For many investors, November was looking like a turning point. A strong rally lifted global equities in the hope that the US Federal Reserve would soon ease aggressive rate hiking.

Not only that, but rumours of a China reopening were also playing into the hands of commodity speculators.

As such, mining stocks soared.

In a matter of weeks, it looked as if some of the large-cap miners were already out of reach. Take Fortescue Metals Group [ASX:FMG]. Its price surged after making a major low in late October. The stock gained almost 50% from trough to peak in just five weeks.

While BHP Group [ASX:BHP], Australia’s largest listed company, posted a 30% rise over the same period.

But just last week, US Fed Reserve Chief Jerome Powell put the brakes on November’s rally, promising aggressive rate hikes well into 2023.

While this may be the beginning of another strong leg down for global equities, does it change the outlook for commodity prices?

Not in my book.

Despite the Fed’s unwavering commitment to dent optimism, undersupply of critical metals remains a major dilemma for the global economy.

That is why I believe commodities are set to continue outperforming the broader market.

If this latest sell-off continues, it will give us further insight into the relative strength of mining.

It may also give you another opportunity to add quality resource stocks to your portfolio at a discount to the highs we recently witnessed.

But rather than focus on the market today, I’m going to shift gears and offer you something a little different…the analysis I’m about to present below is by no means conventional.

In fact, it is something I’ve picked up from working inside the industry.

I thought it would be worth sharing with you as it provides a unique perspective on where we sit in this current commodity cycle.

An unknown piece of data that offers clues for the future

Now, as I highlighted last week, jobs data is considered a lagging indicator of future trends in the economy.

However, in terms of mining, I like to narrow down the analysis…digging up data on SPECIFIC occupations.

For mining it starts with the most speculative part of the game…exploration.

When capital flows into the exploration sector, it is an indication of a long-term secular shift in the market.

You see, investor interest flows toward the producers first…major mining stocks are the early beneficiaries of a new mining boom.

This is what we have seen over the last couple of years as Australia’s largest producers break past their early 2000s boom-time peaks.

But as the cycle progresses and momentum continues to build, capital starts to find its way back into exploration, the most speculative part of mining.

It’s this next leg-up in the cycle that results in a flurry of IPO listings for new exploration companies.

But to find out if we are entering this next phase of the mining cycle, rather than rely on ABS figures on exploration expenditure, we can gain earlier clues by understanding the current demand for geologists.

You see, geologists sit at the forefront of exploration…first come the geos, then come the rigs.

So how can we find data on specific occupations?

One place to start is referring to the professional career bodies.

That’s what I’ve done this week by uncovering past records held by the Australian Institute of Geoscientists (AIG).

The AIG publishes a quarterly review of employment data specifically relating to this profession.

So, let’s dive in!

A step back to the last mining boom

Let’s start our analysis by turning back to the previous mining boom…it’s widely accepted that the boom years lasted from around 2004–12.

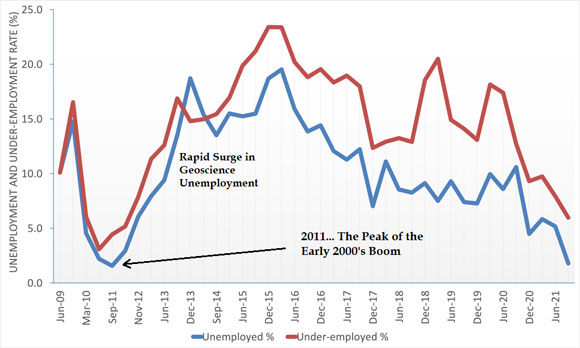

But while the industry was reaching a state of maximum excitement in 2011, the year also marked a major turning point for geologist in the workforce…as the graph below shows, unemployment that year began to surge:

|

|

| Source: Australian Institute of Geoscientists (AIG) |

That is despite widespread bullish sentiment in the mining industry at the time…stocks were making all-time highs.

Yet as the industry was culminating into a final extreme top, toward the end of 2012, geologist under/unemployment was already exceeding

10%.

So, why were geologists being let go, just as mining stocks were recording new highs?

It seems at odds with what we would expect.

It’s possible that industry insiders, perhaps apprehensive about the long-term outlook for their business, suddenly pulled the pin on long-term development projects.

As always, the first to go is exploration!

With geologists making up the bulk of the workforce in this most speculative part of mining, a surge in unemployment was key for understanding a major shift in the industry, well ahead of stock market pressure.

This is a move away from spending capital on new discovery.

Despite record-high commodity prices, companies were already beginning to downsize their exploration budgets…yet directors were unlikely to go public on this news.

For unknowing investors, the mood was overwhelmingly bullish during those culminating years of the last mining boom.

Mining dominated news headlines which fed into the idea ‘that this boom would never end’.

But years of pain lay ahead.

As the graph above confirms, 2011 marked a turning point when companies began reducing exploration staff.

A move to capital preservation…it was an early warning sign for investors.

Seeing how this data captured important trends over the previous cycle, what’s the situation like today?

Unemployment for geologists is falling…rapidly

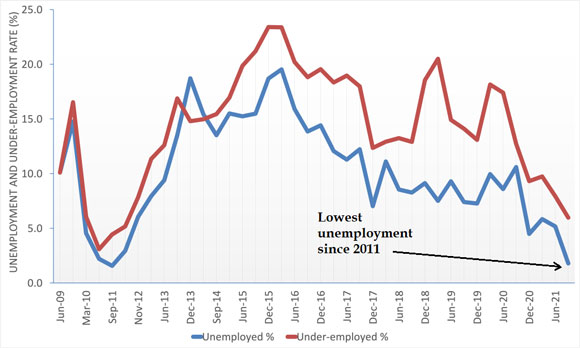

In a sign of changing times and a return to boom conditions, employment in the mining industry has undergone a massive turnaround since the downturn; the problem is even more drastic for exploration staff.

According to AIG spokesperson Andrew Waltho (emphasis added):

‘The survey results supported anecdotal evidence of improved industry activity and a tight market for geoscience skills across all sectors of the geoscience profession across Australia during the past year. The unemployment rate of 1.8% in the latest survey matches that recorded in the first quarter of 2011.’

As Andrew points out, unemployment is as low as it has ever been since mining stocks peaked in 2011.

|

|

| Source: Australian Institute of Geoscientists (AIG) |

While it’s no doubt a positive signal for the industry that we’re reaching a major low in unemployment for geologists…could this stat actually be pointing toward a major top in the market?

After all, when unemployment was this low last time, it marked a major downward change for the industry.

My take is this…

Given the severity of the mining downturn from 2012 to around 2019, and the affect it had on the profession, unemployment was destined to reach a major low far earlier compared with the last cycle.

It means we are likely to see record low unemployment for this profession for some time.

According to AIG, underemployment and unemployment exceeded 40% for geoscientists at the height of the downturn, this was simply unprecedented and will have long-term consequences for the industry.

With no career prospects, professionals left the industry in droves.

As I have indicated already, the situation on the ground today is cautiously optimistic but nowhere near the euphoria we experienced back in 2011.

A moderate uptick in exploration expenditure has already brought unemployment levels back to 2011 lows.

Right now, investors are focused on the large producers that have performed well over the last two years.

But with record low unemployment hitting the geoscience profession, its signalling the next phase in the commodity cycle…a major shift toward exploration.

As an investor, it can be worth allocating a small percentage of your portfolio to capture large, short-term gains as investors pour into the speculative end of the market.

I’ll have more to say about that in 2023.

Until then, I hope you have a wonderful, safe, Christmas break.

Take care and see you in the New Year!

Regards,

|

|

James Cooper,

Editor, The Daily Reckoning Australia