A warning to all the investors eyeing up Queensland’s property market.

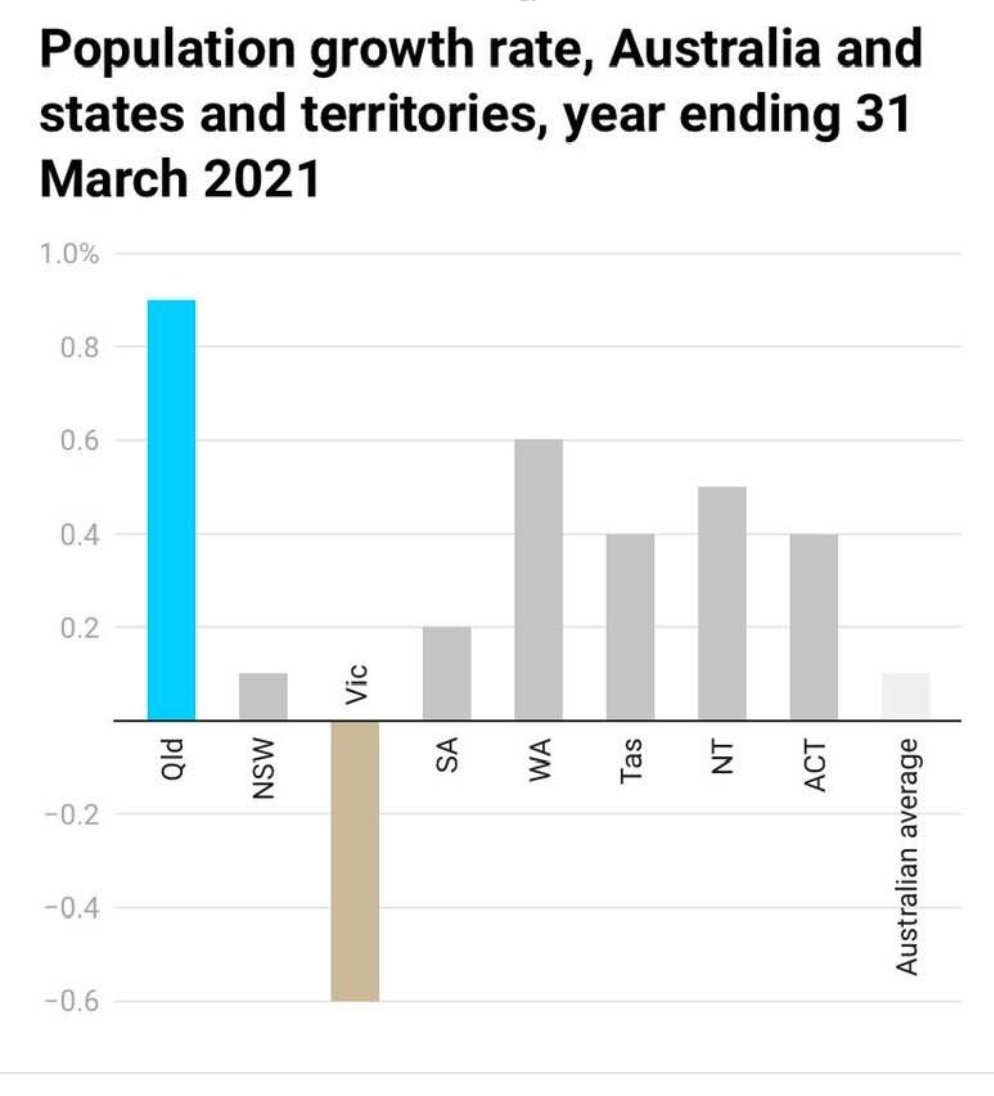

The state has had a boom on the back of interstate COVID migration, with more people moving to Queensland than any other state or territory.

Take a look:

|

|

|

Source: ABC News |

As a result, Queensland’s residential land prices have rocketed up $41.2 billion in the past financial year.

In fact, over the two troubled years of the pandemic, they’ve gained some $74.7 billion.

That’s almost double national banking profits!

It’s hard to say how much of that increase came from out-of-state speculators bidding up prices, but I’ll bet it’s been a big influence!

I know many have been property shopping in QLD based on expectations of further increases in lieu of the Olympic’s infrastructure build-out.

However, things are about to change.

An investor called me a couple of days ago.

He told me he was considering purchasing his next property in Queensland, but after hearing the latest policy shift from the state government, has now reconsidered.

Queensland Treasurer, Cameron Dick, has moved to close one of the loopholes many property investors use to dodge hefty land tax bills.

That is, using the land tax thresholds in each state and territory to keep assessments low.

Every state and territory levies land tax (aside from the NT).

It’s levied on all investment properties — including holiday homes and non-residential holdings.

The tax is calculated on the total value of all taxable land above the land tax threshold.

That means if an investor owns all his properties in the one state, let’s say NSW, the land tax would be significantly higher, than if the properties were spread over four states, thereby taking advantage of the tax-free thresholds.

Last week however, Treasurer Cameron Dick announced a ‘tweak’ to the rules.

This means that the value of property investments in other states or territories will now be taken into account when assessing the taxable component of land in Queensland.

How to Survive Australia’s Biggest Recession in 90 Years. Download your free report and learn more.

In other words, if you own properties in Victoria as well as Queensland, your Queensland property will fall into a higher tax bracket than it would have done under the previous rules.

‘At the moment, interstate property speculators can claim the tax-free threshold and take advantage of lower land tax rates in multiple states.

‘That means these investors can amass multi-state portfolios that fall below the land tax threshold in any single state.

‘Queenslanders, with their entire landholding in this state, can end up paying more tax than these interstate investors.

‘So young families in places like Logan and Ipswich face unfair competition from Sydney-based speculators who are flipping properties around the country at a furious rate.”

‘For example, an individual with taxable landholdings of $1 million in Queensland would pay $4,500 in land tax (or an average rate of 0.45 per cent).

‘Another individual landholder with $600,000 in taxable land in Queensland and $400,000 in NSW would only pay $500 in land tax in Queensland and no land tax in NSW at current thresholds.

‘“We’ll close that loophole while ensuring there are no land tax changes for Queenslanders who own land wholly within our state,” the Treasurer revealed.’

Put simply, Queensland is going to start collecting more of the economic rent from land.

The move will undoubtedly have an effect on the state’s property cycle.

Not to the extent that prices will slide backwards…but I would expect the gains we’ve seen over the last two years to slow.

Investors that own land inside and outside of the state’s borders will likely have an unpleasant shock when they get their next land tax bill.

Some will consider selling no doubt!

Bottom line: if you’re considering a purchase, I’d be giving Queensland the flick for now and eyeing up other states such as Perth instead.

Best wishes for the New Year.

Regards,

|

Catherine Cashmore,

Editor, The Daily Reckoning Australia

PS: Australian real estate expert, Catherine Cashmore, reveals why she thinks we could see the biggest property boom of our lifetimes — over the next five years. Click here to learn more.