At time of writing, shares of The a2 Milk Company Ltd [ASX:A2M] are down over 5%, trading at $18.44.

Lofty expectations could be the reason for the share price action, as the New Zealand milk company made significant gains in revenue and earnings across all its markets.

The company is in a very strong position, but will the growth continue?

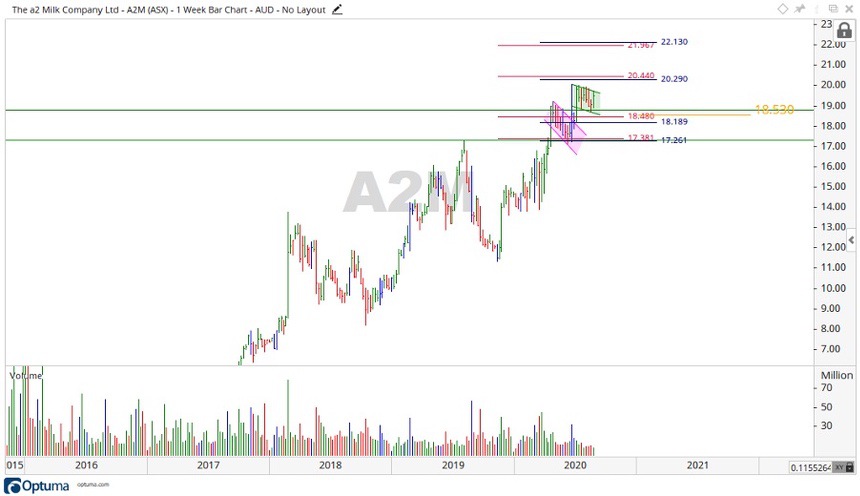

Source: Optuma

a2 Milk’s numbers are strong

A2M has built itself into something of a cash machine. The company holds zero debt, has a year-on-year increasing cash position, and a strong return on equity figure.

This enabled the company to record some truly impressive figures for FY20:

- ‘Total revenue of $1.73 billion, an increase of 32.8%

- EBITDA4 of $549.7 million, an increase of 32.9%

- Net profit after tax of $385.8 million, an increase of 34.1%

- Basic earnings per share (EPS) of 52.39 cents, an increase of 33.5%

- Marketing investment of $194.3 million targeting opportunities in China and the USA, an increase of 45.1%

- Group infant nutrition revenue of $1.42 billion, up 33.8%

- Strong growth in China label infant nutrition, with sales more than doubling to $337.7 million and distribution expanded to ~19.1k stores

- USA milk revenue growth of 91.2% and distribution expanded to ~20.3k stores’

a2 Milk appears to run as a well-oiled machine.

Its core business is high-quality milk and baby formula.

And while there is a global pandemic in motion, a hungry baby is still a hungry baby.

Where to from here for A2M shares?

While the current results for the company are impressive, can the stock price keep going up?

Source: Optuma

Let’s take a look at the A2M share price chart

The current A2M share price sits just below the historical support level of $18.78.

In recent weeks, the A2M share price moved into a falling flag pattern (green) after only moving up slightly from a previous falling flag pattern (pink). These moves took place on declining volume, which may indicate a lack of commitment to the move up.

Should price fall in the short term, the level of $17.30 may prove enough to hold it up. This also happens to be the previous all-time high level set back in August 2019.

Conversely, if price can turn back to the upside, then the levels of $20.30 and $22 may provide future resistance.

Regards,

Carl Wittkopp,

For Money Morning

PS: A2M started its life as a small-cap. Learn about four well-positioned small-cap stocks that could capitalise on post-lockdown megatrends. (Hint: Two are growing players in Australian e-commerce.) Click here to learn more.

Comments