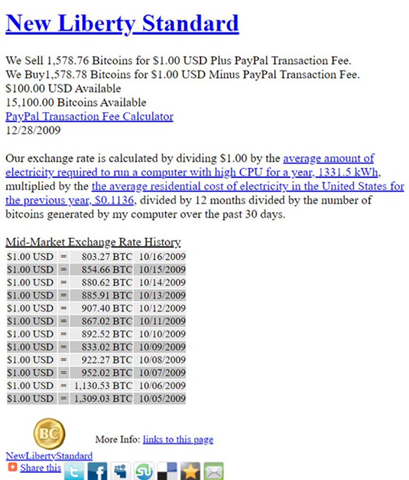

13 years ago, almost to the day, the first ‘exchange’ selling bitcoins went live.

Known simply as New Liberty Standard, this site was made by just one guy trying to sell the bitcoins he mined. So what was the price?

Take a look for yourself:

|

|

| Source: Twitter |

Yes, you’re reading that right. Just one US dollar was enough to get a hold of 1,309.03 bitcoins on day one. At today’s prices (roughly US$19,924), that US$1 purchase would be worth more than US$26 million!

Needless to say, few people in the world were fortunate enough to stumble upon bitcoin at these kinds of levels. Fewer still would have had the confidence to actually believe that bitcoin ever reached the point it has to this day.

Hell, even if you somehow did manage to get a hold of bitcoin back in 2009, I’m sure most of us would have sold out way before 2022 or the peaks in 2021. It was impossible to know back then just how far bitcoin would come in such a relatively short period.

But that is exactly why you need to treat today like it is 2009 all over again…

Your own ‘New Liberty’ moment

It’s easy to look back as an investor with hindsight and wish you’d been more aware of a trend like bitcoin.

Many people who heard about it but didn’t act when they first learned about bitcoin are kicking themselves to this day. I know because I was one of them.

Early 2014 was the first time I learned what cryptocurrency was. The infamous case of Mt Gox’s missing bitcoins gave me my first introduction to this weird digital money. Back then, though, I didn’t really get it, and I didn’t have enough interest to find out more.

It would be three more years, amid the 2017 bitcoin boom, that I would finally immerse myself in the crypto space. And I can tell you right now that it was a hell of a lot harder to not only buy bitcoin back then but also understand it.

Today, getting into crypto is easier than ever.

There are plenty of informative resources, easy-to-use exchanges, and tonnes of commentary.

But here’s the thing, it can still be better…

We’re just living through another point in time for bitcoin’s long history. In 10 or 20 years, people are probably going to look back at this moment and marvel at the naivety surrounding bitcoin once more. Because while more people are certainly aware of cryptocurrency today than they were in 2009, the people who truly understand and appreciate bitcoin are still in the vast minority.

Bitcoin adoption is growing, and knowledge is spreading, but it is still just the beginning.

By the end of the decade, there is a very real possibility that one bitcoin could be worth as much as US$1 million. Some people might scoff at that claim, but so did people back in 2009.

Almost no one back then believed this weird digital money would grow to the point it has now. And that’s why, whether you already own bitcoin or not, you should be paying attention.

A past, present, and future of outperformance

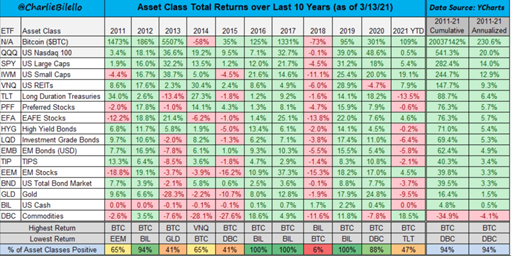

The fact of the matter is, bitcoin, as an asset class, has outperformed basically everything.

You can see this for yourself in the handy spreadsheet below:

|

|

| Source: Smart Valor |

Granted, 2022 certainly looks a lot more like 2018 or 2014 for bitcoin than other years. But as the data clearly shows, even with the bad years, the leading crypto is still leagues ahead of other assets.

It is because of this consistent outperformance that our own crypto expert, Ryan Dinse, believes bitcoin is headed for US$1 million. After following this scene for years, he can see the developments coming. He knows what the timeline looks like.

By 2030, the possibility of a staggering bitcoin boom is more likely than you may think.

To understand why, though, you need to listen to Ryan yourself. You have to be willing to devote the time and energy to figure out why bitcoin matters more than most people think.

Check out Ryan’s full explainer in this video right here.

Because just like the early adopters in 2009, you have the chance to invest in something that can deliver truly life-changing wealth.

Don’t end up looking back at this moment in 10 years’ time with regret.

Otherwise, you’ll be kicking yourself along with everyone else who failed to appreciate the potential of bitcoin.

Regards,

|

Ryan Clarkson-Ledward,

Editor, Money Morning