In today’s Money Morning…tether could be a useful fiction, just like fiat…DeFi might need to find a new stablecoin to truly evolve…move quickly though, the new game has already started…and more…

Have you heard of Tether or USDT?

It’s a stablecoin, meaning it’s pegged to a fiat currency.

In theory you can redeem Tether for greenbacks.

Yes, the same currency that Jerome Powell presides over.

But how redeemable is Tether?

This is a question well worth answering, and the DeFi landscape is quite the rabbit hole, I must admit.

Let’s start with some broad brushstrokes.

Tether could be a useful fiction, just like fiat

The first thing I don’t like about Tether is that it comes from a central entity called iFinex.

It’s a complex web, but a company from the British Virgin Islands — iFinex — is the parent company that operates both Bitfinex (a huge exchange) and Tether.

iFinex faced a pretty gnarly court case in New York recently.

You can read all about that and go over their legal counsel’s affidavit in this CoinDesk article.

iFinex ended up settling for a measly US$18.5 million for a complicated and opaque loan arrangement between the two entities they control to cover a potentially risky arrangement with a Panamanian entity called Crypto Capital.

Which in some ways put the issue to bed.

That being said, one of the main outcomes of the New York probe into Tether was that they had to release a breakdown of their reserves.

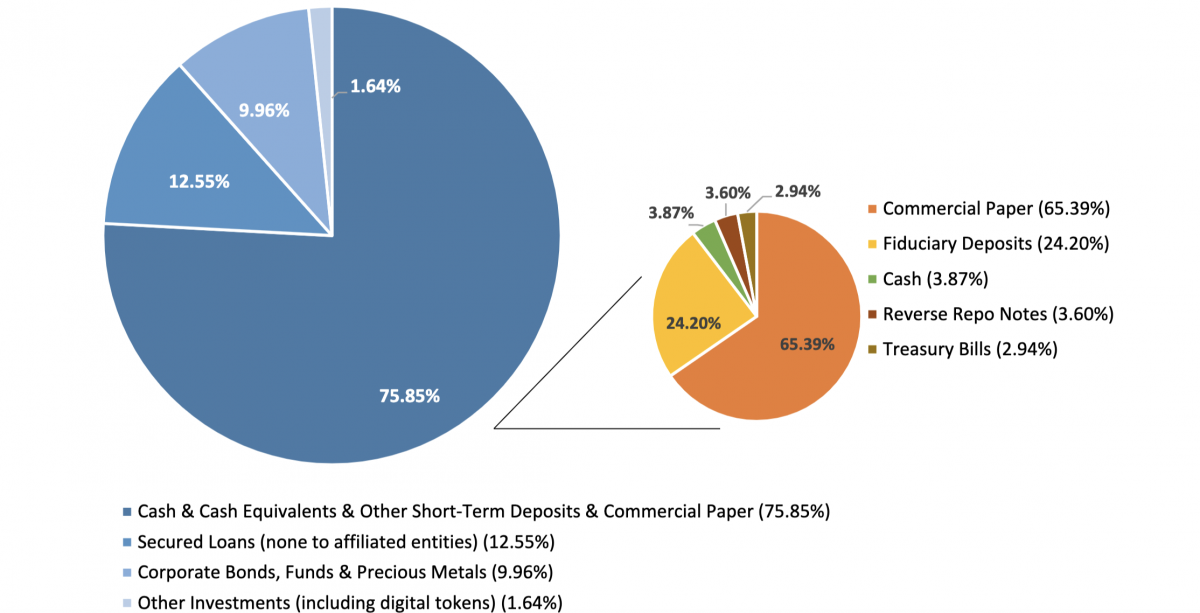

Which you can see below:

|

|

|

Source: Tether via CoinDesk |

As you can see, slightly over 65% of that initial 75.85% ‘cash’ is in ‘commercial paper’.

What on Earth is that, you may ask?

Well, as per Investopedia, commercial paper is:

‘A commonly used type of unsecured, short-term debt instrument issued by corporations, typically used for the financing of payroll, accounts payable and inventories, and meeting other short-term liabilities. Maturities on commercial paper typically last several days, and rarely range longer than 270 days.’

But as one academic quoted by CoinDesk notes:

‘All commercial paper is not created equal, because of the credit ratings of various companies. Even some of the multinationals that used to be pristine are not so anymore.’

So, to some, that may mean that Tether’s ‘reserves’ breakdown smacks a bit of repackaging of potentially dodgy debt à la GFC.

But let’s focus on the cash — which makes up 3.87% of that 75.85%.

That’s significantly lower than all the Aussie Big Four’s common equity Tier 1 (CET1) required amounts of 10.5%.

I won’t get into the reeds on that. Suffice to say, it’s a fair bit more expansive than straight cash.

However, it’s a relevant question to ask. Could there be a run on the DeFi ecosystem much like a bank?

It’s worth noting that getting your Tether redeemed for ‘true blue’ USD is hard — Tether requires a US$100,000 minimum per transaction, along with taking a 0.1% clip on the transaction.

That doesn’t sound great and implies that just like fiat, Tether is a useful fiction.

Which is why this article from AIMultiple leads with the headline ‘Tether USDT is possibly a scam but it can remain valuable’.

A valuable scam, you say…

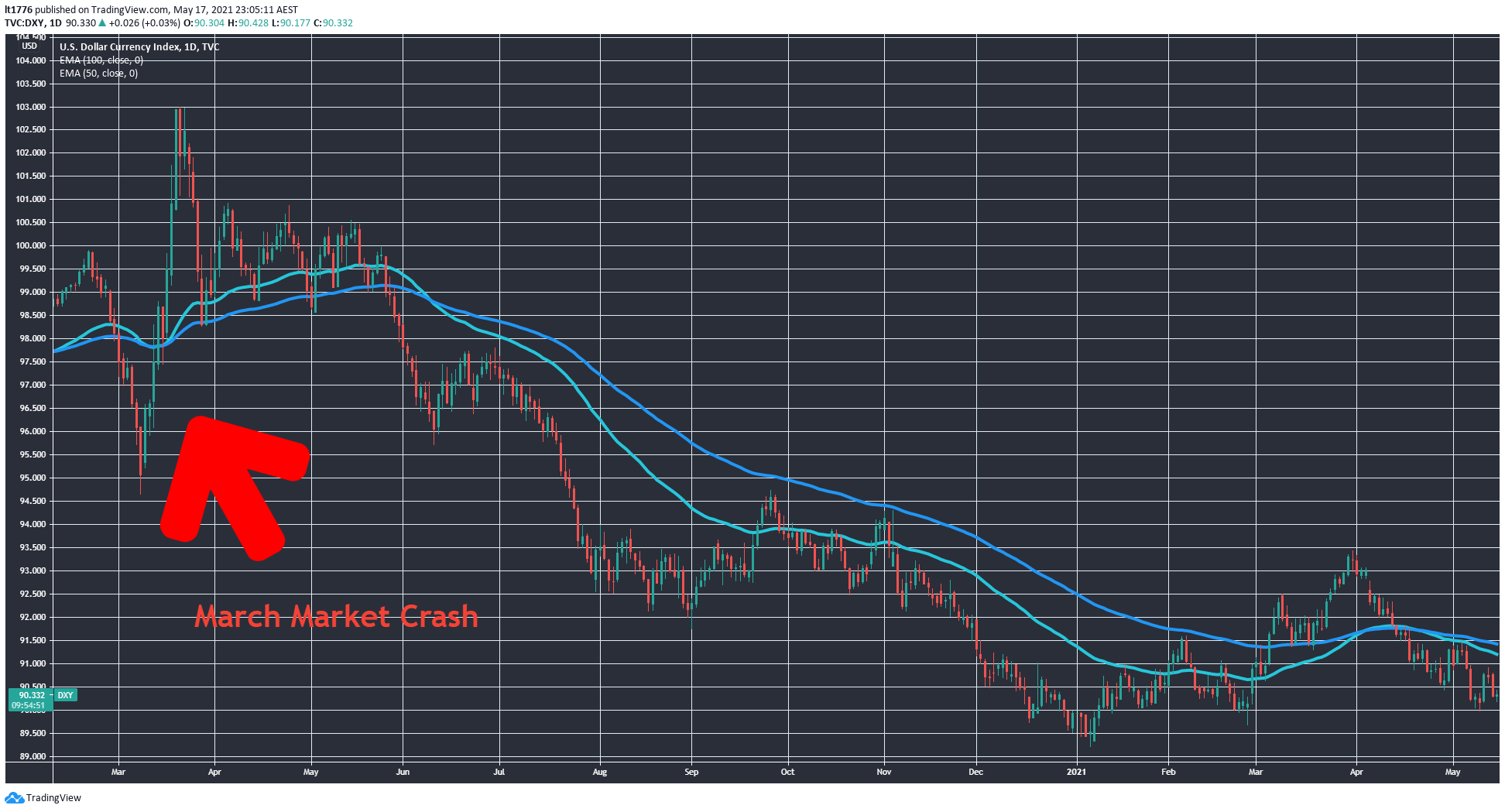

The 100,000 minimum transaction amount would reduce the incentive for redemption, but what if the USD goes nuts again like it did in March 2020?

The USD is looking precariously placed, as you can see below:

|

|

|

Source: Tradingview.com |

It’s conceivable that another market crash could spark the predictable flood into the USD, in turn triggering redemptions by Tether ‘whales’ or large holders.

Then some of the DeFi system could unravel.

How much does DeFi rely on Tether though?

DeFi might need to find a new stablecoin to truly evolve

There’s a great summary of the DeFi landscape published by GlassNode, which is well worth a read.

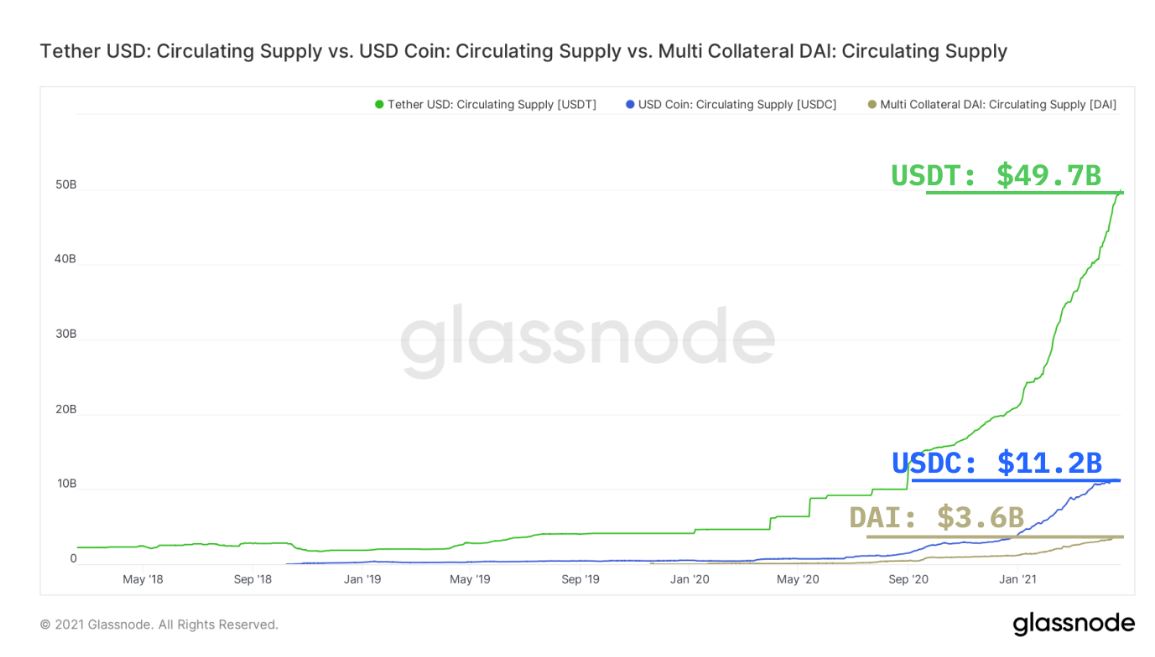

This chart shows you Tether’s (USDT) dominance:

|

|

|

Source: Insights.glassnode.com |

As you can see, USDT is outstripping competitors USD coin (USDC) and DAI by a big margin.

For my money, based on what I’ve seen of Tether, I’d prefer one of these two.

Things may change in that regard over time.

Take, for instance, USDC which is more transparent about its backing (via CoinDesk):

‘Jeremy Allaire, chief executive officer of Circle, part of the CENTRE Consortium (with Coinbase) that manages USD coin (USDC (-0.04%)), says cryptocurrency market traders need stablecoins to move quickly given constantly gyrating digital asset prices.

“If you’re active in the markets, you’re going to keep your money in a stablecoin because it’s radically faster, cheaper, better than the legacy banking system.”

‘Allaire’s USDC is in many ways the sort of transparent enterprise stablecoins promise to be. A top 20 crypto asset, it has almost $5 billion in market capitalization and $2.7 billion in daily trading volume as of press time. Every month, the CENTRE Consortium publishes attestations from accounting firm Grant Thornton LLP to prove the amount of USDC in circulation matches up with the amount of dollars in a bank account, meaning the asset is fully backed by dollars. In accounting-speak, attestations are different from audits. Auditing is defined as an independent examination of data, whereas attestations evaluate and review how true data is.’

DAI is potentially more complex to wrap your head around as well.

Here’s the key takeaway — DeFi may need to move on from its reliance on Tether to generate the trust it needs to take on the big institutions.

At the end of the day, that’s what all of this is about.

Trust.

I’d hate to see a run on DeFi triggered by a lack of it.

I’ll admit, today’s piece is more devil’s advocate than cheerleader.

But that’s the necessary dose of scepticism you need when assessing your options in what Greg Canavan and Ryan Dinse are calling a ‘New Game’.

Finally, a quote from Sun Tzu which I’ve recently rediscovered:

‘Weigh the situation, then move.’

Sun Tzu, The Art of War

Move quickly though, the new game has already started.

Regards,

|

Lachlann Tierney,

For Money Morning

PS: Promising Small-Cap Stocks: Market expert Ryan Clarkson-Ledward reveals why these four undervalued stocks could potentially soar in 2021. Click here to learn more.