Last Thursday, two Australians just shared the Division 1 prize in Australia’s biggest lotto jackpot to-date, the Powerball Draw 1446. Between them, they won $200 million.

A hearty congratulations to them. What an immense win!

According to Ozlotteries.com, the chance of winning the Powerball Division 1 jackpot is 1 in 134.5 million.

It’s hard to imagine how remote that chance. So let me put it in perspective.

According to the Encyclopedia Britannica, the chance of experiencing a lightning strike in one’s lifetime is around 1 in 15,300. From that, the chance of winning the Powerball jackpot is almost as likely as getting hit by lightning twice.

Interestingly, despite such wide odds, someone was able to endure multiple lightning strikes. One man, Roy Sullivan, suffered seven lightning strikes during 1942–1977. Roy lived through each ordeal, passing away in 1983 from an unrelated incident.

It’s estimated the chance of THAT happening is 4.15 in 1032. You could say he’s both the luckiest and unluckiest man to live in recent times.

For your interest, you can read about his shocking (pun intended) experiences here.

The lottery — a losing gamble for most

I don’t intend to write today about increasing your chances of winning a lottery jackpot, nor how to survive a lightning strike.

Rather, I’m going to explain how this lottery jackpot has revealed the state of financial literacy and mindset in our country. That and the potential opportunity it presents you.

Many don’t realise that the growing size of the lottery jackpot over time comes from increasing participation from the Australian people.

I want to clarify one thing. The prizes don’t come from external sources. They’re funds raised via the sale of lottery tickets. Therefore, lotteries are merely a system that redistributes wealth from many participants to a small group of winners.

Sounds like a particular political system, doesn’t it?

It also explains why the recent jackpot was massive. It’s because there were no Division 1 winners in the recent draws.

This naturally enticed even more people to try their luck.

What makes the lottery attractive is that you only need to contribute a small amount to buy a ticket for a chance to win something big. It seems harmless. A cup of coffee or maybe a hearty lunch if you’re buying a syndicated ticket.

When you watch lottery advertisements, you get the unrealistic picture of pursuing the dream of spending for the rest of your life.

It’s also a numbers game. Participate enough and your lucky day might come.

Bluntly put, it’s a get rich quick scheme.

But this amount adds up. One lottery ticket, three times a week, would cost almost $1,000 a year.

Most people wouldn’t think about it, nor even realise they’re spending this much year in, year out.

Granted, the lottery prizes aren’t binary. It’s not all or nothing. They have many division prizes, so most people win a modest amount every so often. These help keep them in the game.

But on a long-term basis, I’d hazard to say that the average punter loses more than they win. It’s designed that way, or else the lottery company goes broke.

Gambling schemes vs calculated investments

The prevalence of people buying the lottery shows how people want to build their wealth but aren’t willing to put in the hard yards or wait for their rewards.

It takes a methodical process to build and keep your wealth. It involves research, calculated risk-taking, patience and a stroke of luck.

Promises of getting rich quick through little or no investment of effort are what you find in gambling schemes. These rely largely on randomness. A coin toss, a roll of the dice, blackjack or the lottery are examples of gambling schemes.

On the other hand, investment assets delivering returns are usually driven by some process or tangible factors. The business cycle, economic growth, market activity and management quality can affect their performance. Stocks, bonds, commodities and property are a few common examples.

Now I must stress that it’s not the size of the potential return that decides if something is a gamble or a calculated investment.

Certain investment assets can deliver life-changing gains that may give a gambling scheme a run for their money. For example, small-cap mining, technology and biotechnology stocks, Bitcoin and real estate have delivered massive gains in the past…allowing some to reap vast fortunes.

And this leads me to the key takeaway for today’s article…

Small-cap stocks: Much better return for risk in 2024

I reckon it’s easier to convince someone to buy a lottery ticket in every draw for an entire year than for them to buy small-cap stocks.

There are a few reasons for that.

I mentioned before that the lottery requires small regular commitment. It doesn’t pinch one’s wallet or bank account. Another is that there’s a quick and cheap thrill element with gambling. You may experience an adrenaline rush in a couple of minutes. Plus, you can quickly find out the outcome of your wager.

It’s different to speculating in small-cap stocks.

These stocks are volatile. Holding and trading them become a test of your emotional fortitude.

Most people can’t handle the suspense, especially when their shares plummet and paper losses mount.

But hear me out on this.

The last two to three years have been rough for many of these companies. Even as market indices made record highs, most investors shunned small-cap companies for the more established peers.

It’s been a distinctly two-speed stock market during this time.

However, we’re reaching a stage where there’s compelling value and future earning potential in this space. There are several signs that point to them hitting their bottom.

For one, trading volume for most companies have all but dried up. Meanwhile, a handful of companies releasing good news have caused panic buying. Their prices move quickly from their lows, resulting in more buying. It becomes a virtuous cycle.

Another is that some companies are trading at a value that is less than their cash balance. These opportunities are normally more rare than a blue moon, but I know a handful of these companies right now!

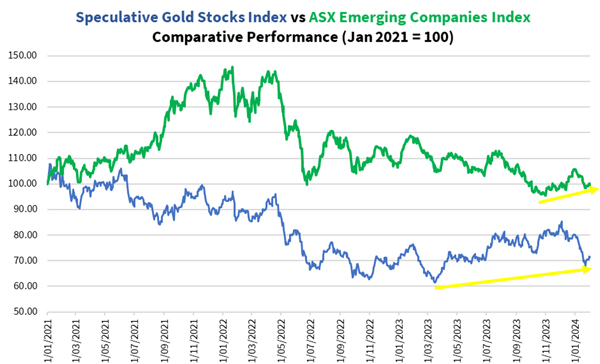

Thirdly is that the small-cap indices are in a bullish pattern. The figure below shows the recent movements of the ASX Emerging Companies Index [ASX:XEC] and my in-house Speculative Gold Stocks Index:

| |

| Source: Internal Research |

Note that both indices hit their lows some time last year. The Speculative Gold Stocks Index bottomed last March while the ASX Emerging Companies Index found its lows in late October last year. Despite the selloff over the past month, they’re down but not out.

But the indices are just the tip of the iceberg. Several companies are trading more than 50% higher than their lows. Some more than 100%. It’s early days.

These are small and speculative companies, so there are no guarantees and investors lose thier invested capital…

…but in the peak of a bull market, some companies can trade a few hundred or even over a thousand percent above their minimum!

Even if you buy now, there’s a potential to benefit should a bull run happen in the future.

So I want you to consider this as your resolution in 2024 — why not give small-cap stocks a chance?

I’d like to invite you to check out The Australian Small-Cap Investigator helmed by my colleague, Callum Newman.

His latest recommendation to subscribers has gone up 30% in just three weeks, and is still an open buy. And just last week, his readers sold out of SiteMinder for a 75% win.

And while he doesn’t always get it right…

Cal sees a heap more potential in this sector on the horizon, and believes the Aussie market could hit all-time highs this year. So if there’s ever a time where the stars appear to be aligning for small-caps, now could be it. Find out more about Australian Small-Cap Investigator here.

Or, if you’re particularly interested in gold and silver, keep an eye on my premium newsletter, Gold Stock Pro. I’m preparing a brand-new presentation on this investment thesis as we speak.

God bless,

|

Brian Chu,

Editor, The Australian Gold Report and Gold Stock Pro

Comments