In today’s Money Morning…betting on bitcoin…start of a domino effect…the endgame is near…and more…

The Bitcoin Miami conference just ended yesterday.

And on the last day Jack Mallers of remittance app Strike dropped a bombshell.

On stage, in trademark hoodie, he announced that El Salvador — a country they work with very closely — was developing a bill to make Bitcoin [BTC] legal tender.

The bill would mark the first time a country had designated bitcoin as such.

This could have huge legal ramifications for the rest of the world, as I’ll go over shortly…

Betting on bitcoin

Stressing the enormity of the news, Mallers said:

‘This is the shot heard ’round the world for Bitcoin. What’s transformative here is that bitcoin is both the greatest reserve asset ever created and a superior monetary network.

‘Holding bitcoin provides a way to protect developing economies from potential shocks of fiat currency inflation.

‘Additionally, adopting a natively digital currency as legal tender provides El Salvador the most secure, efficient and globally integrated open payments network in the world.’

That’s a key point a lot of people still don’t understand about bitcoin. It’s both a unit of account and an independent monetary network in one.

The price of bitcoin re-enforces the security of the network and the more secure the network, the more attractive it is to build products on — like Strike’s remittance app.

El Salvador’s president joined the conference by live stream, saying:

‘In the short term this will generate jobs and help provide financial inclusion to thousands outside the formal economy.’

Today, El Salvador uses the US dollar as legal tender after its own currency collapsed in 2001.

It’s heavily reliant on remittance inflows from expat workers in the US.

70% of the population don’t have a bank account or credit card.

Bitcoin vs Gold: Which Should You Buy in 2021?

It appears that its leaders have decided to back Strike, and a bunch of leading bitcoin companies such as Blockstream, to try and turn their country’s fortunes around.

It’s a bold move, that’s for sure, but as President Bukele tweeted, there’s some compelling upside if it goes to plan:

|

|

| Source: Twitter |

But this isn’t just about accepting bitcoin as a medium of exchange. It’s also about using the technology stack behind the bitcoin blockchain to fast track their lagging financial infrastructure.

As reported on Business Wire:

‘El Salvador has assembled Bitcoin leaders across the world to help build a new financial ecosystem with Bitcoin as the base layer.

‘“It was an inevitability, but here already: the first country on track to make bitcoin legal tender. Another milestone for Bitcoin and El Salvador. We’re pleased to help El Salvador on its journey towards adoption of the Bitcoin Standard,” stated Adam Back, CEO of Blockstream, who plans to contribute technologies like Liquid and satellite infrastructure to make El Salvador a model for the world.’

It’ll be a big test case for bitcoin and the world will be watching closely.

Now, the usual chorus of crypto critics were quick to downplay the news stating El Salvador’s tiny economy (GDP of $24.6 billion) or the current president’s questionable adherence to democratic ideals (he recently fired five Supreme court judges to cement his authority).

But there’s a bigger picture they’re missing on this…

Start of a domino effect?

Beyond El Salvador’s borders, the concept of declaring bitcoin as ‘legal tender’ could have a domino effect on how it is treated in the rest of the world.

Wyoming-based Crypto bank founder Caitlin Long pointed out:

‘If El Salvador adopts legislation to make bitcoin legal tender, its likely to get status as “money” so treated on par as a foreign currency by banks.

‘(Which means) it possibly gets “cash accounting” treatment under USGAAP/IFRS solving adverse Bitcoin accounting treatment.’

In other words, this subtle definitional change actually changes the legal and accounting status of bitcoin globally.

This would make it easy for companies to hold bitcoin on their balance sheets and it may even make bitcoin get favourable treatment under bank capital requirements (Basel 3).

Dutch investor Marc van der Chijs chipped in with this opinion too:

|

|

| Source: Twitter |

No tax on crypto trades! That’d be huge!

But the main game is at the level of nation states…

Ultimately, El Salvador’s move may prove to be the starting gun for a whole range of countries to adopt bitcoin as part of their currency reserves.

Think Russia, Eastern Bloc countries, and more South American laggards.

These are, of course, the countries Western-dominated central banks have long ignored, so it makes sense they’d be most open to something new that sits outside the current financial system.

After all, what have they got to lose?

The endgame is near

With so much potentially at stake, I suspect we’ll see some pushback on this at some point.

After all, it’d be naïve to think that the current economic masters would sit back and let their power over money go too easily.

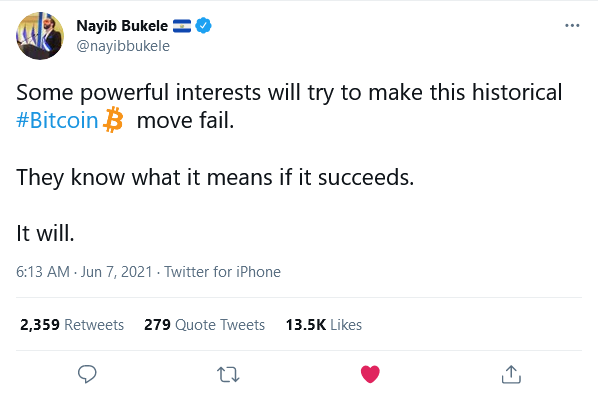

The El Salvador president knows full well he’s stirred the fiat hornet’s nest, tweeting this morning:

|

|

| Source: Twitter |

I’ll be watching carefully over the next few months to see what the policy response to this bombshell is.

I suggest you do too.

The real question, though, is what happens if this turns into a success story?

If it is, then the race for the only 21 million bitcoins that will ever exist is well and truly on.

Good investing,

|

Ryan Dinse,

Editor, Money Morning

Ryan is also editor of New Money Investor, a monthly advisory aimed at helping investors take an early-mover advantage as decentralised finance and digital money take over the world. For information on how to subscribe and see what Ryan’s telling his subscribers right now, click here.