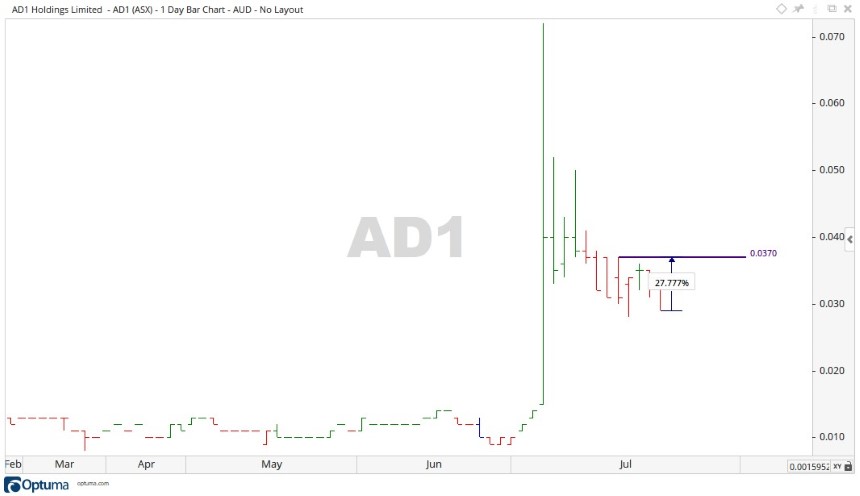

The Melbourne-based technology company jumped up over 27% on the back of strong performance.

Trading at $0.037 at the time of writing, the AD1 Holdings Ltd [ASX:AD1] share price retraced following an announcement at the start of this month.

Source: Optuma

What’s happening at AD1 Holdings?

Specialising in customer-branded recruitment platforms, software billing services, and management platforms, AD1 recently announced their first cash flow positive quarter.

They generated $217,000 in net cash from operating activities.

The company achieved this by securing a variety of new government contracts with both the New South Wales and Victorian governments.

This was coupled with the announcement of a renewal with AD1’s oldest customer — the New South Wales Government — for a further two years.

The company also achieved a significant reduction in out flows compared to last year.

This was on the back of cost savings for the company of approximately $5 million per year.

Where to from here for AD1 Holdings?

Today’s announcement is a strong positive for the nearly $16 million market-capped business,

The company announced a 52% increase in cash receipts compared to the same time last year, up to $3.648 million.

With the government contracts in place and a string of other opportunities in advanced stages of discussion, AD1 news flow could potentially drive its share price higher.

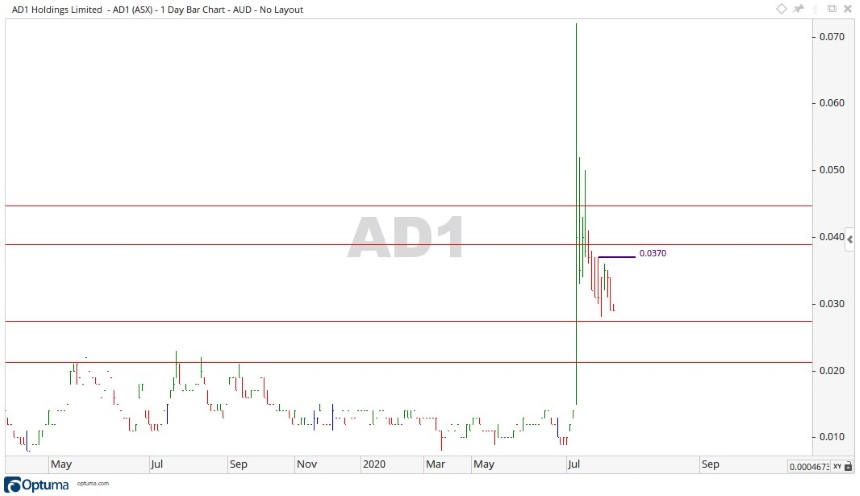

Looking at the charts you can see these levels.

Source: Optuma

The AD1 share price is sitting at $0.037, and on the back of a lot of good news for the company the next level in focus is $0.039.

Should the price be able to push through this, the level of $0.045 may provide future resistance.

On the downside if the price were to fall back again, then levels of $0.027 and $0.022 may provide support in the future.

Regards,

Carl Wittkopp,

For Money Morning

PS: ‘The Coronavirus Portfolio’: The two-pronged plan designed to help you deal with the financial implications of COVID-19. Download your free report here now.