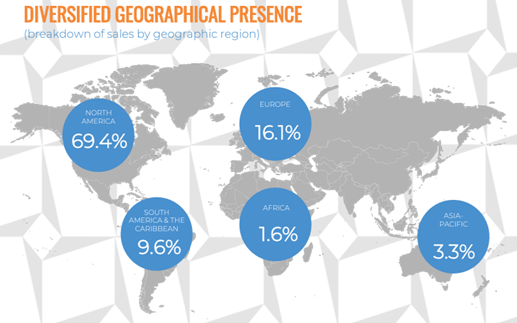

Another clear bonus is their diversified approach, with recent investments flowing towards European countries such as Estonia, which is updating its systems with Adacel.

Source: Adacel

Looking ahead, ADA should see healthy growth across all segment revenue streams. The company has invested heavily in its new flagship solutions for digitising air traffic control and training and says its pipeline is robust.

The company had previously identified six multi-year simulation and training system opportunities valued in excess of $100 million.

Its FY24 outlook forecasts EBITDA of US$5−5.2 million, up from $2.9 million in FY23.

A major concern for the company and shareholders should be regaining its margins, which have fallen in recent years from nearly 40% to its current 32.3%, largely due to inflationary costs pushing up wages.

As long as cost blowouts are tempered, Adacel could see healthy profits and share price gains in the medium term.

The balancing act of dividends

The ASX benchmark is down again. The ASX 200 is now at an 11-month low and is down by -2.31% in 2023.

With central banks echoing the sentiment of ‘higher for longer’ as fuel prices rise, equity markets are shaking.

Investors are moving into defensive positions, focusing on quality stocks that can provide safety and pay dividends.

But blindly buying the ‘best dividend-payers’ could leave you missing out in the longer term.

There are great stock picks that can be found today that can offer growth and income.

That’s why our investing expert and Editorial Director, Greg Canavan, has spent his time finding them.

He calls it the Royal Dividend Portfolio, and it’s the sweet spot between growth and dividends.

Click here to learn more about what that looks like.

Regards,

Charles Ormond,

For Money Morning