Yesterday we finished with the idea that Chinese automakers are coming to wipe out the Western car brands.

Can you imagine being the CEO of Ford or GM right now?

Consider the dynamic in front of you. Tesla has captured the lead in the electric car market in the USA over the last decade.

You’re already playing catch up to the beachhead Tesla has built in terms of brand, charging network and self driving capability.

Now the Chinese are coming with lower cost offerings for the global market, with arguably superior engineering.

They only lack, for now, the same kudos, prestige and heritage that European and US cars do.

The Japanese had the same problem when they began to dismantle the US dominance in this sector fifty years ago. They got there eventually.

You also have Waymo, Uber and Tesla actively pushing to make car driving redundant. There are self driving cars on the streets of Austin already.

Then your President does everything he can to drive up your costs by placing tariffs on your international supply chain.

You also have legacy worker pensions to pay and union labour demanding higher wages.

Good luck making all that work.

There’s no doubt in my mind that the disruption ripping through the car industry is going to obliterate billions in value across the globe. Who wins, who loses…it’s all up in the air.

Then there’s something else. Pretty soon we’re going to have flying transportation. It could cut car travel demand again.

No kidding. Just yesterday the Australian Financial Review reported:

‘An Australian start-up backed by major superannuation funds and the federal government says customers could be buying and flying the company’s vehicles by the end of the decade…

‘AMSL Aero is one of many companies around the world trying to make electric flying happen. The Sydney-headquartered business company was founded by aeronautical engineer Andrew Moore and former Google executive Siobhan Lyndon in 2017.

‘Its aircraft – known as evTOL, or electric vertical take-off and landing – lifts off and lands like a helicopter but flies like a plane, which means that it can land in backyards instead of needing a long airfield runway.’

One stock idea you might like to keep an eye on is Joby Aviation ($JOBY). This trades in the USA.

Former fund manager Whitney Tilson says it’s his favourite “moonshot” idea.

Now, don’t take that as a recommendation. It’s just an idea, that could flame out to zero…or possibly soar like Tesla did on the back of the electric car revolution.

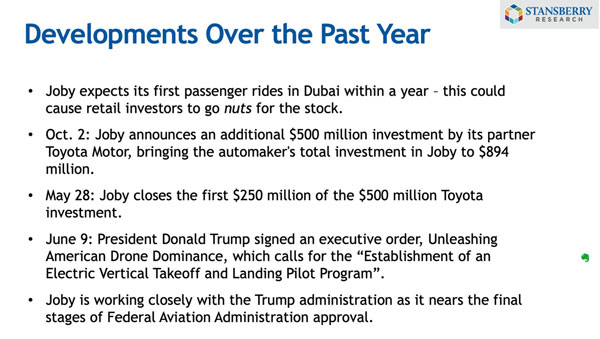

Whitney shared these points in a recent presentation…

| |

| Source: Stansberry Research |

Generally, I don’t recommend you buy the air taxi firms directly.

100 years ago, dozens of car companies opened up shop as automobiles rose to social prominence.

But history shows that only a few of these car brands survived…

And it was a crapshoot for investors to pick the eventual winners.

That’s why I prefer the classic ‘pick and shovel’ strategy…

Where you simply buy the company that can supply ALL the air taxi firms…

In the same way Nvidia benefits off Amazon, Google, Meta, and everybody else.

That’s why I strongly suggest you consider investing in the company pioneering the technology that ALL air taxis will need…

Believe it or not, you can start right here on the ASX. Go here for my idea on this moonshot industry forming now.

Best wishes,

|

Callum Newman,

Editor, Small-Cap Systems and Australian Small-Cap Investigator

Murray’s Chart of the Day –

Copper

| |

| Source: Tradingview |

Trumps announcement that he is considering adding a 50% tariff to copper imports has been the catalyst for a major breakout.

Copper has been struggling to overcome resistance at US$5.00/lb for years.

Is this THE breakout we have been waiting for?

Perhaps, but I must admit the reason for the run has me nervous.

US firms are scrambling to increase their copper supplies ahead of the tariffs coming online.

They were already doing so before Trump said what the size of the tariff would be. But now that the size of the tariff is known traders have a clearer understanding of how much they can pay above normal pricing.

This is front loading demand in a big way, and we should expect to see demand fall in a hole once the tariffs begin.

The price for future copper isn’t jumping. It is just copper that can be delivered ahead of the tariffs that is running hard.

That’s why copper companies aren’t jumping with the copper price at the moment.

Perhaps the price of copper would be much lower without the threat of these tariffs hanging over the market.

If so, we may be in for a rude shock if the tariffs start and copper drops to US$4.00/lb or so.

The long-term outlook for copper remains strong in my view. But distortions in the price of copper caused by tariffs may lead to outsized volatility in the price of copper in the short-term.

If copper fails to hold above US$5.00/lb, the chart will look like it is confirming a false breakout. More downside in the copper price would be expected then.

Regards,

|

Murray Dawes,

Editor, Retirement Trader and Fat Tail Microcaps

Comments