US interest rates are at a 22-year high…

Inflation may not return to ‘normal’ till 2025…

And the market just couldn’t care less…

Despite doing exactly what he said he would do; it seems Powell’s rate rise has caught the media off guard this time. Headlines everywhere are trying to dissect how this latest hike will impact stocks, bonds, and more assets.

The market though, at least for equities, offered up a huge shrug.

Better-than-expected earnings from both Google and Meta certainly helped on this front. These two big tech stocks helped prop up the NASDAQ from further pain, a quandary that continues to fly in the face of Powell’s desire to draw blood from the hot US economy.

Back in Australia, though, we’re in a somewhat more fascinating predicament.

Our own central bank is set to meet next Tuesday and make their own call on whether to raise rates or not. Prior to the release of the latest inflation data this week, odds would suggest that the chance of a rate rise was close to 50/50.

Not any more though…

How the RBA may have dropped the ball

The latest data on local inflation shows that it cooled to 6% for the June quarter. That’s down a whole percentage point from March, and roughly 0.2 of a percent better than most ‘experts’ expected.

As a result, everyone is sighing with relief as they expect the RBA to not follow in Powell’s footsteps. Unlike the US, it seems our inflation may be cooling quicker than most thought.

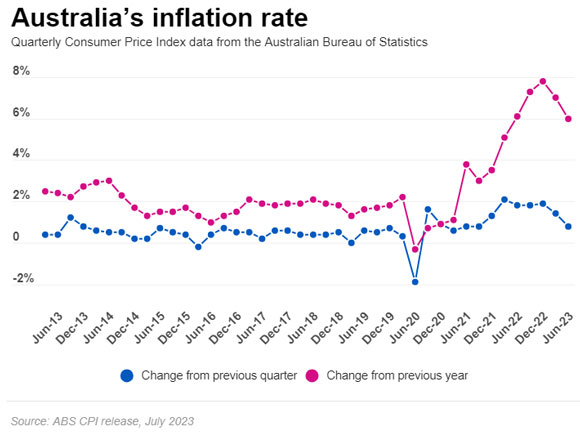

Take a look at this chart to see what I mean:

|

|

| Source: Australian Bureau of Statistics |

You can see in the annual data that inflation is dropping almost as quickly as it rose — a good sign that we may yet be on the road back to more normal levels of price rises.

But we may not have Philip Lowe to thank for that…

One of his staunchest critics, Deloitte Access Economist Stephen Smith, believes that this latest tape read proves that Lowe isn’t the one abetting inflation. Rather, in Smith’s view, it’s the revival in global supply chains following the pandemic and Ukraine war that is finally normalising prices.

All Lowe has done, according to Smith, is weaken our economy:

‘As Deloitte Access Economics has been warning for the past 12 months — and as the Reserve Bank’s own research shows – excessive inflation in Australia has mostly been caused by supply side factors, meaning that interest rate increases have mostly been ineffective at bringing inflation under control.

‘In those areas of the Australian economy that are still seeing strong price growth — namely housing and energy markets — supply side challenges are similarly to blame.

‘Higher interest rates will not encourage a faster energy transition, nor unleash a wave of home building. Instead they will make these issues worse.

‘A narrow, dogmatic view of the link between unemployment and inflation fails to recognise the key sources of excessive inflation in Australia at present, and therefore misdiagnoses the correct policy response.’

It’s certainly an interesting assessment, and only time will tell if Smith is right.

But for investors right now, it begs only one simple question…

Is it time to buy or sell?

Asking the right questions

Markets in 2023 have been caught in a massive battle between the bulls and bears.

Everyone is trying to argue whether we’re on the precipice of ruin or utopia. And for everyday investors like yourself, it makes finding the right investments even more of a headache than it usually is.

This infatuation with inflation and interest rates has distorted market perceptions. Things seem crazier than they are, and it’s easy to panic as a result.

As our own trading guru Murray Dawes recently put it:

‘If you ask the wrong questions of the market, you are going to get the wrong answers. And those answers will lead you to immense losses at some point.’

Wise words for times like these, especially as we now enter the endgame of this latest rate cycle.

Regards,

|

Ryan Clarkson-Ledward,

Editor, Money Morning