Shares of Auckland-based dairy company The a2 Milk Company Ltd [ASX:A2M] are currently sitting just off an all-time high. Since releasing half-yearly results on 27 February 2020, the A2M share price is up over 15%, driven by a 31.6% increase in revenue, bringing it to a total of $806.7 million.

Source Optuma

Specialising in infant formula and premium milks, the company has experienced a remarkable rise, giving it a market cap of $13.74 billion and making it the 22nd largest company on the ASX.

a2 Milk share price: the past

Since listing on the ASX back in March 2015, A2M has now had five years on the market. And in that time has recorded a nearly 4,000% jump in share price coming from strong growth in Australia, the US, China, and the broader Asia region.

Source: Optuma

I believe A2M’s success can be traced back to strong management of its balance sheet.

Industry beating Return on Equity (ROE) over the years is part of the story.

Now, with a strong cash position of $618.4 million as of their half-yearly, a2 Milk has found itself in an enviable position within the top 100 ASX stocks.

This comes at a time when some companies, including big banks like National Australia Bank Ltd [ASX:NAB], are tapping the market for capital raisings.

a2 Milk share price: the present

With many ASX 100 stocks taking a hit, A2M has been one of the few outliers, bucking the trend down to move up in price.

Commenting in the AFR in February, interim boss Geoff Babidge noted:

‘China label sales are above expectation in February, just as our English label is.

‘Online and reseller and Daigou channels are also performing strongly into the market at this time. How that plays out in coming months is the question. Two months to date, the results are positive but it’s too early to predict.’

a2 Milk share price: the future

With the FY20 outlook announced on 22 April, A2M confirmed that revenue for the three months to 31 March 2020 (3Q20) was above expectations.

The announcement went on to say:

‘This primarily reflected the impact of changes in consumer purchase behaviour arising from the COVID-19 situation and included an increase in pantry stocking of our products particularly via online and reseller channels.’

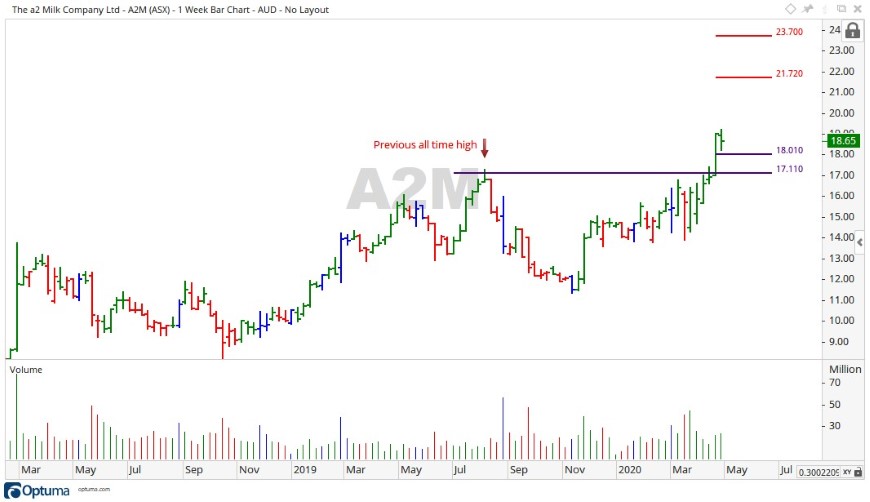

The positive news showed up in the chart:

Source: Optuma

Taking a technical view of a2 Milk, the price has moved up strongly in the last four weeks after a small move sideways.

The last bar on the chart having a close lower than the open coupled on higher trading volume may indicate a future fall in the short term, if levels of $18.00 and $17.11 could come into to play, with $17.11 being the previous all-time high.

Source: Optuma

Given its seemingly relentless rise, any move down may prove to be short lived considering A2M’s strong growth.

Should the A2M share price return to the upside, then price targets of $21.72 and $23.70 may come into focus.

Not all stocks have performed like a2 Milk since the coronavirus crisis started. If you want to learn about the two types of assets that could benefit from this new investing environment, download a free copy of ‘The Coronavirus Portfolio’. In it, my colleague Lachlann Tierney runs you through the kinds of investments he thinks have the most potential in the downturn.

Regards,

Carl Wittkopp,

For Money Morning