In today’s Money Morning…are you tired of hearing about Tesla yet?…the IPO…the future is quiet…and more…

When it comes to Tesla, most people fall into one of two camps. Either you’re sick of hearing about them, or you’re a shareholder and feeling pretty smart.

The Tesla story is pretty well known, but I want to revisit it in light of a recent IPO that I think gives a bit more depth to the story and is worth reflecting on.

I promise I am not about to recommend you buy Tesla stock. That is hardly a unique recommendation and there are a million articles on why you should or shouldn’t buy Tesla already.

I am much more interested in what Tesla means for the world and for other hidden investing opportunities.

Let me explain…

Are you tired of hearing about Tesla yet?

I’m sure I don’t need to tell you that Tesla has been getting a lot of attention this year. They make electric cars, but the hottest topic always seems to be its share price.

How can this young upstart that is still ramping up production be valued at four times Toyota?

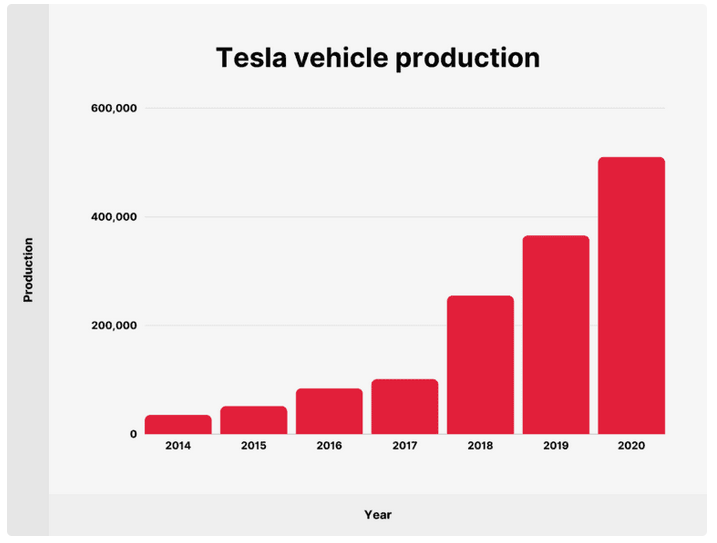

To put it into perspective, in the first three quarters of this year, Tesla produced 624,582 vehicles. In December this year alone, Toyota plans to build 800,000 vehicles. Still, the production growth from Tesla has been quite impressive.

Check out the below chart:

|

|

|

Source: Backlinko.com |

The way I see it, there are two things driving the Tesla share price to these heights.

Firstly, Tesla isn’t just a carmaker. They’re an electric carmaker and they’re by far the leader in this technology. Electric cars are the future. The writing is on the wall. The writing is even in the law books.

Take Amsterdam, for example. The city plans to ban petrol and diesel vehicles from 2030. Now, let me be very clear, they aren’t only banning new sales. If you own a petrol or diesel vehicle in 2030, it’s going to be a rather nice museum piece at best.

Europe is leading the charge on electric vehicle policy. Norway plans to ban fossil fuel new car sales by 2025 — just over three years away — while many other countries have targets to begin bans in 2030 up to 2050. A recent COP26 policy paper for banning fossil fuel car sales by 2040 — and 2035 for ‘leading markets’ — was signed by 34 countries.

It seems pretty obvious that the future of the car industry is electric, and that Tesla has a first-mover advantage.

The second thing that is driving the Tesla share price is that Tesla isn’t just a carmaker AND isn’t just an electric carmaker. They’re a technology and information company. Batteries, solar, processors, machine learning, robotics…I think you get the idea.

They’re at the forefront of several exploding technologies.

Self-driving technology itself has the potential to completely change the structure of our cities. Imagine a future where all cars are self-driving and communicating with each other all the time. Traffic will be constantly optimised by each car on the road as it communicates with every other car — a large hive mind.

Computers can have much greater control and accuracy than a human. Cars can drive millimetres apart from each other and at much higher speeds. Roads can shrink to half their current size or allow twice as many cars. Safety features on cars will become redundant as collisions all but disappear. A single car won’t just tap into its own cameras and sensors, it will use information relayed from other cars in the network to identify hazards and to plan ahead. Traffic will accelerate and decelerate in unison. Traffic lights will disappear.

Now, think about all the time we spend driving. Many of us commute for an hour or more a day. A fully self-driving future gives that time back to consumers to spend more time reading Money Morning and Exponential Stock Investor. A self-driving future is safer, more efficient, and more educated. Couple that with clean air and no more noisy diesel engines, and I think you can start to see where all the hype is coming from.

The reason I am suddenly talking about all of this is…

Discover our top three ASX-listed pot stocks in 2021. Click here to learn more.

The IPO

The Rivian Automotive Inc IPO last week.

It was hotly anticipated, and it did not disappoint. The IPO priced the company at about US$66 billion, and the company ended its first week of trading at US$113 billion, making it the fifth most valuable carmaker in the world. Rivian is valued at more than GM and Ford and it hasn’t even shown any revenue.

Major shareholders include Amazon and Ford, with Amazon also placing an order for 100,000 electric vans to be delivered by 2030. Just like Tesla, demand is not going to be a problem for Rivian, it is going to be supplying that demand.

Check out this interview with the Rivian CEO on IPO day, where he discusses business structure and how they’re managing their supply chain, among other things.

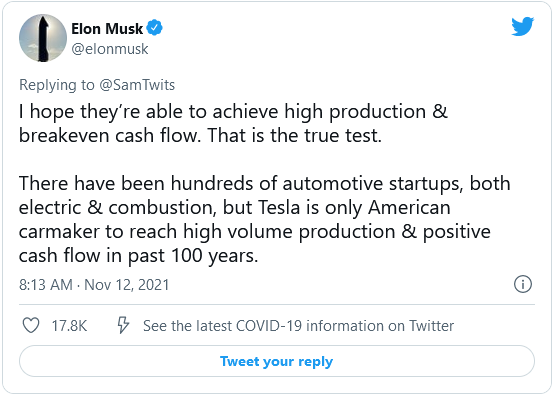

Of course, Elon Musk hasn’t been shy about sharing his thoughts on Rivian. His comments below get to the heart of the issue with a large manufacturing operation like this. They need to scale up and start covering their costs as soon as possible. At the moment, Rivian is a cash-burning machine, with current expenditure to the end of 2023 expected to be about US$8 billion. Keep in mind that they haven’t shown any revenue yet.

|

|

|

Source: Twitter |

The reason I think all of this is interesting?

The future is quiet

The way I see it, the Rivian IPO legitimises the Tesla share price. It tells us that the world is ready to go electric. It’s the future. A very quiet, internal combustion engine free future.

Now, I am not telling you to buy Tesla or Rivian shares. Do it if you want to. But they are big obvious stories that everyone is looking at.

The key for me is that the market is willing to invest in this technology, and we are only at the beginning of the adoption. The electric carmakers themselves are priced for explosive growth.

So that gets me thinking about batteries, machine learning, cameras, and sensors. We know there’s already a chip shortage for carmakers globally. So who wins from that? And what about the massive amounts of information that comes with self-driving? That requires storage and processing. How much decision-making will be made at the car, and how much will be made centrally?

I don’t have a crystal ball for answering these questions. Yet they are important questions which I would like to encourage you to start thinking about. I know I will be.

Regards,

|

Izaac Ronay,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here