Dear Reader,

The two principal pillars of the Biden policy program boil down to monetary policy (zero rates and money printing) and fiscal policy (deficit spending and a higher debt-to-GDP ratio). This will be exacerbated by higher taxes, lower wages (due to immigration), and more regulation (due to the Green New Deal). It’s a recipe for economic disaster.

Monetary policy will fail because velocity is falling faster than money can be printed.

Why QE doesn’t work

Velocity refers to the turnover of money. For a certain money supply, you determine how much actual spending is going on. To do this, you simply take GDP and divide it by the money supply.

There is some finesse around choosing the right ‘money supply’. M0 is base money. M1 is a broader definition that includes demand deposits and checking accounts. M1 is highly liquid and is the best proxy of ‘money’ for our purposes.

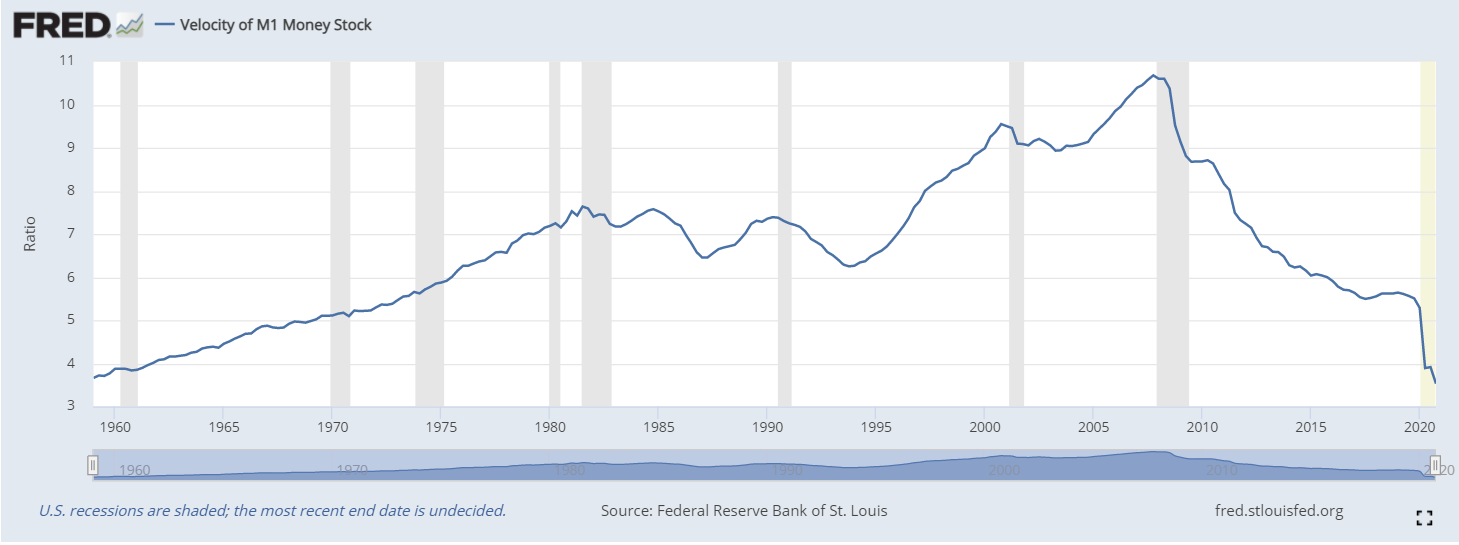

This chart from the Federal Reserve Bank of St Louis shows M1 velocity peaked in 2008, just ahead of the global financial crisis, and has been plunging ever since. Velocity took a cliff dive in 2020 during the pandemic.

|

|

|

Source: Federal Reserve Bank of St Louis |

How to Survive Australia’s Biggest Recession in 90 Years. Download your free report and learn more.

What does velocity really mean?

The chart shows that in 2007 a dollar of M1 gave us $10.50 of GDP. Today, a dollar of M1 only gives us $3.90 of GDP (more likely only $3.40 when the chart is updated). This is why the Fed has been printing so much money. It takes more money just to keep GDP constant when velocity is collapsing. When velocity drops, you get less ‘bang for the buck’ in terms of economic growth.

The Fed can influence M1 to some extent. But it has almost no control over velocity. That’s because velocity is driven by psychology and inflationary expectations. Right now, people are frightened and depressed. Their expectations of inflation are low. They don’t want to spend; they want to save or pay down debt. The result is that velocity continues to drop, which is a major headwind to growth.

If Americans won’t spend, America will

The Fed’s solution (now endorsed by Janet Yellen, former Fed chair and new Secretary of the Treasury) is more deficit spending by Congress. The idea is that if citizens won’t spend, Congress will. The goal is to pump up velocity.

This brings us to fiscal policy as captured in the debt-to-GDP ratio. That ratio is another simple concept. Just take the total amount of US government debt divided by GDP; that gives you the ratio in percentage terms.

On 31 August 2020, national debt was $26.7 trillion. GDP was around $21.8 trillion. That puts the debt-to-GDP ratio at about 125% ($26.7 trillion/$21.8 trillion = 1.25). That ratio will get worse once the new Biden spending bills pass.

You can add $2 trillion more to the debt, which would push the debt-to-GDP ratio to 130%. The only other developed countries with debt ratios that high are Greece, Lebanon, Italy, and Japan.

Beyond the point of no return (on spending)

This debt-to-GDP ratio is highly significant. The research shows that at debt-to-GDP ratios of 90% or less, there is some Keynesian multiplier from government borrowing and spending. You can borrow a dollar, spend a dollar and get, say, $1.25 of GDP.

The multiplier drops as the ratio gets higher, but up to a 90% ratio there is still some bang for your buck. Once you hit 90%, you go through the looking glass in what physicists call a ‘phase transition’ or ‘critical threshold’. In plain English, it’s sometimes called a tipping point. Once the ratio is greater than 90%, the multiplier is less than one. The US crossed this critical threshold in 2011.

This means that if you borrow a dollar and spend a dollar, you get less than $1 of GDP. You are now in a debt death spiral. When the debt is that high, you can’t borrow your way out of it. Each dollar of additional borrowing adds a dollar to the debt but adds less than a dollar to GDP. The ratio gets higher and the situation grows more desperate.

The reason for this is that citizens know intuitively that the high debt will lead to default, inflation, or higher taxes. Default is unlikely because the US can print dollars. But inflation and/or higher taxes are definite possibilities.

People begin to save more and spend less in anticipation of a bad outcome. They may invest their savings (which leads to asset bubbles — a separate danger), but they won’t spend. So, the situation gets worse until the system collapses entirely.

The debt death trap is sprung

Now, let’s connect the dots between velocity and the debt-to-GDP ratio:

- Velocity is dropping, which requires more money printing. But that doesn’t work because you can’t change consumer psychology. Savings soar as a result.

- Government next turns to deficit spending. But that doesn’t work either because the debt-to-GDP ratio is already too high. You get asset bubbles, but no growth.

It’s a debt death trap. There’s no way out. Monetary policy fails because of velocity. Fiscal policy fails because of high-debt ratios. People save more and inflate asset bubbles. The economy barely grows at all.

Actually, there is one way out…

Golden recipe for growth

The solution is to increase the price of gold in order to change inflationary expectations. That will increase velocity and get the growth engine running again. Biden and Yellen could do this, but probably won’t.

So, an economic time bomb is ticking. Velocity is dropping. Debt is growing, growth is slowing. The explosion will come in the form of asset bubbles bursting, stocks crashing, and soaring gold prices.

The endgame is that the US ceases to be credible to its lenders. This reduced confidence is usually seen in the form of higher interest rates (as happened between 1977 and 1980). That won’t happen this time because the Fed is prepared to squash any interest rate spike. If China won’t buy our bonds, JPMorgan will. If JPMorgan doesn’t play ball, the Fed will crush it from a regulatory perspective and buy the bonds itself. Either way, rates will stay under control. But there are two other ways for creditor revulsion to make itself known.

The symptoms of crashing credibility

The first is in a higher dollar price for gold as investors flee dollar-denominated securities and buy gold for protection. The second way is a collapsing exchange rate in which investors dump dollars and buy euros, yen, or Swiss francs (and maybe bitcoin). This is highly inflationary because it will take more dollars to buy needed imports. That will drive up prices for oil, electronics, autos and other imports, and light a fire under gold.

In short, even with massive deficit spending and interest rate controls, the system can still spin out of control through the channels of gold prices and foreign exchange rates.

The miserable outlook for the world’s most important economy

The Biden economic program — of more spending, higher taxes, more regulation, open borders, and a war on fossil fuels — is coming. The plan is to finance this with more money printing and bond issuance to fund deficits. The plan will fail to stimulate growth because money printing cannot offset the decline in velocity. Deficit spending is actually a headwind to growth when debt levels are so high to begin with.

Investors should expect slow growth and technical recessions from time to time. The COVID pandemic will fade, but not before 2022 at the earliest. The US economy will resemble Japan with one lost decade following another.

Stocks will correct to reflect this reality, although the current bubble may grow even bigger before that correction sets in. Deflation will be the dominant trend for 2021, but inflation will emerge in 2022 and later as a way to reduce the real value of debt.

For now, the big winner on a risk-adjusted basis will be a well-structured portfolio that includes the right bonds, cash, and gold.

How does this end for you? I explain all in my latest book The New Great Depression. Next week I’ll show you how to get a copy.

All the best,

|

Jim Rickards,

Strategist, The Daily Reckoning Australia