It’s 3:42am and today’s Daily Reckoning Australia finds me in a reflective mood.

My elderly father’s health is failing.

One fall too many has forced him to surrender his highly prized independence.

We knew this day of reckoning was coming…but it’s still sad to watch.

A tour of the assisted care facilities provided me with a stark reminder of what constitutes a rich life.

When a financial publication usually mentions the term ‘rich’, it tends to be associated with money or a vein of ore.

Not this time.

Don’t get me wrong, money is important — especially when it comes to paying the not-so-insignificant Refundable Accommodation Deposit (RAD). However, when the final tally on your life is done, true net worth is measured by other factors.

Money can’t buy love

In 1964, the year when the last of my parents’ five children was born, The Beatles’ hit single ‘Can’t Buy Me Love’ was released.

In Paul McCartney’s own words, his motivation for the song was…

‘“Can’t Buy Me Love” is my attempt to write a bluesy mode. The idea behind it was that all these material possessions are all very well but they won’t buy me what I really want.’

Growing up in a working-class family, material possessions were few and far between. Money was needed for the basics…shelter, transportation, food, clothing, and education. Precious little was left for material indulgences.

Society has changed quite a bit since then.

Credit-funded consumerism has literally consumed the developed and a good chunk of the developing world.

The quip, ‘we buy things we don’t need, with money we don’t have, to impress people we don’t like’ originally referred to Hollywood. These days, it extends well beyond the zip code of Beverly Hills.

And this increasing obsession with ‘look at me’ on social media suggests the penny has not yet dropped on true love extending beyond self.

Of the limited number of possessions Dad can take with him, the most prized are his photos of family and friends. These are his permanent reminders of a rich life…one that money alone cannot buy.

When it all gets distilled down, material goods become immaterial and it’s not how much you love yourself, but how much you are loved by others.

In the final tally, love and respect are what matters most.

Money can’t buy happiness

Long before The Beatles were singing ‘Tell me that you want the kind of things that money just can’t buy’, Roman philosopher Seneca (4 BC to 65 AD) wrote a letter to his mother.

The title…Of Consolation: To Helvia

Here’s an extract…

‘Consider in the first place how many more poor people there are than rich, and yet you will not find that they are sadder or more anxious than the rich: nay, I am not sure that they are not happier, because they have fewer things to distract their minds. From these poor men, who often are not unhappy at their poverty, let us pass to the rich. How many occasions there are on which they are just like poor men!’

Prior to reading Seneca’s wisdom, I’d never looked at life from this angle.

In number, the poor far exceed those of the rich…yet the poor are not sadder or more anxious than the rich.

Money does not buy happiness…just ask any psychologist practising in the more well-heeled postcodes.

A few years ago, the Australian Financial Review published an article about the struggles James Packer was having with his mental health. Here’s an extract (emphasis added):

‘…the very rich have financial worries of their own, says (psychologist Joel) Curtis: while poorer people worry about paying the bills, and middle-class people are trying to get ahead of the bills to pay off the mortgage, the seriously affluent are preoccupied not with what they have done, but how to keep it that way. Their entire self-esteem is tied up with money, so any downturn or the “business going south” can cause stress and depression. Nothing is ever enough, there’s always another goal. Everyone is striving for self-actualisation and unfortunately for highflyers, it is based on results, so they have to keep chasing the high, the feel-good factor.’

When you measure your self-worth in material possessions only, contentment is both fleeting and elusive.

Genuine happiness must come from within.

The other circle of life

How do we create a happy life?

By deciding on what’s really important…and then putting it into practice on a daily basis.

In the day-to-day hustle and bustle, it’s easy to lose focus on all aspects of life.

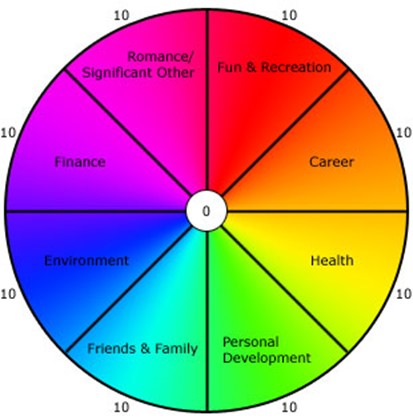

This alternative ‘circle of life’ has been invaluable to me in my quest for a balanced and happy life.

|

|

| Source: Positive Changes |

Every now and then, it’s good to take stock of your life.

What would your score be on each of the segments of life?

If you’re brutally honest, it can a confronting but also liberating exercise…putting you on the pathway to living a truly rich and rewarding life.

We’ve all heard versions of these tales…

‘On their death bed no-one wishes they’d spent more time at the office.’

And:

‘All work and no play makes Jack a dull boy.’

Avoiding these sad anecdotes being your lived experience requires a conscious effort to live a full and rich life…and to do it before it’s too late.

Upon reflection, I’d say Dad scores reasonably high marks on each segment in the ‘Circle of Life’.

Seneca’s view on wealth was, ‘[it’s] useful and brings great comfort to life’.

Very true.

However, an even greater source of comfort to my father is in knowing he has the love, respect and support of his five children, 14 grandchildren, and 15 great-grandchildren.

Final thought on this morning’s moment of reflection…Dad has lived a rich life.

Until next week.

Regards,

|

Vern Gowdie,

Editor, The Daily Reckoning Australia